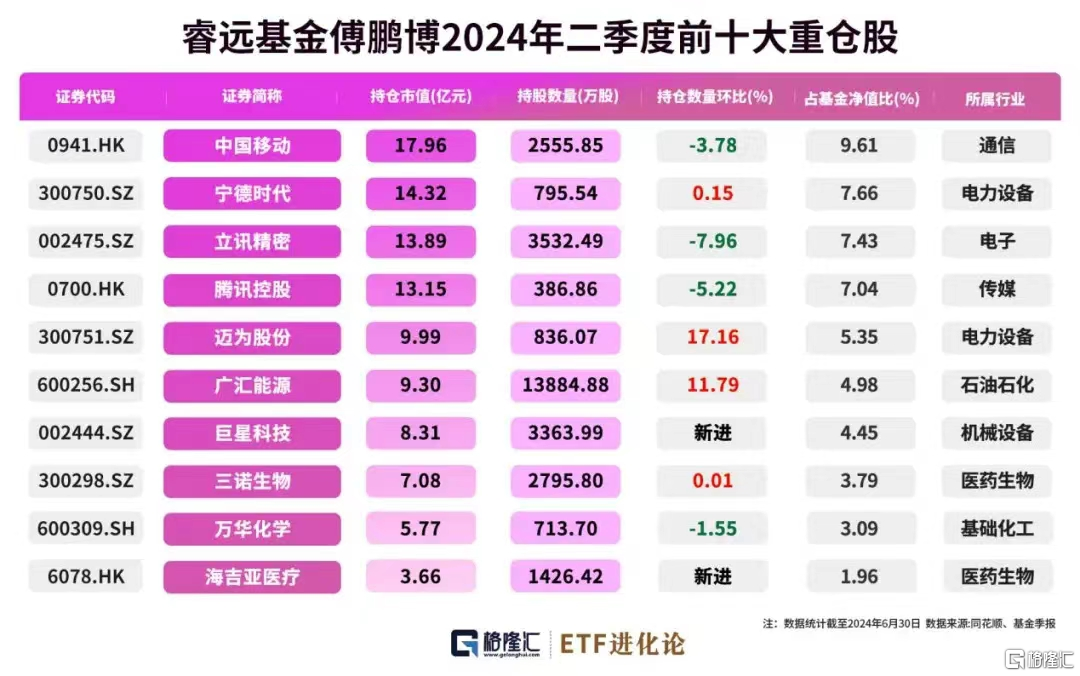

Fu Pengbo's managed product, Ruiyuan Growth Value Mixed Fund, released its Q2 report. Fu Pengbo's latest managed size is CNY 18.686 billion, and the top ten holdings in Q2 are China Mobile, Contemporary Amperex Technology, Luxshare Precision Industry, Tencent, Suzhou Maxwell Technologies, Guanghui Energy, Hangzhou Great Star Industrial, Sinocare Inc., Wanhua Chemical Group, and Hygeia Health.

Compared with the first quarter holding, Great Star Industrial and Hygeia Health became its top ten heavy stocks in Q2. Fu Pengbo added shares of Suzhou Maxwell Technologies, Guanghui Energy, Contemporary Amperex Technology, and Sinocare Inc. in Q2; reduced holdings of China Mobile, Luxshare Precision Industry, Tencent, and Wanhua Chemical Group.

