This Is What Whales Are Betting On MercadoLibre

This Is What Whales Are Betting On MercadoLibre

Financial giants have made a conspicuous bullish move on MercadoLibre. Our analysis of options history for MercadoLibre (NASDAQ:MELI) revealed 17 unusual trades.

金融巨頭們對MercadoLibre採取了明顯的看好行動。我們對MercadoLibre(NASDAQ:MELI)期權交易歷史的分析表明,出現了17筆不尋常的交易。

Delving into the details, we found 35% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $690,190, and 11 were calls, valued at $433,143.

深入了解後,我們發現35%的交易員看漲,而35%的交易員表現出看淡的趨勢。在我們發現的所有交易中,6筆是看跌期權,價值690,190美元,11筆是看漲期權,價值433,143美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1400.0 to $2600.0 for MercadoLibre over the recent three months.

根據交易活動,顯然重要的投資者們正瞄準MercadoLibre在近三個月內的價格區間,該區間從1400.0美元到2600.0美元。

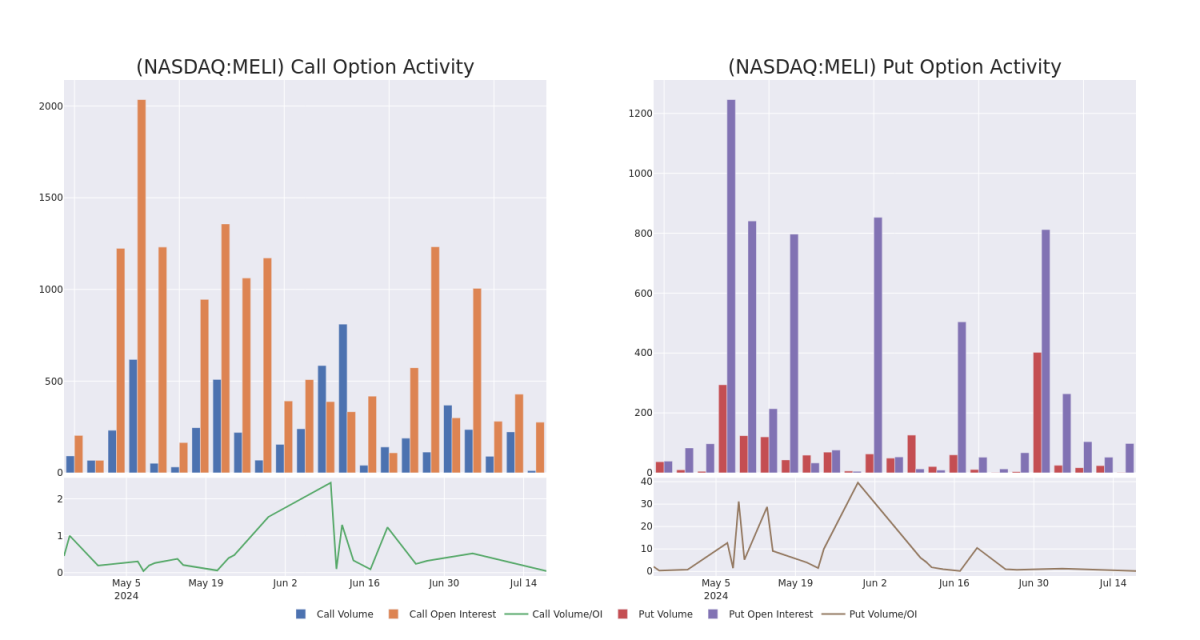

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale trades within a strike price range from $1400.0 to $2600.0 in the last 30 days.

在交易期權時,分析成交量和未平倉利息是一個強有力的方法。這些數據可以幫助您追蹤特定行權價的MercadoLibre期權的流動性和利率。下面,我們觀察了過去30天內MercadoLibre鯨魚交易中所有看漲和看跌期權的成交量和未平倉利息的演變,範圍爲1400.0美元到2600.0美元的行權價區間。

MercadoLibre Call and Put Volume: 30-Day Overview

MercadoLibre期權看漲和看跌交易量:30天總覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | TRADE | NEUTRAL | 01/17/25 | $101.4 | $95.4 | $98.1 | $1500.00 | $490.5K | 69 | 0 |

| MELI | CALL | SWEEP | BEARISH | 01/16/26 | $107.0 | $102.0 | $102.0 | $2600.00 | $71.4K | 54 | 0 |

| MELI | CALL | TRADE | NEUTRAL | 01/17/25 | $202.0 | $190.6 | $196.81 | $1620.00 | $59.0K | 46 | 0 |

| MELI | PUT | TRADE | BEARISH | 12/18/26 | $503.0 | $496.0 | $503.0 | $2000.00 | $50.3K | 13 | 1 |

| MELI | PUT | TRADE | BULLISH | 12/18/26 | $508.0 | $490.1 | $496.0 | $2000.00 | $49.6K | 13 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| mercadolibre | 看跌 | 交易 | 中立 | 01/17/25 | $101.4 | $95.4 | $98.1 | $1500.00 | $490.5K | 69 | 0 |

| mercadolibre | 看漲 | SWEEP | 看淡 | 01/16/26 | $107.0 | $102.0 | $102.0 | $2600.00 | $71.4K | 54 | 0 |

| mercadolibre | 看漲 | 交易 | 中立 | 01/17/25 | $202.0 | $190.6 | $196.81 | $1620.00 | 59.0千美元 | 46 | 0 |

| mercadolibre | 看跌 | 交易 | 看淡 | 12/18/26 | $503.0 | $496.0 | $503.0 | $2000.00 | $50.3K | 13 | 1 |

| mercadolibre | 看跌 | 交易 | 看好 | 12/18/26 | $508.0 | $490.1 | $496.0 | $2000.00 | 49.6K美元 | 13 | 0 |

About MercadoLibre

關於mercadolibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre是拉美地區最大的電子商務市場,截至2023年底,在其涵蓋18個國家的商業網絡或金融科技解決方案中,擁有超過2.18億活躍用戶和100萬活躍賣家。該公司在其核心在線商店之外運營一系列互補業務,包括貨運解決方案(Mercado Envios)、支付和融資業務(Mercado Pago和Mercado Credito)、廣告(Mercado Clics)、分類廣告和一站式電子商務解決方案(Mercado Shops)等。MercadoLibre從最終價值費用、廣告版稅、付款處理、插入費用、訂閱費用以及來自消費者和小企業貸款的利息收入中獲取收入。

In light of the recent options history for MercadoLibre, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於MercadoLibre最近的期權歷史,現在適當關注公司本身。我們旨在探索其當前業績。

Present Market Standing of MercadoLibre

MercadoLibre的當前市場狀況

- With a volume of 125,463, the price of MELI is down -3.03% at $1619.53.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

- MELI的成交量爲125,463,價格下跌了-3.03%,爲1,619.53美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一次收益預計將在13天內發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。