Investors with a lot of money to spend have taken a bearish stance on Thermo Fisher Scientific (NYSE:TMO).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with TMO, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Thermo Fisher Scientific.

This isn't normal.

The overall sentiment of these big-money traders is split between 0% bullish and 100%, bearish.

Out of all of the options we uncovered, 8 are puts, for a total amount of $591,345, and there was 1 call, for a total amount of $27,200.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $500.0 and $560.0 for Thermo Fisher Scientific, spanning the last three months.

Volume & Open Interest Development

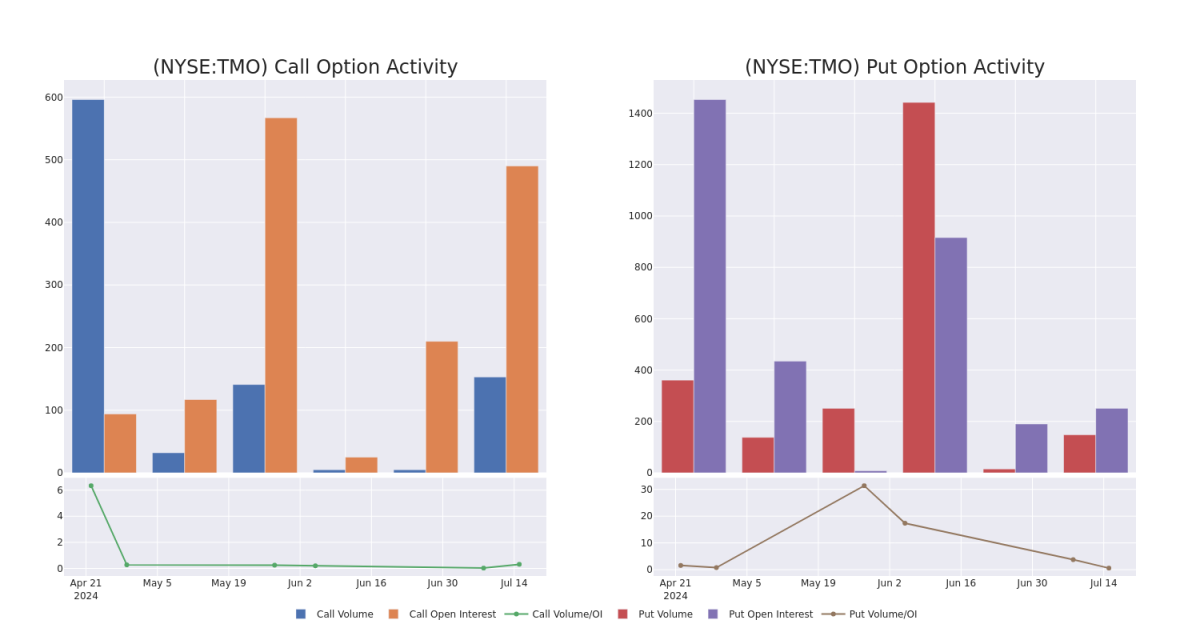

In today's trading context, the average open interest for options of Thermo Fisher Scientific stands at 288.0, with a total volume reaching 873.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Thermo Fisher Scientific, situated within the strike price corridor from $500.0 to $560.0, throughout the last 30 days.

Thermo Fisher Scientific Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | PUT | SWEEP | BEARISH | 07/19/24 | $23.0 | $20.4 | $23.0 | $560.00 | $140.3K | 710 | 54 |

| TMO | PUT | SWEEP | BEARISH | 07/19/24 | $23.6 | $19.9 | $23.6 | $560.00 | $127.4K | 710 | 0 |

| TMO | PUT | SWEEP | BEARISH | 07/19/24 | $22.7 | $22.6 | $22.7 | $560.00 | $106.6K | 710 | 159 |

| TMO | PUT | SWEEP | BEARISH | 07/19/24 | $22.9 | $22.8 | $22.9 | $560.00 | $87.0K | 710 | 54 |

| TMO | PUT | SWEEP | BEARISH | 07/19/24 | $22.5 | $20.8 | $22.5 | $560.00 | $40.5K | 710 | 218 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of end-2023 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (10%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

After a thorough review of the options trading surrounding Thermo Fisher Scientific, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Thermo Fisher Scientific

- Currently trading with a volume of 223,267, the TMO's price is down by -0.47%, now at $538.07.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 5 days.

What The Experts Say On Thermo Fisher Scientific

In the last month, 2 experts released ratings on this stock with an average target price of $600.0.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Thermo Fisher Scientific with a target price of $600.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Thermo Fisher Scientific, which currently sits at a price target of $600.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.