A Closer Look at Vertiv Hldgs's Options Market Dynamics

A Closer Look at Vertiv Hldgs's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Vertiv Hldgs (NYSE:VRT).

有大量资金可以花的投资者对Vertiv Hldgs(纽约证券交易所代码:VRT)采取了看跌立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VRT, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当VRT发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 12 uncommon options trades for Vertiv Hldgs.

今天,Benzinga的期权扫描仪发现了Vertiv Hldgs的12笔不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 33% bullish and 58%, bearish.

这些大资金交易者的整体情绪在33%的看涨和58%的看跌之间。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $379,272, and 8 are calls, for a total amount of $938,080.

在我们发现的所有特殊期权中,有4个是看跌期权,总额为379,272美元,8个是看涨期权,总额为938,080美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $87.5 to $110.0 for Vertiv Hldgs over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Vertiv Hldgs的价格范围从87.5美元扩大到110.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

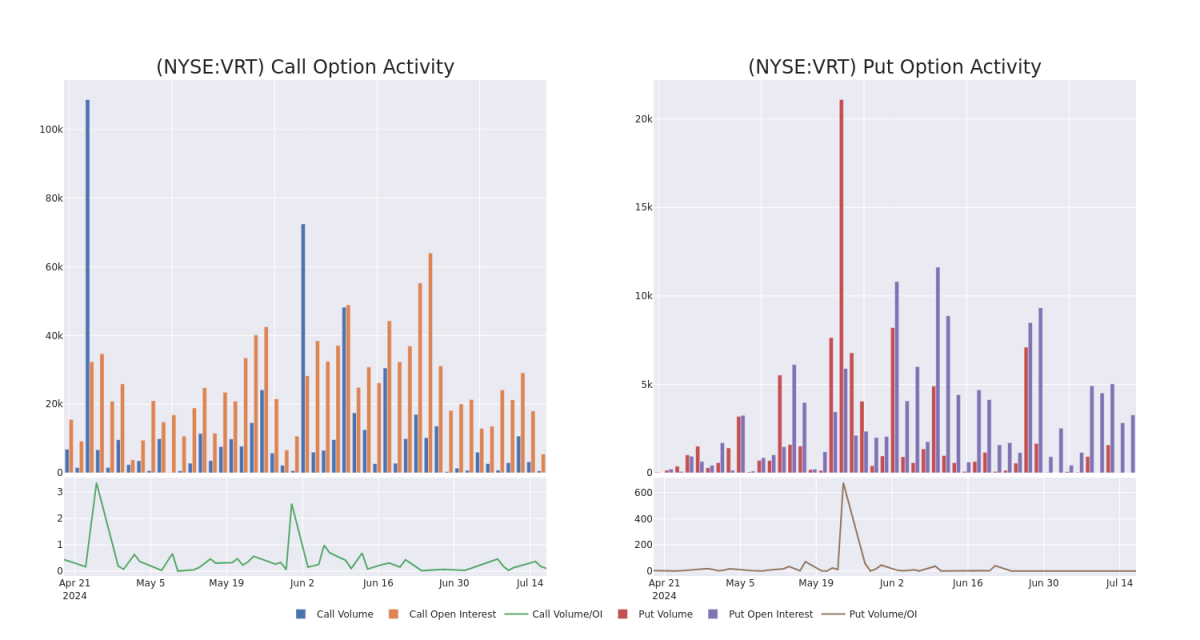

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vertiv Hldgs's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vertiv Hldgs's significant trades, within a strike price range of $87.5 to $110.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量Vertiv Hldgs在特定行使价下期权的流动性和利息水平的关键。下面,我们简要介绍了过去一个月Vertiv Hldgs在87.5美元至110.0美元行使价区间内的重要交易的看涨期权和未平仓合约的趋势。

Vertiv Hldgs 30-Day Option Volume & Interest Snapshot

Vertiv Hldgs 30 天期权交易量和利息快照

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | SWEEP | BULLISH | 08/16/24 | $6.5 | $6.4 | $6.5 | $90.00 | $640.2K | 918 | 9 |

| VRT | PUT | SWEEP | BEARISH | 07/19/24 | $10.0 | $9.7 | $10.0 | $95.00 | $214.0K | 2.5K | 0 |

| VRT | CALL | TRADE | BEARISH | 07/26/24 | $4.4 | $4.0 | $4.0 | $90.00 | $80.0K | 467 | 0 |

| VRT | PUT | SWEEP | BULLISH | 07/26/24 | $6.3 | $6.1 | $6.1 | $88.00 | $74.4K | 654 | 4 |

| VRT | PUT | SWEEP | BEARISH | 07/19/24 | $10.0 | $9.9 | $10.0 | $95.00 | $64.0K | 2.5K | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 打电话 | 扫 | 看涨 | 08/16/24 | 6.5 美元 | 6.4 美元 | 6.5 美元 | 90.00 美元 | 640.2K 美元 | 918 | 9 |

| VRT | 放 | 扫 | 粗鲁的 | 07/19/24 | 10.0 美元 | 9.7 美元 | 10.0 美元 | 95.00 美元 | 214.0 万美元 | 2.5K | 0 |

| VRT | 打电话 | 贸易 | 粗鲁的 | 07/26/24 | 4.4 美元 | 4.0 美元 | 4.0 美元 | 90.00 美元 | 80.0K | 467 | 0 |

| VRT | 放 | 扫 | 看涨 | 07/26/24 | 6.3 美元 | 6.1 美元 | 6.1 美元 | 88.00 美元 | 74.4 万美元 | 654 | 4 |

| VRT | 放 | 扫 | 粗鲁的 | 07/19/24 | 10.0 美元 | 9.9 美元 | 10.0 美元 | 95.00 美元 | 64.0 万美元 | 2.5K | 0 |

About Vertiv Hldgs

关于 Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co 将硬件、软件、分析和持续服务相结合,以确保其客户的重要应用程序持续运行、以最佳性能运行并随着其业务需求而增长。该公司通过从云端延伸到网络边缘的电力、冷却和IT基础设施解决方案和服务组合,解决了数据中心、通信网络以及商业和工业设施面临的重要挑战。其服务包括关键电源、散热管理、机架和机柜、监控和管理以及其他服务。其三个业务部门包括美洲、亚太地区以及欧洲、中东和非洲。

Where Is Vertiv Hldgs Standing Right Now?

Vertiv Hldgs 现在处于什么位置?

- With a volume of 1,345,926, the price of VRT is down -3.5% at $86.58.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 7 days.

- vRT的交易量为1,345,926美元,价格下跌了-3.5%,至86.58美元。

- RSI 指标暗示,标的股票目前在超买和超卖之间保持中立。

- 下一份财报预计将在7天后公布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro获取实时提醒,了解维帝夫控股的最新期权交易。