Markets Weekly Update (July 19) : Fed Prepares for September Cut as Powell Shifts Focus to Job

Markets Weekly Update (July 19) : Fed Prepares for September Cut as Powell Shifts Focus to Job

Macro Matters

宏观事项

Fed Prepares for September Cut as Powell Shifts Focus to Jobs

美国联邦储备委员会将焦点转向就业,准备在9月份实施利率切割。

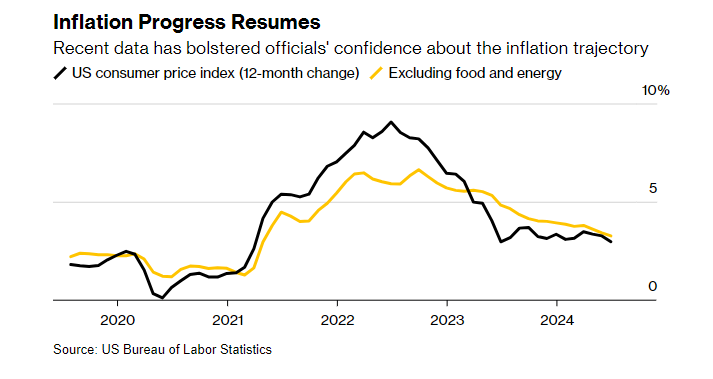

For over two years, inflation has been the Federal Reserve's primary focus, but this is set to change. US central bankers are preparing to cut interest rates in September, driven by growing confidence in achieving price stability and increased risks to the labor market. Recent speeches have laid the groundwork, and Chair Jerome Powell is expected to signal this more clearly after the July 30-31 policy meeting. However, Fed officials want to see monthly price numbers trending down toward the 2% annual inflation goal before committing to rate cuts. They aim to achieve a soft landing for the US economy, which is showing signs of slowing down.

在过去的两年多时间里,通货膨胀一直是美联储的首要关注点,但这一点即将改变。美国央行正在准备在9月份实施降息,这是由于在实现物价稳定方面的信心增强和劳动力市场风险增加所驱动。最近的演讲已经铺好了基础,预计主席杰罗姆·鲍威尔(Jerome Powell)将在7月30-31日的政策会议后更加明确地表明这一点。然而,美联储官员希望在承诺降息之前看到每月的价格数据朝着2%的年通货膨胀目标趋势下降。他们旨在实现美国经济的软着陆,这表现出放缓的迹象。

Fed’s Bowman, Logan Signal Need for Discount Window Reform

美联储的鲍曼和洛根暗示,央行应该评估其紧急贷款设施——折扣窗口,在解决银行体系流动性需求方面的有效性。这种审查是对2023年银行危机的回应,该危机见证了硅谷银行和Signature Bank的失败。美联储理事米歇尔·鲍曼强调了通过更新折扣金融操作和技术、确保在需要时提供支付服务等方式来解决2023年银行压力暴露问题的必要性。达拉斯联储行长Lorie Logan在达拉斯联邦储备银行的一次会议上也对此表示了支持,呼吁审查折扣窗口。

Two Federal Reserve leaders suggested that the central bank should evaluate the effectiveness of its emergency lending facility, known as the discount window, in addressing liquidity needs in the banking system. This scrutiny follows the 2023 banking crisis, which saw the failures of Silicon Valley Bank and Signature Bank. Fed Governor Michelle Bowman emphasized the need to tackle issues exposed during the 2023 banking stress by updating discount window operations and technology, ensuring payment services are available when needed. Dallas Fed President Lorie Logan echoed this sentiment, calling for an examination of the discount window during a conference at the Dallas Fed.

