Unfortunately for some shareholders, the East Group Co.,Ltd (SZSE:300376) share price has dived 39% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

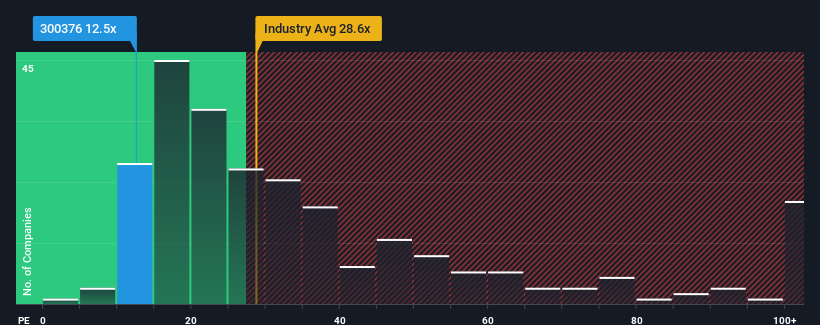

In spite of the heavy fall in price, East GroupLtd's price-to-earnings (or "P/E") ratio of 12.5x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 52x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The earnings growth achieved at East GroupLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like East GroupLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. EPS has also lifted 9.8% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why East GroupLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From East GroupLtd's P/E?

Shares in East GroupLtd have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of East GroupLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with East GroupLtd (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com