Financial giants have made a conspicuous bearish move on Marathon Petroleum. Our analysis of options history for Marathon Petroleum (NYSE:MPC) revealed 24 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 79% showed bearish tendencies. Out of all the trades we spotted, 22 were puts, with a value of $636,902, and 2 were calls, valued at $84,825.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $170.0 for Marathon Petroleum over the recent three months.

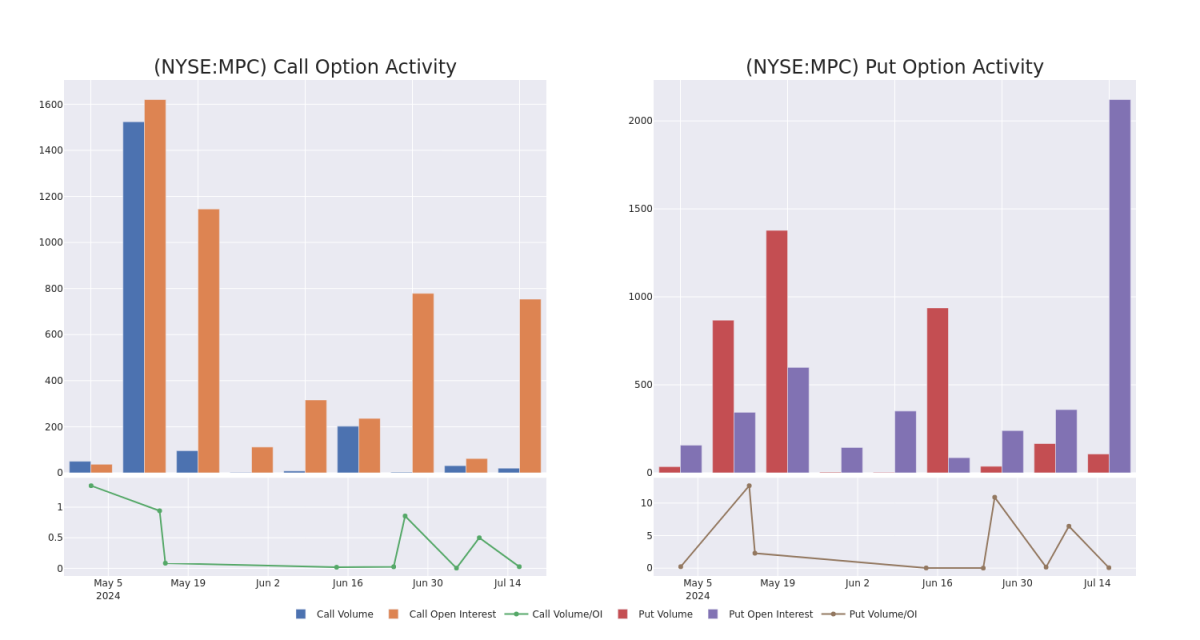

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Marathon Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Marathon Petroleum's whale trades within a strike price range from $160.0 to $170.0 in the last 30 days.

Marathon Petroleum Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | CALL | SWEEP | BEARISH | 01/17/25 | $18.85 | $18.4 | $18.4 | $160.00 | $55.2K | 272 | 0 |

| MPC | CALL | SWEEP | BULLISH | 12/20/24 | $11.85 | $11.8 | $11.85 | $170.00 | $29.6K | 37 | 0 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $14.7 | $14.2 | $14.7 | $160.00 | $29.4K | 677 | 0 |

| MPC | PUT | TRADE | BEARISH | 06/20/25 | $14.65 | $14.25 | $14.65 | $160.00 | $29.3K | 677 | 73 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $14.6 | $14.2 | $14.6 | $160.00 | $29.2K | 677 | 46 |

About Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Following our analysis of the options activities associated with Marathon Petroleum, we pivot to a closer look at the company's own performance.

Marathon Petroleum's Current Market Status

- Trading volume stands at 542,244, with MPC's price down by -0.03%, positioned at $165.51.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 19 days.

What Analysts Are Saying About Marathon Petroleum

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $200.8.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Marathon Petroleum with a target price of $196.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Marathon Petroleum, targeting a price of $231.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Marathon Petroleum, targeting a price of $201.

- Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Marathon Petroleum, targeting a price of $191.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Marathon Petroleum, targeting a price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.