A Closer Look at PayPal Holdings's Options Market Dynamics

A Closer Look at PayPal Holdings's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on PayPal Holdings.

有很多钱可花的鲸鱼已经采取了明显看好paypal控股的立场。

Looking at options history for PayPal Holdings (NASDAQ:PYPL) we detected 8 trades.

查看paypal控股(纳斯达克:PYPL)期权历史,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有50%的投资者带着看好的预期开仓,有50%的投资者带着看淡的预期开仓。

From the overall spotted trades, 2 are puts, for a total amount of $113,500 and 6, calls, for a total amount of $416,070.

在所有已发现的交易中,有2笔看跌期权,总金额为113,500美元,6笔看涨期权,总金额为416,070美元。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $57.5 and $85.0 for PayPal Holdings, spanning the last three months.

经评估成交量和未平仓利益,显然,主要市场交易商正在关注paypal控股的区间价位,因为它跨越了过去三个月的57.5至85.0美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for PayPal Holdings options trades today is 3509.17 with a total volume of 231.00.

在流动性和利益方面,今天paypal控股期权的平均未平仓利益为3509.17,总成交量为231.00。

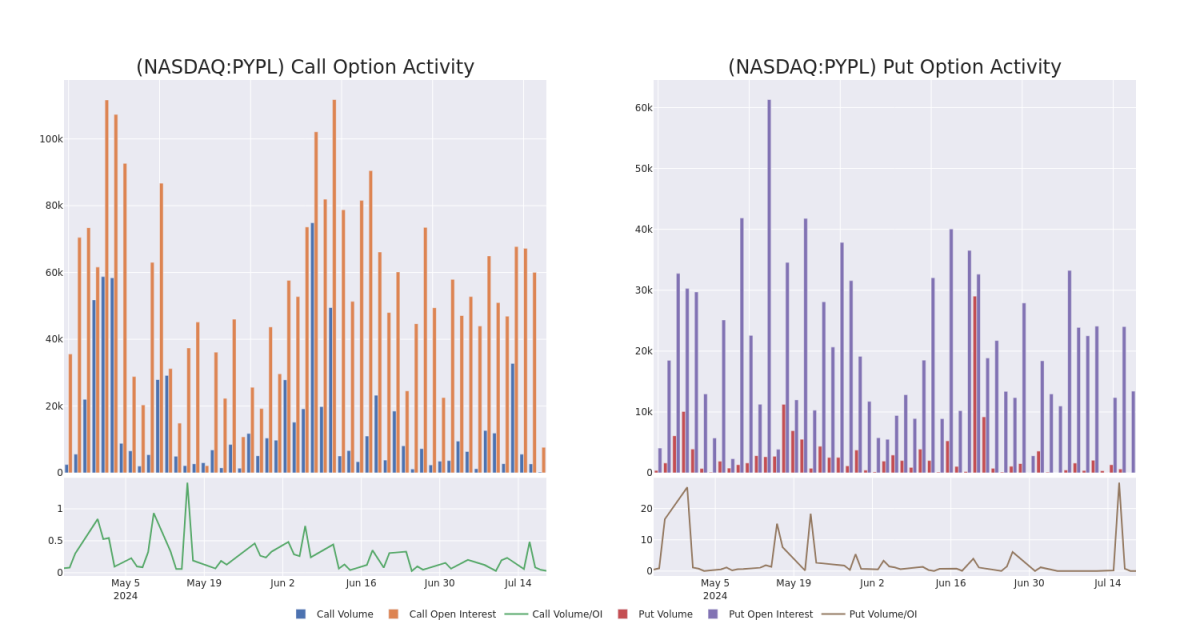

In the following chart, we are able to follow the development of volume and open interest of call and put options for PayPal Holdings's big money trades within a strike price range of $57.5 to $85.0 over the last 30 days.

在以下图表中,我们可以追踪paypal控股的看跌和看涨期权的成交量和未平仓利益的发展,它们位于57.5至85.0美元的行权价格范围内,为期30天。

PayPal Holdings Option Volume And Open Interest Over Last 30 Days

过去30天内PayPal Holdings期权成交量和持仓量

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BULLISH | 12/19/25 | $12.7 | $12.5 | $12.7 | $60.00 | $101.6K | 1.6K | 0 |

| PYPL | CALL | TRADE | BEARISH | 12/19/25 | $12.7 | $12.6 | $12.6 | $60.00 | $100.8K | 1.6K | 80 |

| PYPL | PUT | TRADE | BULLISH | 01/17/25 | $8.8 | $8.65 | $8.7 | $65.00 | $86.9K | 11.4K | 1 |

| PYPL | CALL | TRADE | BULLISH | 01/16/26 | $14.35 | $13.9 | $14.2 | $57.50 | $86.6K | 3.2K | 0 |

| PYPL | CALL | SWEEP | BULLISH | 06/20/25 | $2.86 | $2.77 | $2.86 | $85.00 | $57.2K | 2.2K | 150 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看涨 | 交易 | 看好 | 2025年12月19日 | $12.7 | $12.5 | $12.7 | $60.00 | $101.6K | 1.6K | 0 |

| PYPL | 看涨 | 交易 | 看淡 | 2025年12月19日 | $12.7 | $12.6 | $12.6 | $60.00 | $100.8K | 1.6K | 80 |

| PYPL | 看跌 | 交易 | 看好 | 01/17/25 | $ 8.8 | $ 8.65 | $8.7 | $65.00 | $86.9K | 11.4千 | 1 |

| PYPL | 看涨 | 交易 | 看好 | 01/16/26 | 14.35美元 | $13.9 | 14.2 | $57.50 | $86.6K | 3.2K | 0 |

| PYPL | 看涨 | SWEEP | 看好 | 06/20/25 | $2.86 | $2.77 | $2.86 | $85.00 | $57.2K | 2.2K | 150 |

About PayPal Holdings

关于paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股于2015年从ebay分拆出来,为商家和消费者提供电子支付解决方案,重点放在在线交易方面。该公司在2023年末拥有4.26亿活跃账户。该公司还拥有Venmo,这是一个人对人的支付平台。

Where Is PayPal Holdings Standing Right Now?

paypal控股现在的处境如何?

- With a volume of 1,224,643, the price of PYPL is down -0.65% at $59.61.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

- 随着成交量1,224,643,PYPL的价格下跌了-0.65%至59.61美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一次公布的收益预计将在12天后发行。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。