Benzinga's options scanner just detected over 8 options trades for Chevron (NYSE:CVX) summing a total amount of $309,250.

At the same time, our algo caught 3 for a total amount of 99,565.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $170.0 for Chevron over the last 3 months.

Analyzing Volume & Open Interest

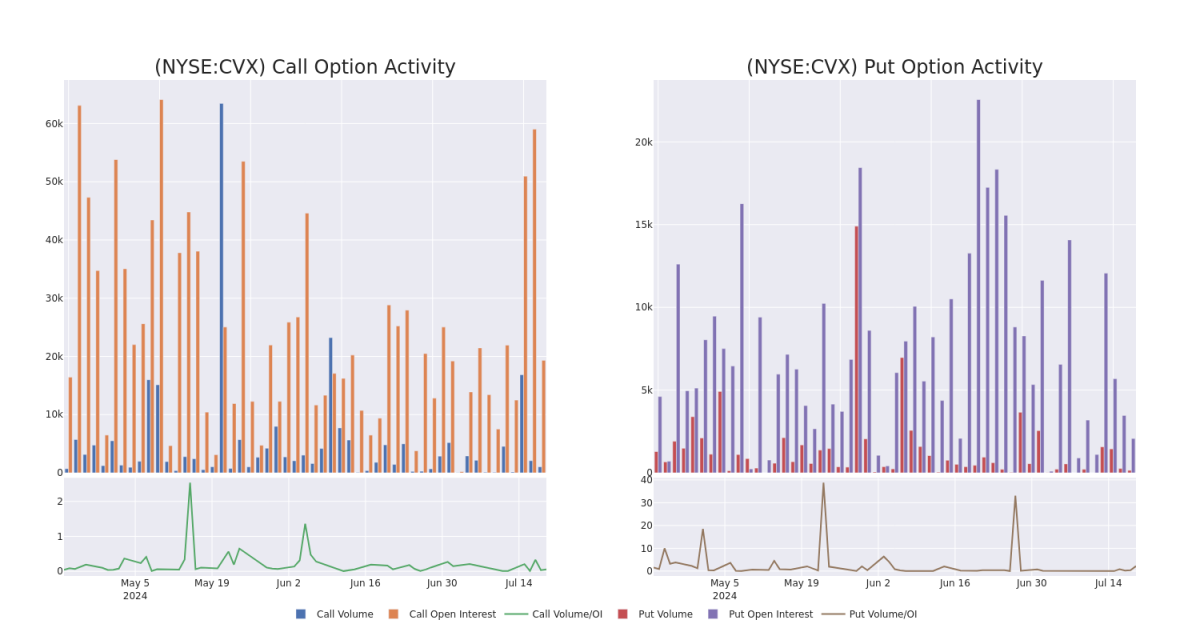

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Chevron's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chevron's whale activity within a strike price range from $150.0 to $170.0 in the last 30 days.

Chevron Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | CALL | SWEEP | BULLISH | 08/23/24 | $1.07 | $1.06 | $1.07 | $170.00 | $64.2K | 924 | 23 |

| CVX | CALL | TRADE | BULLISH | 12/20/24 | $7.05 | $6.95 | $7.05 | $165.00 | $58.5K | 2.0K | 8 |

| CVX | CALL | TRADE | BULLISH | 01/17/25 | $6.1 | $6.0 | $6.1 | $170.00 | $46.9K | 4.5K | 1 |

| CVX | CALL | TRADE | BULLISH | 08/02/24 | $2.6 | $2.58 | $2.6 | $162.50 | $39.0K | 1.8K | 135 |

| CVX | PUT | TRADE | BULLISH | 12/20/24 | $4.3 | $4.25 | $4.25 | $150.00 | $36.1K | 2.0K | 39 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

Following our analysis of the options activities associated with Chevron, we pivot to a closer look at the company's own performance.

Current Position of Chevron

- Trading volume stands at 2,426,089, with CVX's price down by -0.81%, positioned at $160.66.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 14 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.