Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like MGE Energy (NASDAQ:MGEE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide MGE Energy with the means to add long-term value to shareholders.

How Fast Is MGE Energy Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years MGE Energy grew its EPS by 5.7% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 21% to 24%, the company has actually reported a fall in revenue by 8.5%. That falls short of ideal.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 21% to 24%, the company has actually reported a fall in revenue by 8.5%. That falls short of ideal.

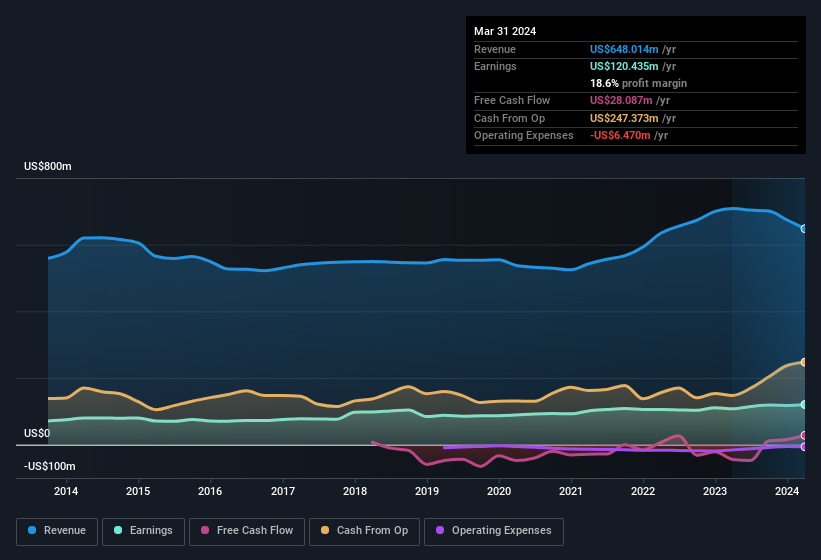

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are MGE Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did MGE Energy insiders refrain from selling stock during the year, but they also spent US$94k buying it. That's nice to see, because it suggests insiders are optimistic.

It's commendable to see that insiders have been buying shares in MGE Energy, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to MGE Energy, with market caps between US$2.0b and US$6.4b, is around US$6.7m.

MGE Energy's CEO took home a total compensation package of US$2.6m in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does MGE Energy Deserve A Spot On Your Watchlist?

As previously touched on, MGE Energy is a growing business, which is encouraging. And there's more to MGE Energy, with the insider buying and modest CEO pay being a great look for those with an eye on the company. If these factors aren't enough to secure MGE Energy a spot on the watchlist, then it certainly warrants a closer look at the very least. What about risks? Every company has them, and we've spotted 2 warning signs for MGE Energy you should know about.

Keen growth investors love to see insider activity. Thankfully, MGE Energy isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com