We Might See A Profit From Suzhou Centec Communications Co., Ltd. (SHSE:688702) Soon

We Might See A Profit From Suzhou Centec Communications Co., Ltd. (SHSE:688702) Soon

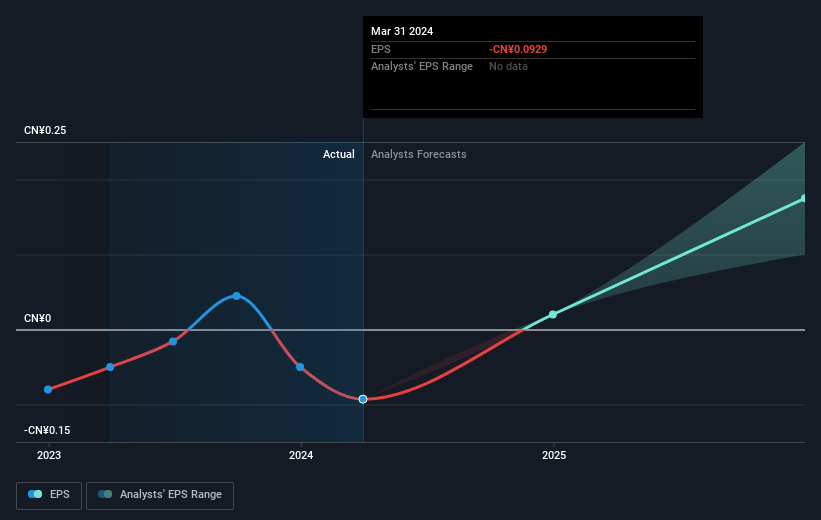

With the business potentially at an important milestone, we thought we'd take a closer look at Suzhou Centec Communications Co., Ltd.'s (SHSE:688702) future prospects. Suzhou Centec Communications Co., Ltd. provides ethernet switch silicon products and network solutions for 5G, cloud computing, machine learning and industrial markets. The company's loss has recently broadened since it announced a CN¥20m loss in the full financial year, compared to the latest trailing-twelve-month loss of CN¥41m, moving it further away from breakeven. As path to profitability is the topic on Suzhou Centec Communications' investors mind, we've decided to gauge market sentiment. Below we will provide a high-level summary of the industry analysts' expectations for the company.

隨着業務潛在的重要里程碑的到來,我們認爲應該更加關注蘇州斯恩特通信股份有限公司(SHSE:688702)的未來前景。蘇州斯恩特通信股份有限公司提供以太網交換機芯片產品和5G、雲計算、機器學習和行業市場的網絡解決方案。該公司近期虧損擴大,全財年虧損2,000萬元,而最新的滾動年度虧損爲4,100萬元,使其與實現盈虧平衡的距離進一步拉大。由於盈利指日可待,我們決定評估市場情緒。以下我們將提供行業分析師對該公司期望的高層次摘要。

Consensus from 2 of the Chinese Semiconductor analysts is that Suzhou Centec Communications is on the verge of breakeven. They anticipate the company to incur a final loss in 2023, before generating positive profits of CN¥9.8m in 2024. So, the company is predicted to breakeven approximately a year from now or less! We calculated the rate at which the company must grow to meet the consensus forecasts predicting breakeven within 12 months. It turns out an average annual growth rate of 101% is expected, which is extremely buoyant. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

兩位中國半導體分析師的共識是,蘇州斯恩特通信有望實現盈虧平衡。他們預計,該公司將在2023年遭受最終的虧損,然後在2024年實現980萬元人民幣的正利潤。因此,該公司預計將在明年或更早時期實現盈虧平衡!我們計算了公司必須增長的速度,以符合共識預測在12個月內實現盈虧平衡的預期。結果表明,預計平均年增長率爲101%,非常樂觀。如果這個速度被證明過於激進,該公司可能會比分析師預測的晚得多才實現盈利。

Underlying developments driving Suzhou Centec Communications' growth isn't the focus of this broad overview, though, bear in mind that typically a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

推動蘇州斯恩特通信增長的基本面並不是這個廣泛概述的重點,不過請記住,通常高增長率並不罕見,尤其是當公司處於投資期時。

Before we wrap up, there's one aspect worth mentioning. The company has managed its capital judiciously, with debt making up 16% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

在我們結束之前,有一個值得一提的方面。該公司管理資本有方,負債佔股本的16%。這意味着它主要從股本資金融資其業務,而低債務責任降低了對虧損公司投資的風險。

Next Steps:

下一步:

There are too many aspects of Suzhou Centec Communications to cover in one brief article, but the key fundamentals for the company can all be found in one place – Suzhou Centec Communications' company page on Simply Wall St. We've also put together a list of relevant aspects you should further examine:

蘇州斯恩特通信有太多方面需要涵蓋,但是該公司的所有關鍵基本面都可以在Simply Wall St的蘇州斯恩特通信公司頁面上找到。我們還整理了一份相關方面的清單,請進一步查看:

- Historical Track Record: What has Suzhou Centec Communications' performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Suzhou Centec Communications' board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 歷史業績記錄:蘇州斯恩特通信過去的表現如何?在過去的業績記錄分析中進行更詳細的分析,並查看我們的分析的免費視覺表現,以獲得更清晰的說明。

- 管理團隊:經驗豐富的管理團隊使我們對業務的信心增強——看看誰坐在蘇州斯恩特通信的董事會上和CEO的背景。

- 其他高表現的股票:是否有其他表現更好的股票並具有經過驗證的歷史記錄?查看這裏的免費列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。