High-rolling investors have positioned themselves bullish on FTAI Aviation (NASDAQ:FTAI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FTAI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for FTAI Aviation. This is not a typical pattern.

The sentiment among these major traders is split, with 36% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $36,000, and 10 calls, totaling $727,486.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $72.5 and $105.0 for FTAI Aviation, spanning the last three months.

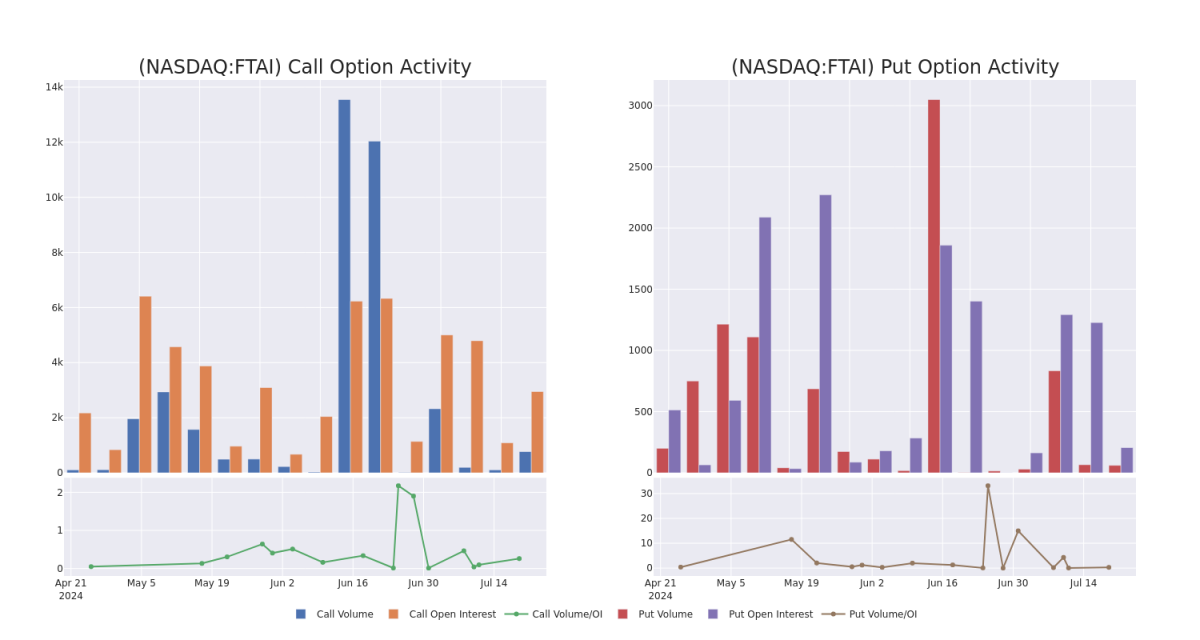

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in FTAI Aviation's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to FTAI Aviation's substantial trades, within a strike price spectrum from $72.5 to $105.0 over the preceding 30 days.

FTAI Aviation Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FTAI | CALL | SWEEP | BEARISH | 08/16/24 | $16.4 | $15.6 | $15.6 | $90.00 | $134.2K | 1.0K | 151 |

| FTAI | CALL | SWEEP | BULLISH | 08/16/24 | $15.9 | $15.6 | $15.9 | $90.00 | $103.3K | 1.0K | 0 |

| FTAI | CALL | SWEEP | BULLISH | 08/16/24 | $15.2 | $15.1 | $15.2 | $90.00 | $94.2K | 1.0K | 251 |

| FTAI | CALL | SWEEP | BEARISH | 08/16/24 | $15.7 | $15.6 | $15.7 | $90.00 | $87.7K | 1.0K | 0 |

| FTAI | CALL | TRADE | NEUTRAL | 08/16/24 | $16.0 | $14.4 | $15.3 | $90.00 | $76.5K | 1.0K | 351 |

About FTAI Aviation

FTAI Aviation Ltd is a aerospace company .It owns and maintains commercial jet engines with a focus on CFM56 engines. FTAI owns and leases jet aircraft which often facilitates the acquisition of engines at attractive prices. It invests in aviation assets and aerospace products that generate strong and stable cash flows with the potential for earnings growth and asset appreciation.

Having examined the options trading patterns of FTAI Aviation, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is FTAI Aviation Standing Right Now?

- Trading volume stands at 503,256, with FTAI's price up by 0.98%, positioned at $104.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 4 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for FTAI Aviation with Benzinga Pro for real-time alerts.