两位美国联邦储备的领导人建议央行评估其紧急贷款设施——折扣窗口,在解决银行体系流动性需求方面的有效性。这一审查是对2023年银行危机的回应,该危机见证了硅谷银行和Signature Bank的失败。美联储理事米歇尔·鲍曼强调了通过更新折扣金融操作和技术、确保在需要时提供支付服务等方式来解决2023年银行压力暴露问题的必要性。达拉斯联储行长Lorie Logan在达拉斯联邦储备银行的一次会议上也对此表示了支持,呼吁审查折扣窗口。

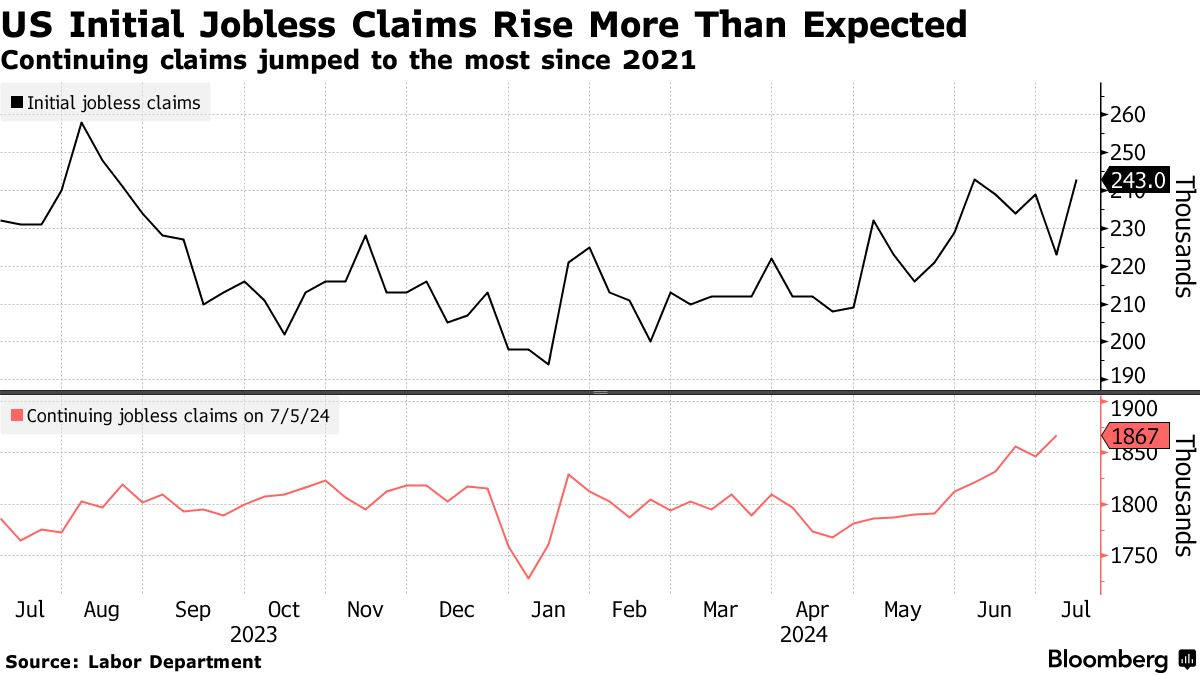

Initial Jobless Claims in US Increase by Most Since Early May

根据劳工部周四公布的数据,截至7月13日的那一周,初请失业救济人数增加了2万,达到了24.3万,与2023年8月以来的最高水平持平。《彭博》(Bloomberg)调查的经济学家的中值预测为22.9万。连续索赔是失业救济金领取人数的一个指标,这一数字在截至7月6日的那一周内也增加了2万,达到了187万,这是自2021年11月以来的最高水平。这个时期的索赔数据很容易出现大幅波动,因为包括独立日等假期以及暑假学校停课。

Initial claims increased by 20,000 to 243,000 in the week ended July 13, matching the highest level since August 2023, according to Labor Department data released Thursday. The median forecast in a Bloomberg survey of economists called for 229,000 applications.Continuing claims, a proxy for the number of people receiving unemployment benefits, also rose by 20,000 to 1.87 million in the week ended July 6, the highest since November 2021.The claims data are prone to big weekly swings this time of year, which include holidays such as Independence Day as well as school closures for summer break.

