Walt Disney Unusual Options Activity

Walt Disney Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Walt Disney.

有大量資金可支配的鯨魚在迪士尼股票上採取了明顯的看淡立場。

Looking at options history for Walt Disney (NYSE:DIS) we detected 9 trades.

查看迪士尼(紐交所:DIS)期權歷史,我們發現9筆交易。

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 55% with bearish.

如果我們考慮每筆交易的具體細節,那麼可以準確地說,22%的投資者持有看漲期權,55%持有看跌期權。

From the overall spotted trades, 2 are puts, for a total amount of $110,725 and 7, calls, for a total amount of $351,360.

從整體看到的交易中,有2張看跌期權,總金額爲110,725美元,7張看漲期權,總金額爲351,360美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $125.0 for Walt Disney over the recent three months.

根據交易活動情況,顯然,重要投資者在最近三個月內瞄準了迪士尼的價格區間,在95.0美元到125.0美元之間。

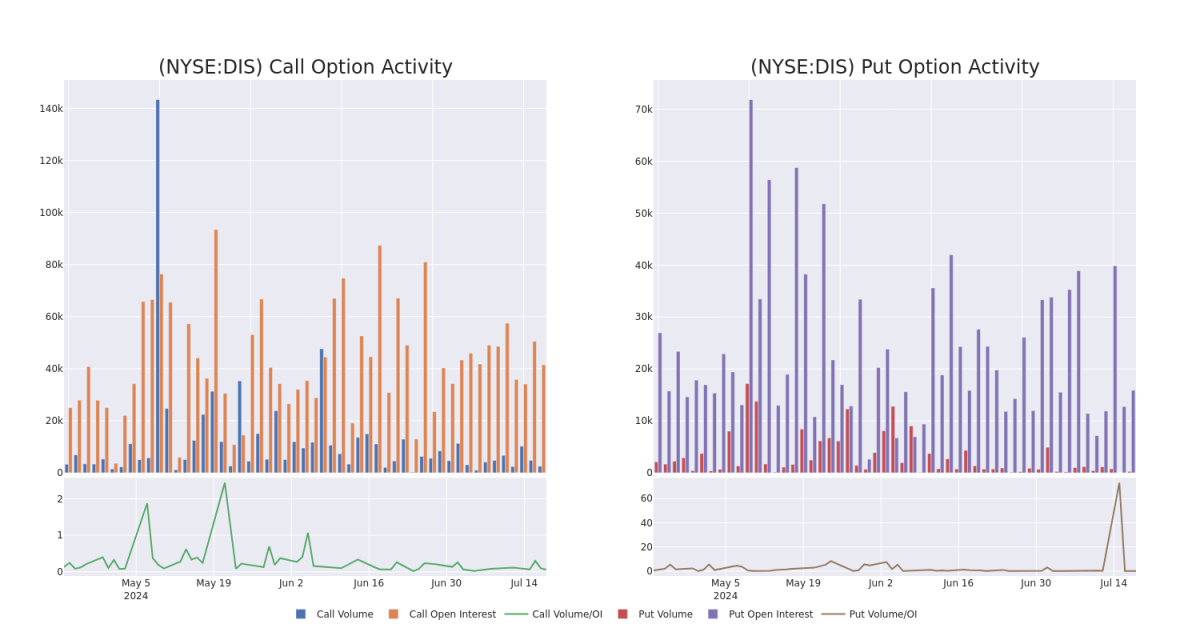

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In today's trading context, the average open interest for options of Walt Disney stands at 1751.5, with a total volume reaching 620.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $95.0 to $125.0, throughout the last 30 days.

