The headline news that was jointly reported by global financial media last night and this morning mainly included:

Gold prices have surged to a record high, with traders betting on a rate cut by the Federal Reserve and a reelection victory by Donald Trump. Spot gold rose to $2,451.44 an ounce, breaking the previous record set at the end of May. Signs of slowing US inflation have fueled speculation that the Fed will soon start cutting interest rates. Investors in various markets are also weighing the increasing probability of Trump's triumphant return to the White House, following the failed assassination attempt and the dismissal of a prosecution case over the weekend.

Spot gold rose to $2,451.44 per ounce, breaking the previous record set at the end of May. Signs of slowing inflation in the United States have fueled speculation that the Federal Reserve will soon start cutting interest rates.

Gold prices hit new highs as market hopes for a Fed rate cut continue to rise, and some traders increase their bets on Donald Trump's reelection as President of the United States.

Investors in various markets are also weighing the growing probability of Donald Trump's return to the White House, as his momentum has surged after an unsuccessful assassination attempt and the rejection of a criminal case over the past weekend.

Russia plans to cut crude oil production to compensate for OPEC+ overproduction.

According to sources, Russia plans to further reduce crude oil production during the next two warm seasons to compensate for excess production beyond the OPEC+ quota.

Sources, who requested anonymity because the information had not been made public, said Russia's additional production limits are likely to be implemented in the summer and early fall due to technical reasons. These sources also said that Russia needed more crude oil for domestic consumption during the cold months.

Russia is currently the largest crude oil producing country in the OPEC+ alliance and is significantly lagging behind in implementing agreements aimed at supporting global oil prices. Russia pledged last month to compensate for excess production since April, and the compensation period is expected to last until September 2025.

Musk threatens to move Tesla and SpaceX headquarters out of California over new laws.

Elon Musk announced that the headquarters of X and SpaceX will be relocated to Texas, with the billionaire citing dissatisfaction with the laws in California, where both companies are currently based.

Musk announced the move on his X account on Tuesday, citing a new California law that makes the state the first in the United States to prohibit school districts from requiring teachers to notify parents of changes in students' sexual orientation and gender identity.

Low-alcohol beer sales surge during Euro 2020 in UK.

Although England failed again in the European Cup, the tournament boosted the expenditure of British grocery stores and hotels, with sales of non-alcoholic and low-alcohol beverages showing special prosperity.

According to research released by market research company Kantar on Tuesday, takeaway sales from grocery stores increased by 2.2% in the four weeks to July 7, while average beer sales on England's match days increased by 13%.

Meanwhile, Kantar said sales of low-alcohol beer soared 38% because several of England's matches were played on weekday evenings.

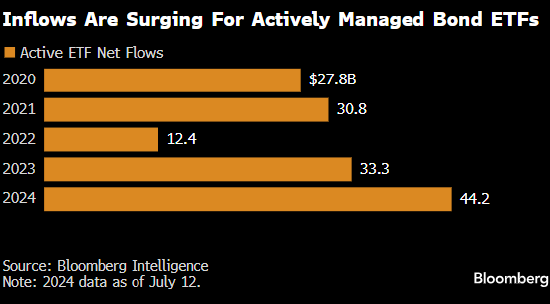

The active ETF of the bond king attracted a record high amount of funds.

The moment bond giants have been waiting for has finally arrived: record client inflows into active management ETFs.

According to data from Morningstar Direct, investors poured a total of $245 billion into active and index mutual funds and ETFs in the first half of the year, far exceeding the $150 billion in the first half of 2023, as the Federal Reserve is expected to begin cutting rates as early as September.

Active ETFs from Janus Henderson Group, BlackRock, Fidelity Investments and Pimco have been particularly popular.

Federal Reserve Board member Clarida reiterates that rate cuts may be appropriate later this year.

Federal Reserve Board Governor Lael Brainard said that if inflation continues to slow, the labor market cools but remains resilient, then an interest rate cut later this year would be appropriate.

Brainard stressed the need for data, particularly given that risks to both inflation and employment have become more balanced. Her comments on the interest rate outlook were largely in line with those made in June.

Brainard said, "If the economy continues to develop favorably toward slowing inflation and resilient but weak employment, I expect that an interest rate cut later this year would be appropriate."