Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Caribou Biosciences (NASDAQ:CRBU) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Does Caribou Biosciences Have A Long Cash Runway?

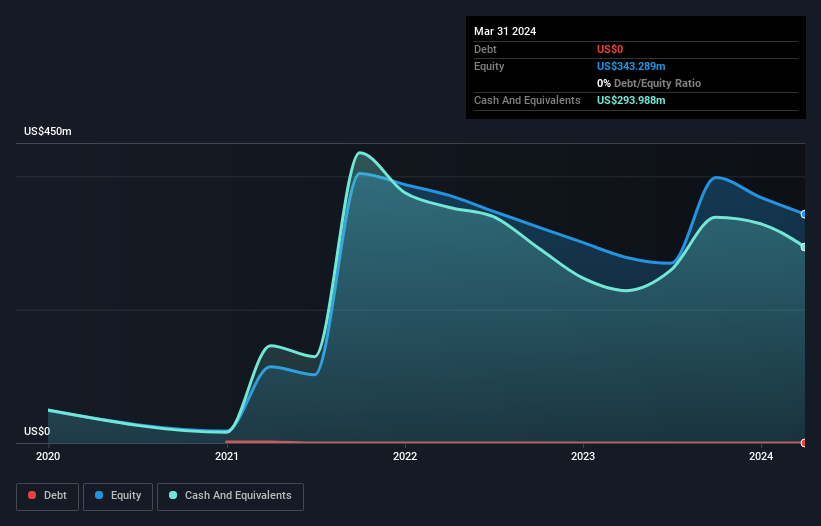

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2024, Caribou Biosciences had cash of US$294m and no debt. Importantly, its cash burn was US$115m over the trailing twelve months. Therefore, from March 2024 it had 2.6 years of cash runway. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Well Is Caribou Biosciences Growing?

At first glance it's a bit worrying to see that Caribou Biosciences actually boosted its cash burn by 9.0%, year on year. Given that its operating revenue increased 127% in that time, it seems the company has reason to think its expenditure is working well to drive growth. If revenue is maintained once spending on growth decreases, that could well pay off! It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

At first glance it's a bit worrying to see that Caribou Biosciences actually boosted its cash burn by 9.0%, year on year. Given that its operating revenue increased 127% in that time, it seems the company has reason to think its expenditure is working well to drive growth. If revenue is maintained once spending on growth decreases, that could well pay off! It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Caribou Biosciences Raise More Cash Easily?

While Caribou Biosciences seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Caribou Biosciences has a market capitalisation of US$192m and burnt through US$115m last year, which is 60% of the company's market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

How Risky Is Caribou Biosciences' Cash Burn Situation?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Caribou Biosciences' revenue growth was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 4 warning signs for Caribou Biosciences you should be aware of, and 1 of them doesn't sit too well with us.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com