In the Q2 report, Fu Pengbo wrote: "Looking back on the second quarter, in April, the Hong Kong stock market performed well, and some overseas funds flowed to Hong Kong stocks with lower valuations and improved macro expectations in the high-low switching. At the same time, the A-share market improved its sentiment, and the index rebounded." Under the background of stock funds trading, the sectors that performed relatively well were large-cap stocks, where the industrial chains, especially the export industrial chain, performed well, and the home appliances and automobile industries led the gains. In May, the market sentiment began to decline. Although various real estate policies were introduced, the market took a "wait-and-see" attitude after a short-term rebound. At the industry level, the leading sectors were traditional and dividend stocks, and overseas AI was popular, but TMT-related stocks showed no significant fluctuations in China. In June, domestic demand data was not optimistic, and the export industry faced unfriendly trade policies. The market trading sentiment was low, and the stock prices of benchmark companies in the food and new energy sectors underwent significant adjustments. In the past three years, funds have been overcrowded and clustered in the aforementioned two sectors, and the risk-reward ratio has continued to decline. Recently, similar phenomena have appeared in the dividend and bank sectors. In Q2, impressive macro events include: (1) credit data was weaker than expected due to seasonality, credit demand contracted, and both new loans for residents and businesses increased less year-on-year. The growth of new social financing was below the seasonal level, and the decline in financing for the real economy was the main drag. The year-on-year growth rates of M1 and M2 both declined, and the negative gap between M1 and M2 increased. (2) Against the backdrop of a new low in the 30-year government bond yield and a low long-term bond yield, the central bank issued warnings and guided the second-quarter bond yields upward. When the market turned a deaf ear, the central bank stated that it would "borrow government bonds on a large scale." If these two major events are linked with market performance in May-June, the internal logic is clear, that is, under the background of weakened macro expectations and strengthened overseas protectionism, the market's capital tends to allocate "safe" assets with high dividend yields and good liquidity.

At the beginning of July, the A-share market performed poorly, with the index adjustment combined with low trading volume. Indeed, the capital market and the Chinese economy are in a stage of "nurturing the foundation," and fully recognizing this can help control the risk and return of investments. As interim reports of listed companies are disclosed, we will actively look for companies with prosperous growth, and the screening process and standards will be more cautious, assessing the target's ability to create future cash flow and paying attention to the odds and win rates of stock selection. In the second half of the year, the market may face some upward driving factors, such as better-than-expected real estate data, policy inspirations from the Third Plenary Session, accelerated issuance of budgetary and local bonds, etc. Currently, we will dynamically respond to market changes and control the pullback of the portfolio."

In Q2, we slightly reduced the allocation of equity assets, but the position is still not low, and the overall contribution of Hong Kong stocks is significant. We have made certain adjustments to the holdings. Compared with Q2, the net value of the top ten holdings has increased. In particular, we have increased our holdings in the machinery equipment, power equipment, and energy industries, reduced our holdings of telecom operators, but the change was limited, and the holdings of other key companies remained almost unchanged. There have been relatively many changes to the holdings after the top ten holdings. We reduced our holdings of companies with fundamental pressures that do not match their valuations and growth.

The impressive macro events in Q2 include: (1) credit data was weaker than expected due to seasonality, credit demand contracted, and both new loans for residents and businesses increased less year-on-year. The growth of new social financing was below the seasonal level, and the decline in financing for the real economy was the main drag. The year-on-year growth rates of M1 and M2 both declined, and the negative gap between M1 and M2 increased. (2) Against the backdrop of a new low in the 30-year government bond yield and a low long-term bond yield, the central bank issued warnings and guided the second-quarter bond yields upward. When the market turned a deaf ear, the central bank stated that it would "borrow government bonds on a large scale." If these two major events are linked with market performance in May-June, the internal logic is clear, that is, under the background of weakened macro expectations and strengthened overseas protectionism, the market's capital tends to allocate "safe" assets with high dividend yields and good liquidity.

The fund slightly reduced equity asset allocation during this stage, but the position is still not low, and the overall contribution of Hong Kong stocks is significant. We have made certain adjustments to the holdings. Compared with Q2, the net value of the top ten holdings has increased. In particular, we have increased our holdings in the machinery equipment, power equipment, and energy industries; reduced our holdings of telecom operators, but the change was limited; and the holdings of other key companies remained almost unchanged. There have been relatively many changes to the holdings after the top ten holdings. We reduced our holdings of companies with fundamental pressures that do not match their valuations and growth.

At the beginning of July, the A-share market performed poorly, with the index adjustment combined with low trading volume. Indeed, the capital market and the Chinese economy are in a stage of "nurturing the foundation," and fully recognizing this can help control the risk and return of investments. As interim reports of listed companies are disclosed, we will actively look for companies with prosperous growth, and the screening process and standards will be more cautious, assessing the target's ability to create future cash flow and paying attention to the odds and win rates of stock selection. In the second half of the year, the market may face some upward driving factors, such as better-than-expected real estate data, policy inspirations from the Third Plenary Session, accelerated issuance of budgetary and local bonds, etc. Currently, we will dynamically respond to market changes and control the pullback of the portfolio."