The moment bond giants have been waiting for has finally arrived: record client inflows into active management ETFs.

According to data from Morningstar Direct, investors poured a total of $245 billion into active and index mutual funds and ETFs in the first half of the year, far exceeding the $150 billion in the first half of 2023, as the Federal Reserve is expected to begin cutting rates as early as September.

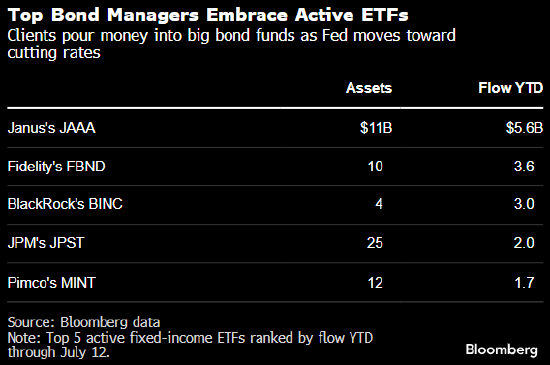

Active ETFs from Janus Henderson Group, BlackRock, Fidelity Investments and Pimco have been particularly popular.

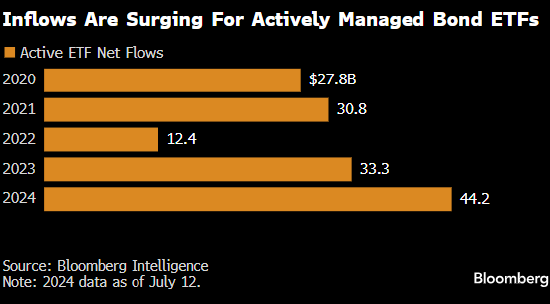

According to compiled data, as of July 12, the net inflow of active fixed income ETF funds was $44 billion, about one-third higher than the full-year figure last year, and more than three times that of 2022.

Gargi Chaudhuri, Chief Investment and Portfolio Strategist for BlackRock Americas, said in a phone interview, "Investors choose an active investment style because they want portfolio managers to have the necessary skills to operate in a high-yield, low-spread, and highly diversified environment." While returns are important, active management and the ability to select bonds are equally important.

Data shows that so far this year, about one-third of the funds attracted by fixed income ETFs have flowed into active bond ETFs, a significant increase from last year's 16%. The new funding for core and broad-based bond ETFs is approximately $24 billion.

The industry has been warning money market fund investors that there is risk in holding 12-month or shorter-term US Treasury bonds for too long, and they should consider switching to an active bond investment strategy. With traders now fully digesting expectations of a rate cut in September, 2-year and 5-year Treasury yields have fallen sharply from recent highs near 5% and 4.75%, respectively.

The total return index of US Treasuries regained all lost ground since the beginning of the year in July and is expected to record a third consecutive monthly gain. According to data from about 100 funds, with Bloomberg's Total Return Index of US Bonds as the benchmark, 91% of funds with assets under management exceeding $1 billion have outperformed the benchmark this year.

This is the best performance by active ETF fund managers since 2012, with 86% and 46% of them outperforming the benchmark in 2023 and 2024, respectively.