根据劳工部周四公布的数据,截至7月13日的那一周,初请失业救济人数增加了2万,达到了24.3万,与2023年8月以来的最高水平持平。《彭博》(Bloomberg)调查的经济学家的中值预测为22.9万。连续索赔是失业救济金领取人数的一个指标,这一数字在截至7月6日的那一周内也增加了2万,达到了187万,这是自2021年11月以来的最高水平。这个时期的索赔数据很容易出现大幅波动,因为包括独立日等假期以及暑假学校停课。

IMF Sees Obstacles on the Road to Reducing Inflation

国际货币基金组织周二警告说,通货膨胀的上行风险加大,质疑了今年多次美联储降息的前景。在其最新的《世界经济展望》更新中,国际货币基金组织表示,“全球通货紧缩的势头正在减弱,预示着未来的关键时刻”。报告称,美国此前的顺序通货膨胀走势已经将其落后于其他主要经济体的量化宽松路线。

The International Monetary Fund warned Tuesday that upside risks to inflation have increased, calling into question the prospect of multiple Federal Reserve interest rate cuts this year.

国际货币基金组织周二警告说,通货膨胀的上行风险加大,质疑了今年多次美联储降息的前景。

In its latest World Economic Outlook update, the IMF said “the momentum on global disinflation is slowing, signaling bumps along the path.” The rise in sequential inflation in the U.S. earlier in 2024 has put it behind other major economies in the quantitative easing path, the report said.

在其最新的《世界经济展望》更新中,国际货币基金组织表示,“全球通货紧缩的势头正在减弱,预示着未来的关键时刻”。报告称,美国此前的顺序通货膨胀走势已经将其落后于其他主要经济体的量化宽松路线。

Smart Money Flow

智能资金流

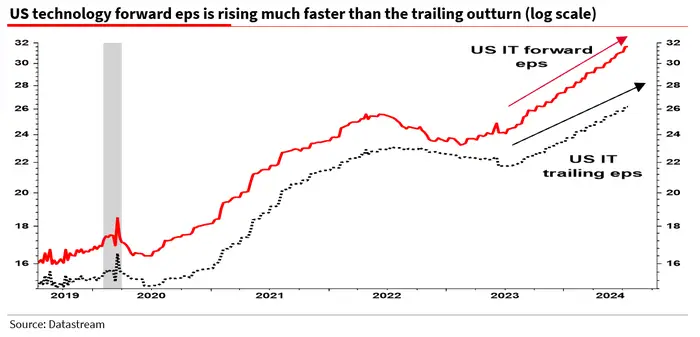

The Stock Market Is Flashing Warning Signs as Tech Shares Are a 'valuation Timebomb,' Socgen Says

瑞银称,机构投资经理在正在追逐从未表现过的“超级预期”,也就是超出业绩预期的股票价格。根据瑞银分析师的估计,这就意味着新的市场泡沫正在形成,而向主流币的转移应该是一个警示信号。历史数据显示,当投资者向主流币转移时,股票市值增长速度会放缓。

Albert Edwards, the chief global strategist for Societe Generale, issued another warning about the blistering 2024 stock rally in a note on Thursday.

Societe Generale的首席全球策略师Albert Edwards周四发布了一份关于2024年股市猛烈上涨的警告。

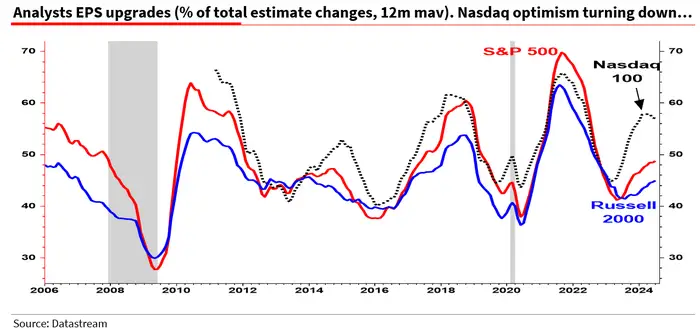

Wall Street still has lofty expectations for tech earnings. Analysts are expecting tech stocks to post forward earnings growth of around 30% year-over-year, Edwards noted, though tech stocks have actually been posting around 20% yearly earnings growth.

