Investors with significant funds have taken a bearish position in Snap (NYSE:SNAP), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in SNAP usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Snap. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 33% being bullish and 55% bearish. Of all the options we discovered, 8 are puts, valued at $341,814, and there was a single call, worth $173,810.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $15.5 for Snap, spanning the last three months.

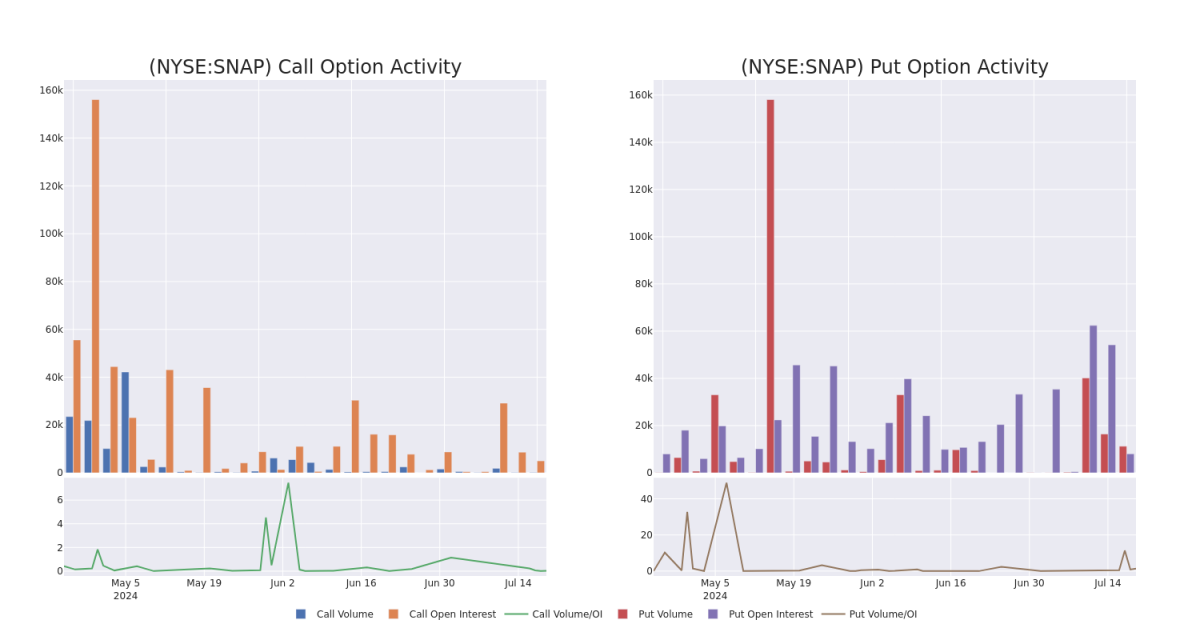

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $15.0 to $15.5, over the past month.

Snap Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BEARISH | 07/26/24 | $0.36 | $0.34 | $0.35 | $15.00 | $173.8K | 5.0K | 155 |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.94 | $0.85 | $0.85 | $15.50 | $66.9K | 8.0K | 3.7K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $0.95 | $0.85 | $0.85 | $15.50 | $62.7K | 8.0K | 1.5K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $1.1 | $0.72 | $0.8 | $15.50 | $51.1K | 8.0K | 3.0K |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.89 | $0.88 | $0.89 | $15.50 | $36.3K | 8.0K | 751 |

About Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

After a thorough review of the options trading surrounding Snap, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Snap Standing Right Now?

- With a volume of 54,463, the price of SNAP is down 0.0% at $14.57.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.