在今天的交易情境中,迪士尼期權的平均持倉量爲1,751.5,總成交量爲620.00。附帶的圖表描述了過去30天內處於95.0美元到125.0美元的行權價通道內的迪士尼高價值交易的看漲和看跌期權成交量和持倉量的進展情況。

Walt Disney Option Volume And Open Interest Over Last 30 Days

迪士尼期權的成交量和持倉量過去30天的情況

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | TRADE | BEARISH | 07/26/24 | $0.54 | $0.5 | $0.5 | $99.00 | $117.5K | 1.4K | 48 |

| DIS | PUT | TRADE | BEARISH | 08/02/24 | $15.75 | $15.65 | $15.75 | $112.00 | $63.0K | 0 | 9 |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $14.0 | $14.0 | $14.0 | $100.00 | $57.4K | 2.5K | 1 |

| DIS | PUT | SWEEP | BEARISH | 10/18/24 | $4.15 | $4.15 | $4.15 | $95.00 | $47.7K | 2.5K | 511 |

| DIS | CALL | SWEEP | BEARISH | 07/26/24 | $1.59 | $1.57 | $1.57 | $96.00 | $47.1K | 275 | 7 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 項目8.01 | 看漲 | 交易 | 看淡 | 07/26/24 | $0.54 | $0.5 | $0.5 | $99.00 | $117.5K | 1.4千 | 48 |

| 項目8.01 | 看跌 | 交易 | 看淡 | 08/02/24 | $15.75 | $15.65 | $15.75 | $112.00 | $63.0K | 0 | 9 |

| 項目8.01 | 看漲 | 交易 | 看好 | 01/16/26 | $14.0 | $14.0 | $14.0 | $100.00。 | $57.4千美元 | 2.5千 | 1 |

| 項目8.01 | 看跌 | SWEEP | 看淡 | 10/18/24 | $4.15 | $4.15 | $4.15 | $ 95.00 | $47.7K | 2.5千 | 511 |

| 項目8.01 | 看漲 | SWEEP | 看淡 | 07/26/24 | $1.59 | $1.57 | $1.57 | 96.00美元。該公司的股價上週四收於65.65美元。 | $47.1K | 275 | 7 |

About Walt Disney

關於迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼主營業務涵蓋娛樂、體育和體驗三大全球業務板塊。一個世紀以來,娛樂和體驗都受益於該公司爲這些業務板塊創造的知名品牌和形象。娛樂業務包括ABC廣播網絡、多個有線電視網以及Disney+和Hulu等流媒體服務。在該業務板塊內,迪士尼還涉足電影和電視節目的製作和發佈,其內容被授權給電影院、其他內容提供商或自用於迪士尼自身的流媒體平台和電視網絡上。體育板塊包括ESPN和ESPN+流媒體服務。體驗板塊包括迪士尼的主題公園和度假村,也受益於商品授權。

Having examined the options trading patterns of Walt Disney, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了迪士尼的期權交易模式後,我們現在將直接轉向公司本身。這個轉變使我們能夠深入探討其現在的市場地位和表現。

Walt Disney's Current Market Status

迪士尼的當前市場狀況

- With a trading volume of 1,262,820, the price of DIS is down by -0.38%, reaching $96.42.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 19 days from now.

- 隨着1,262,820的交易量,迪士尼的股價下跌-0.38%,達到96.42美元。

- 當前RSI指標表明該股可能被超賣。

- 下一次業績將於19天后發佈。

Expert Opinions on Walt Disney

專家對迪士尼的評價

In the last month, 3 experts released ratings on this stock with an average target price of $131.66666666666666.

在最近一個月裏,有3位專家發佈了關於這個股票的評級,平均目標價爲131.66666666666666美元。

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $145.

- In a cautious move, an analyst from Goldman Sachs downgraded its rating to Buy, setting a price target of $125.

- Maintaining their stance, an analyst from MoffettNathanson continues to hold a Buy rating for Walt Disney, targeting a price of $125.

- 反映出擔憂,Needham的一位分析師將其評級下調爲買入,以145美元的新目標價。

- 在一個謹慎的動作中,高盛的一位分析師將其評級下調爲買入,設置了125美元的目標價。

- MoffettNathanson的一位分析師保持不變,繼續持有迪士尼的買入評級,目標價爲125美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walt Disney with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因素以及注意市場動態來降低這些風險。通過Benzinga Pro的實時警報,跟上迪士尼的最新期權交易動態。