华尔街对科技股的盈利预期依然很高。分析师预计,科技股的前瞻性盈利增长率约为30%左右,虽然科技股的实际年盈利增长率约为20%。

The earnings gap is quickly becoming apparent to analysts. Earnings-per-share upgrades have fallen sharply for the Nasdaq 100, while upgrades for the S&P 500 and Russell 2000 are on the rise.

尽管纳斯达克100已经出现了收益差距,而标普500指数和罗素2000指数的收益已在上升,但纳斯达克100的每股盈利升级下降严重。

Russell 2000 Rally to 'lose Some Steam,' Blackrock Says

贝莱德投资研究所高级投资策略师Ann-Katrin Petersen表示,小盘股股指Russell 2000的超额表现将会褪色。"我们观察到目前40%的盈利正在收缩,"Petersen于周四在彭博电视台上说。"这次近日的涨势可能会失去一些动力。" Petersen还讨论了国债的前景,称贝莱德处于中性立场。

BlackRock Investment Institute Senior Investment Strategist Ann-Katrin Petersen says the outperformance of the Russell 2000 index of small-cap stocks will fade. "We are observing that 40% of earnings are currently contracting," Petersen said on Bloomberg Television, Thursday. "This rally of the past days could lose some steam." Petersen also discusses the outlook for Treasuries, saying BlackRock is "neutrally positioned."

大规模的网络安全平台CrowdStrike提供了先进的Windows PC网络安全解决方案,目前正在遭受的一场停机事件。许多印度、日本、加拿大、澳大利亚和其他许多国家的用户都受到了这个问题的影响。这些国家的用户已经转向社交媒体平台,如X和Reddit,报告了该平台上的一个蓝屏错误或死亡问题。

Top Corporate News

头条公司新闻

Cybersecurity Platform Crowdstrike down Worldwide, Many Users Logged out of Systems

奈飞(Netflix)周四表示,其第二季度新增了超过800万的订阅用户,超过了分析师预期的500万。这一增长是由密码共享的打击以及《Bridgerton》、《Baby Reindeer》和《The Roast of Tom Brady》等热门节目的推动。尽管订阅用户增长强劲,但Netflix对第三季度提供了谨慎的指引,并表示其广告业务在至少2026年之前不会显著促进营收增长。

A major cybersecurity platform, CrowdStrike that also provides advanced cybersecurity solutions to Windows PCs is facing an outage. Many users across India, Japan, Canada, Australia and many other countries have been affected by the issue. The users across these countries have taken to social media platforms like X and Reddit to report a BSOD error or Blue Screen of Death on the platform.

一家重要的网络安全平台CrowdStrike,该平台还为Windows PC提供先进的网络安全解决方案,正在面临着停机。许多来自印度、日本、加拿大、澳大利亚的用户受到了这个问题的影响。这些国家的用户都正在社交媒体平台上,如X和Reddit,报告了这个平台上的蓝屏错误或死亡屏幕问题。

Netflix Beats Subscriber Targets, Cautions on Ad Growth

奈飞(Netflix)周四表示,其第二季度新增了超过800万的订阅用户,超过了分析师预期的500万。这一增长是由密码共享的打击以及《Bridgerton》、《Baby Reindeer》和《The Roast of Tom Brady》等热门节目的推动。尽管订阅用户增长强劲,但Netflix对第三季度提供了谨慎的指引,并表示其广告业务在至少2026年之前不会显著促进营收增长。

Netflix (NFLX.O) reported on Thursday that it added over 8 million subscribers in the second quarter, surpassing analyst expectations of 5 million. This growth was driven by a password-sharing crackdown and popular titles like "Bridgerton," "Baby Reindeer," and "The Roast of Tom Brady." Despite the strong subscriber gains, Netflix provided cautious guidance for the third quarter and indicated that its advertising business would not significantly drive revenue growth until at least 2026.

