The company maintains targets of 30-40 billion euros in 2025 and 44-60 billion euros in 2030.

Author of this article: Zhang Yifan

Editor: Shen Siqi

Source: Hard AI

On July 17, ASML released financial reports, and both revenue and profit exceeded expectations. During the evening conference call, the sources of growth that investors are concerned about and the high-NA EUV situation were updated —

1) Q2 revenue and profit both exceeded expectations, mainly due to strong demand for AI. This strong demand is expected to continue until 2026;

2) Revenue is expected to reach 30-40 billion euros in 2025 and 44-60 billion euros in 2030. Compared with 2023, there was an increase of 10%-45% and 60%-118%, respectively;

3) High-NA currently has sufficient orders, and it is expected that High-NA EUV revenue will be confirmed for the first time in the second half of 2024;

4) Reiterate the “600 DUV and 90 EUV” production capacity plan;

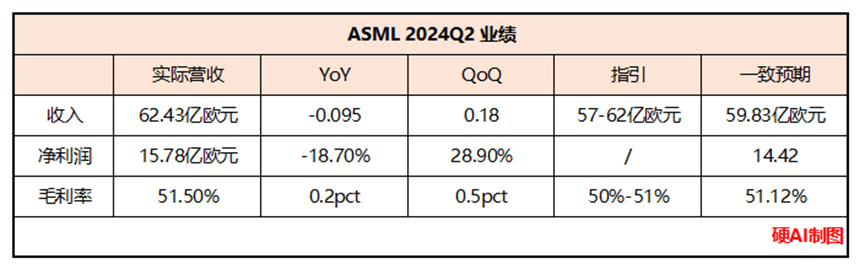

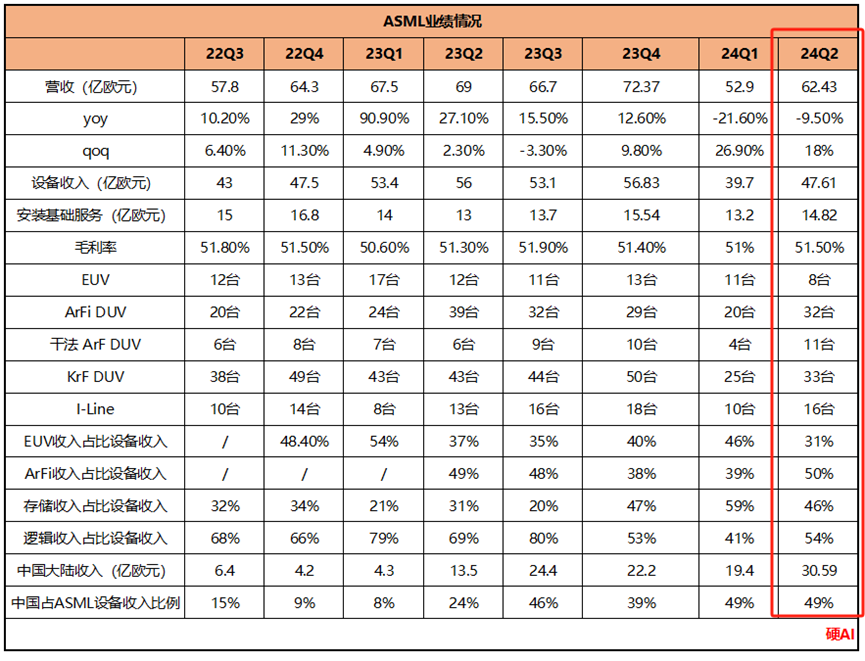

1. Revenue and profit both exceeded expectations

On July 17, ASML released its 2024Q2 financial report. The report showed that both revenue and profit exceeded expectations.

The company mentioned in the evening conference call that the reason for the increase is mainly due to strong demand for AI, and it is expected that this strong demand will continue until 2026.

2. Income Guidelines

In terms of guidance, the company predicts Q3 revenue of 6.7-7.3 billion euros (the agreed forecast is 7.532 billion euros), with a gross margin range of 50%-51%. Revenue for the full year of 2024 is expected to be close to 2023, with the second half of the year performing better than the first half. Furthermore, the company predicts that the logic business in 2024 will be lower than in 2023 and the storage business will be higher than in 2023.

In the longer term, the company maintained its targets of 30-40 billion euros in 2025 and 44-60 billion euros in 2030.

In particular, in 2025, benefiting from the energy transition, electrification, and AI cycle recovery, the company indicated strong growth.

3. Recent developments in high-NA EUV

On the high-NA EUV side, the company revealed that it will confirm high-NA EUV revenue for the first time in the second half of 2024.

Currently, ASML's first high-NA EUV has been validated on the customer side, and the second is being assembled on the customer side. Customers are actively testing the High-NA EUV, and the data is performing well, and it is expected that it will be introduced in 2025 and 2026.

Overall, customers are more interested in high-NA lithographs. The company said that High-NA now has sufficient orders, and ASML will begin supplying equipment to all customers who order high-NA equipment. In addition, ASML also helps customers test and obtain data before equipment installation is complete. This data provides valuable information to customers and helps them adjust their plans.

4. Production capacity

In terms of production capacity, the company said it is working hard to achieve the production capacity target of “600 DUV and 90 EUV”.

At the end of 2022, the company proposed a “600 DUV and 90 EUV” production capacity plan. Over the next year, DUV shipments gradually increased. At this conference call, the company once again emphasized that it is working hard to implement this plan and stated that it will promote high-NA EUV production capacity.

Looking ahead, ASML has identified three growth points:

1) On the DRAM side, benefiting from the transformation of technology nodes, revenue will continue to grow. It is expected that this trend will continue until 2026;

2) In the future, all customers will use EUV in production (currently only 12% of shipments), but the speed of adoption is different;

3) High-NA EUV will be introduced in 2025 and 2026;

Finally, from a market perspective, although ASML's 2024Q2 revenue and profit both exceeded expectations, the intraday decline was 13%. The main reason is that foreign media have reported that the Biden administration may continue to strengthen controls on semiconductor devices including ASML and Tokyo Electronics, and market concerns will affect future ASML shipments.