What the Options Market Tells Us About Oracle

What the Options Market Tells Us About Oracle

Deep-pocketed investors have adopted a bullish approach towards Oracle (NYSE:ORCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ORCL usually suggests something big is about to happen.

深謀遠慮的投資者對Oracle(NYSE:ORCL)採取了看好的態度,這是市場參與者不應該忽視的事情。我們在Benzinga對公開期權記錄的跟蹤披露了這一重大動作。這些投資者的身份尚不明確,但ORCL的如此重大舉措通常意味着大事將要發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Oracle. This level of activity is out of the ordinary.

我們從觀察中獲得了這一信息,當Benzinga的期權掃描器突出了Oracle的13項非凡期權活動時。這種活動水平超出了常規範疇。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 46% bearish. Among these notable options, 6 are puts, totaling $294,190, and 7 are calls, amounting to $603,572.

這些大時代的投資者的總體心態分爲兩派,其中46%看好,46%看淡。在這些值得注意的期權中,有6個看跌期權,總額爲294,190美元,7個看漲期權,總額爲603,572美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.

在評估成交量和持倉量之後,我們發現主要的市場搬動者正在關注Oracle的價格區間,涵蓋了過去三個月的125.0美元到165.0美元之間。

Insights into Volume & Open Interest

成交量和持倉量分析

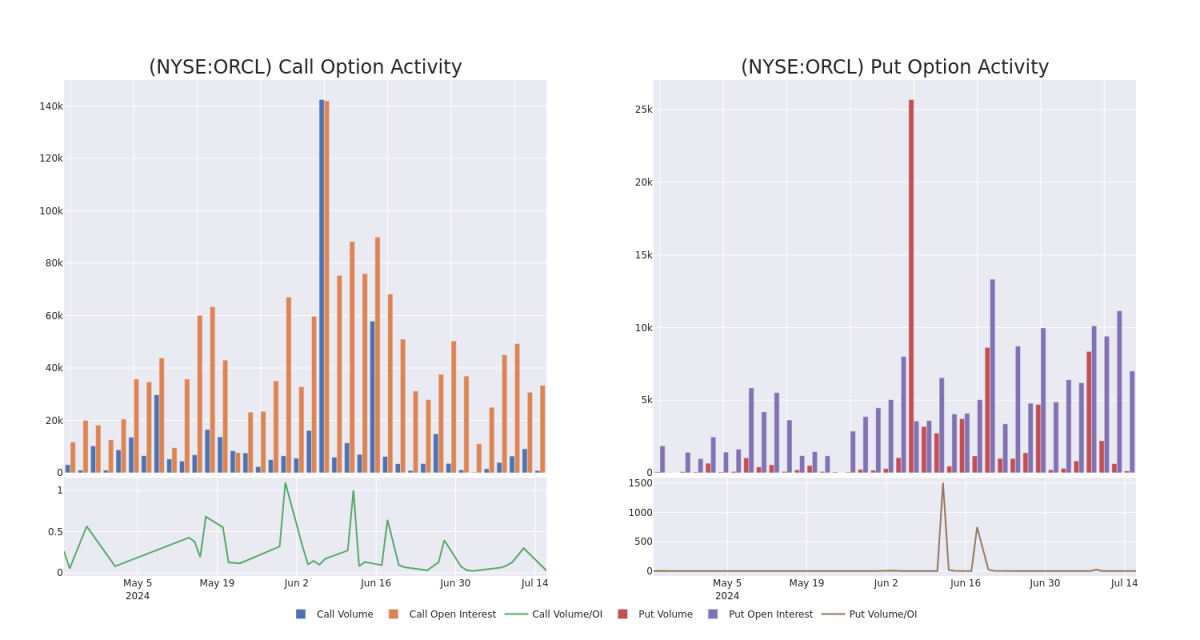

In today's trading context, the average open interest for options of Oracle stands at 2086.23, with a total volume reaching 624.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $125.0 to $165.0, throughout the last 30 days.

在今天的交易環境中,Oracle期權的平均持倉量爲2086.23,總成交量達到624.00。附帶的圖表勾畫了Oracle高價值交易的看漲和看跌期權成交量和持倉量的進展情況,這些期權均位於從125.0美元到165.0美元的行權價格帶內,在過去的30天內發生。

Oracle Call and Put Volume: 30-Day Overview

Oracle看漲期權和看跌期權成交量:30天概覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BULLISH | 12/19/25 | $30.95 | $30.3 | $30.95 | $125.00 | $216.6K | 2.4K | 0 |

| ORCL | CALL | TRADE | BEARISH | 12/20/24 | $18.65 | $18.25 | $18.35 | $130.00 | $165.1K | 2.2K | 0 |

| ORCL | PUT | TRADE | BEARISH | 06/20/25 | $28.0 | $27.1 | $28.0 | $165.00 | $140.0K | 350 | 0 |

| ORCL | CALL | SWEEP | BULLISH | 08/16/24 | $0.37 | $0.36 | $0.36 | $155.00 | $72.7K | 3.6K | 255 |

| ORCL | CALL | TRADE | BULLISH | 12/20/24 | $6.05 | $6.0 | $6.03 | $155.00 | $60.3K | 5.9K | 14 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看漲 | SWEEP | 看好 | 2025年12月19日 | $30.95 | $30.3 | $30.95 | $125.00 | $216.6K | 2.4K | 0 |

| ORCL | 看漲 | 交易 | 看淡 | 12/20/24 | $18.65 | $18.25 | $18.35 | $130.00 | $165.1K | 2.2K | 0 |

| ORCL | 看跌 | 交易 | 看淡 | 06/20/25 | $28.0 | $27.1 | $28.0 | 165.00美元 | 140,000美元 | 350 | 0 |

| ORCL | 看漲 | SWEEP | 看好 | 08/16/24 | $0.37 | $0.36 | $0.36 | $155.00 | $72.7K | 3.6千 | 255 |

| ORCL | 看漲 | 交易 | 看好 | 12/20/24 | $6.05 | $6.0 | $6.03 | $155.00 | $60.3K | 5.9K | 14 |

About Oracle

關於Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企業提供數據庫技術和企業資源規劃(ERP)軟件。Oracle成立於1977年,是第一個商用SQL數據庫管理系統的創始人。如今,Oracle在175個國家擁有430,000個客戶,由136,000名員工支持。

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

在對Oracle的期權活動進行分析之後,我們將轉向更密切關注公司的表現。

Current Position of Oracle

Oracle的當前位置

- With a trading volume of 2,560,240, the price of ORCL is down by -2.11%, reaching $139.59.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 54 days from now.

- 在2,560,240的交易量下,ORCL的價格下跌了-2.11%,達到了139.59美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一個收益報告將在54天后公佈。

What The Experts Say On Oracle

專家們對Oracle的評價

4 market experts have recently issued ratings for this stock, with a consensus target price of $152.25.

4位市場專家最近對這隻股票發表了評級,其中共識目標價爲152.25美元。

- In a cautious move, an analyst from Guggenheim downgraded its rating to Buy, setting a price target of $175.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Oracle with a target price of $150.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Oracle, maintaining a target price of $125.

- An analyst from Argus Research has decided to maintain their Buy rating on Oracle, which currently sits at a price target of $159.

- 爲謹慎起見,來自古根海姆的一位分析師將其評級下調爲買入,並設置了每股175美元的目標價格。

- 派傑投資公司的分析師在評估中保持了對Oracle的超配評級,目標價爲150美元。

- 大摩資源lof的分析師堅持給Oracle打持平評級,並維持目標價125美元。

- 雅運股份的分析師決定維持對Oracle的買入評級,目標價爲159美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.