奈飞(Netflix)周四表示,其第二季度新增了超过800万的订阅用户,超过了分析师预期的500万。这一增长是由密码共享的打击以及《Bridgerton》、《Baby Reindeer》和《The Roast of Tom Brady》等热门节目的推动。尽管订阅用户增长强劲,但Netflix对第三季度提供了谨慎的指引,并表示其广告业务在至少2026年之前不会显著促进营收增长。

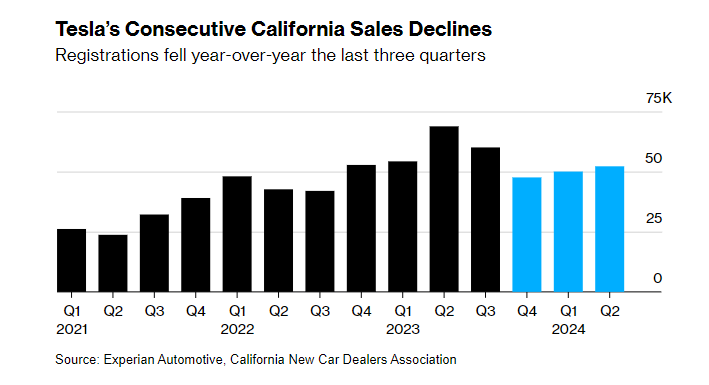

Tesla’s California Sales Plunge With Competitors Moving In

随着竞争对手进入加州市场,特斯拉(Tesla)的加州销售暴跌。

Tesla Inc.'s new-car registrations in California fell 24% year-over-year in the second quarter, marking the third consecutive decline, according to the California New Car Dealers Association (CNCDA). Despite the Model Y remaining the top-selling car in the state, Tesla's market share in California's battery-electric car market dropped to 53.4% in the first half of the year, down from 64.6% a year ago. Overall, Tesla's sales in California have decreased by 17% this year. CNCDA analysts noted that Tesla's diminishing allure could signal potential trouble for the direct-to-consumer manufacturer.

据加利福尼亚州新车经销商协会(CNCDA)称,特斯拉公司在第二季度的新车注册量同比下降24%,这标志着连续第三个季度的下滑。尽管Model Y仍是该州最畅销的汽车,但特斯拉在加利福尼亚电池电动汽车市场中的市场份额在今年上半年下降至53.4%,低于一年前的64.6%。总体来看,特斯拉在加利福尼亚的销售额今年已经下降了17%。CNCDA的分析师指出,特斯拉的吸引力逐渐减弱可能预示着直销制造商可能会面临潜在的麻烦。

Homebuilder D.R. Horton Soars to Record on Strong Profit Margin

房地产开发商D.R.霍顿以强劲的利润率创下历史新高

D.R. Horton Inc. shares soared to a record high after the homebuilder reported a stronger-than-expected quarterly profit margin of 24%, surpassing both its earlier guidance and analyst expectations. The company also projected 90,000 to 90,500 home closings for the fiscal year ending Sept. 30, with the upper end of this forecast exceeding analyst predictions. Investor optimism was further boosted by expectations of lower mortgage rates.

