Those holding Pop Culture Group Co., Ltd (NASDAQ:CPOP) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 64% share price drop in the last twelve months.

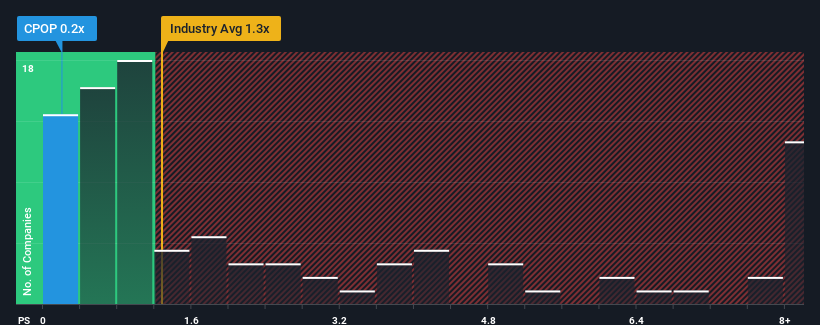

Although its price has surged higher, Pop Culture Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Pop Culture Group's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Pop Culture Group has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Pop Culture Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Pop Culture Group?

In order to justify its P/S ratio, Pop Culture Group would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Pop Culture Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. Pleasingly, revenue has also lifted 60% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

In light of this, it's peculiar that Pop Culture Group's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Pop Culture Group's P/S?

Despite Pop Culture Group's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Pop Culture Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 4 warning signs for Pop Culture Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com