D.R.霍顿股份有限公司的股价飙升至历史新高,因为这家房地产开发商报告了比预期更强的季度利润率,超过了早期的指引和分析师的预期。该公司还预计,在截至9月30日的财年中,其房屋成交量将达到90,000至90,500套,并且该预测的上限超过了分析师的预期。投资者的乐观情绪进一步提高,原因是预计将有更低的抵押贷款利率。

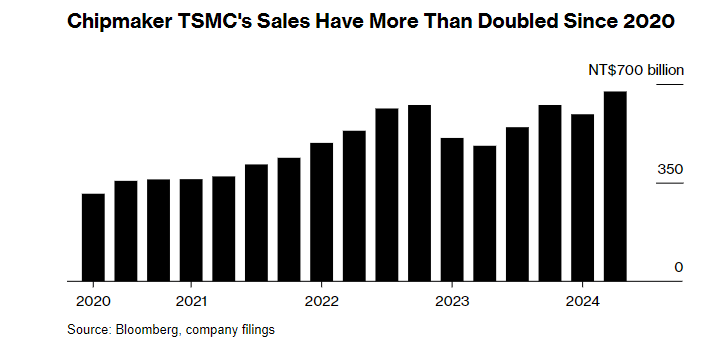

TSMC Hikes Revenue Outlook to Reflect Heated AI Demand

台积电提高营收预期以应对人工智能市场的强劲需求

Taiwan Semiconductor Manufacturing Co. (TSMC) raised its 2024 revenue growth projections after beating quarterly estimates, showing confidence in the global AI spending boom. The chipmaker for Apple and Nvidia now expects sales growth to exceed the previously guided mid-20% range. For the current quarter, TSMC forecasts revenue up to $23.2 billion, surpassing analysts' expectations. Additionally, it revised its capital spending forecast to $30 billion to $32 billion, from a previous low of $28 billion.

台湾半导体制造股份有限公司(TSMC)在超过季度预期后提高了2024年的营收增长预期,表明对全球人工智能开支的信心。这家为苹果和英伟达生产芯片的公司现将销售增长预期提高至先前指导的中间值20%以上。对于当前季度,台积电预计收入将高达232亿美元,超过分析师的预期。此外,它将资本支出预测修订为300亿至320亿美元,而不是之前的最低280亿美元。

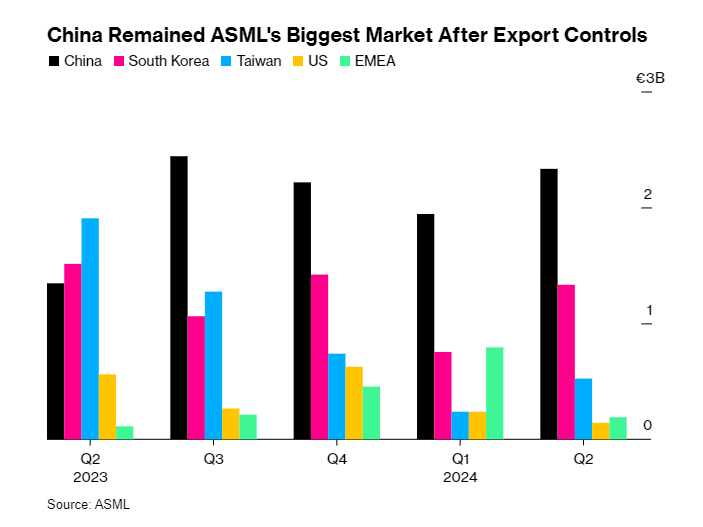

ASML Falls as Outlook Clouded by Risk of US Export Curbs

ASML萎靡不振,前景受到美国出口限制风险阴影的困扰

ASML Holding NV's shares fell despite a 54% increase in second-quarter bookings to €5.57 billion ($6.1 billion), surpassing estimates, due to concerns over potential severe US restrictions on its business in China. The Biden administration is considering the strictest trade measures if companies like ASML continue providing China with advanced semiconductor technology. This pressure aims to curb China's progress in the semiconductor industry, overshadowing ASML's growth in order intake.

尽管第二季度订单增长54%,达到5.57亿欧元(61亿美元),超过预期,但由于担心美国可能对中国市场的业务实施严格的限制措施,ASML Holding NV的股价仍然下跌。拜登政府正在考虑最严格的贸易措施,如果像ASML这样的公司继续向中国提供先进的半导体技术,应该采取什么措施。此举旨在遏制中国在半导体行业中的进展,掩盖了ASML订单接收增长的成果。

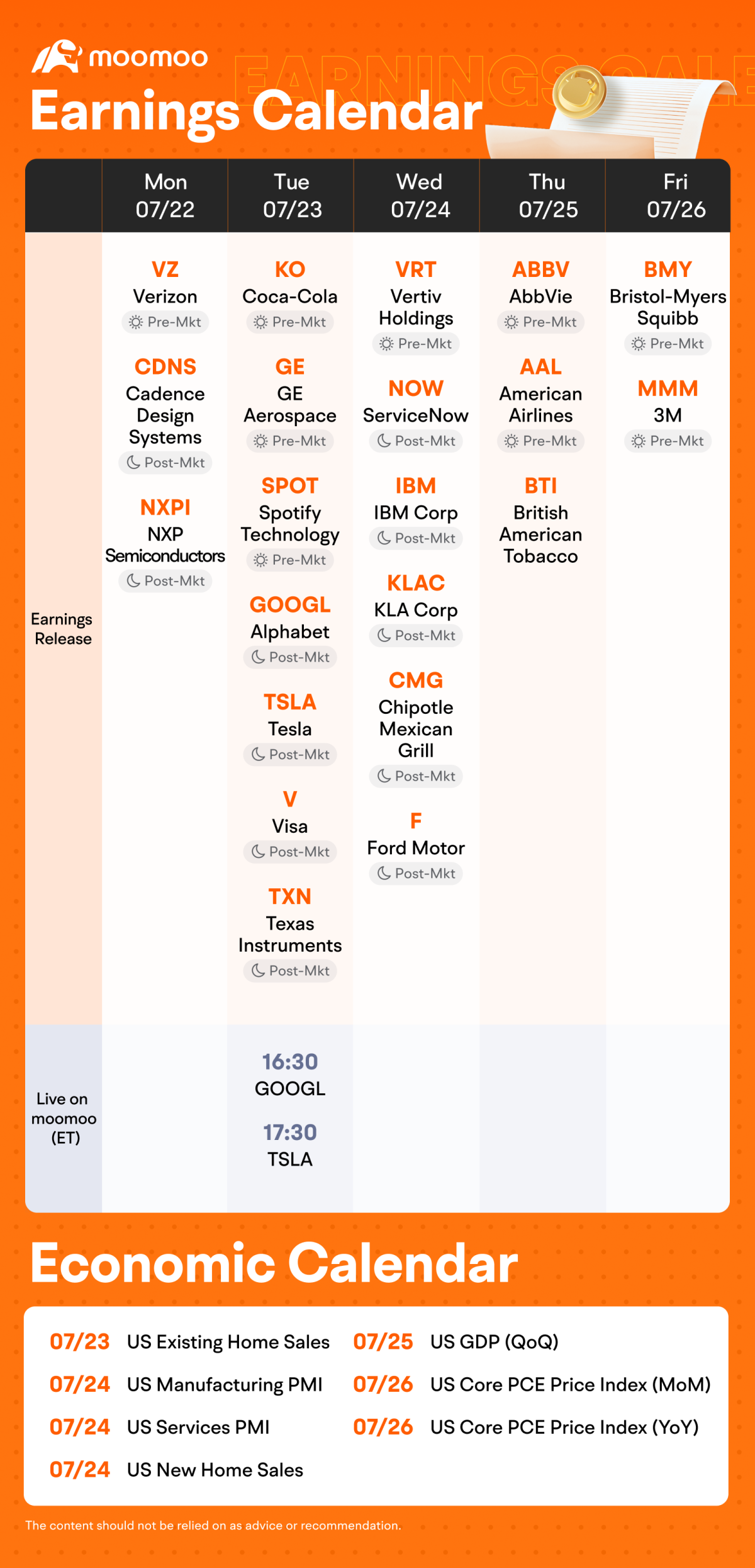

Earnings Calendar

财报日历

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。