Decoding Diamondback Energy's Options Activity: What's the Big Picture?

Decoding Diamondback Energy's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Diamondback Energy. Our analysis of options history for Diamondback Energy (NASDAQ:FANG) revealed 8 unusual trades.

金融巨头对响尾蛇能源采取了明显的看跌举动。我们对响尾蛇能源(纳斯达克股票代码:FANG)期权历史的分析显示了8笔不寻常的交易。

Delving into the details, we found 12% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $91,850, and 5 were calls, valued at $152,830.

深入研究细节后,我们发现12%的交易者看涨,而25%的交易者表现出看跌趋势。在我们发现的所有交易中,有3笔是看跌期权,价值为91,850美元,5笔是看涨期权,价值为152,830美元。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $166.75 to $220.0 for Diamondback Energy during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注响尾蛇能源在过去一个季度的价格范围从166.75美元到220.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

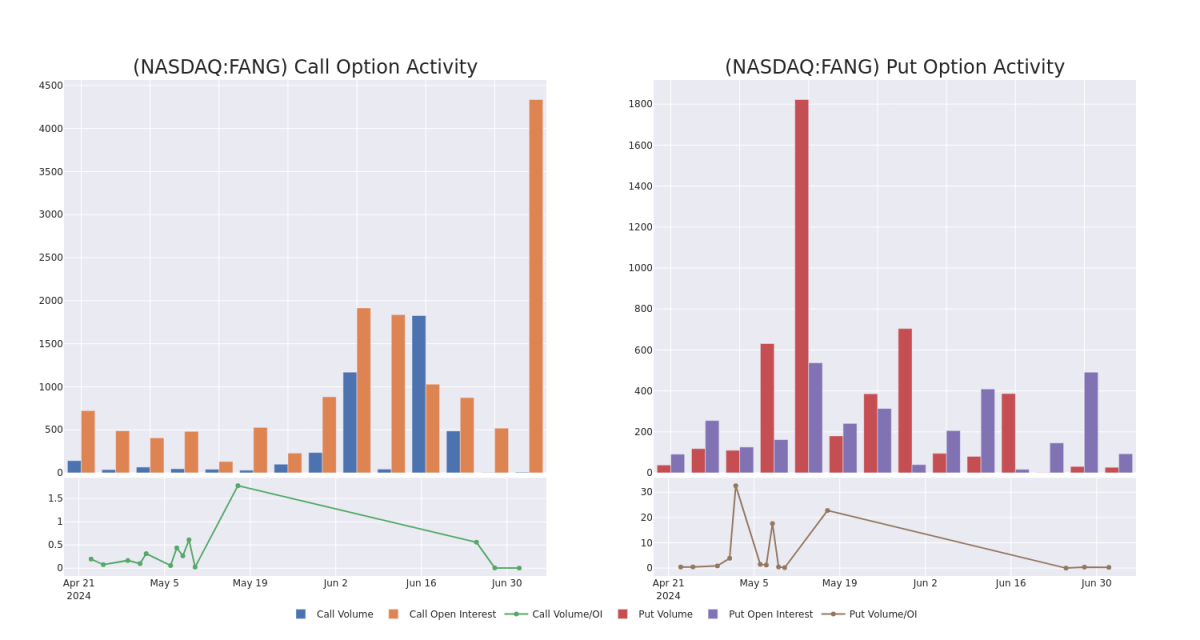

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Diamondback Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Diamondback Energy's substantial trades, within a strike price spectrum from $166.75 to $220.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了以指定行使价计算的响尾蛇能源期权的流动性和投资者对该期权的兴趣。即将发布的数据可视化了与响尾蛇能源的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从166.75美元到220.0美元不等。

Diamondback Energy Option Activity Analysis: Last 30 Days

响尾蛇能源期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FANG | CALL | TRADE | BULLISH | 07/19/24 | $40.2 | $37.1 | $39.2 | $166.75 | $39.2K | 28 | 1 |

| FANG | PUT | SWEEP | NEUTRAL | 01/16/26 | $32.5 | $28.8 | $30.85 | $216.75 | $30.7K | 0 | 427 |

| FANG | PUT | SWEEP | NEUTRAL | 01/16/26 | $32.0 | $29.3 | $30.74 | $216.75 | $30.6K | 0 | 378 |

| FANG | PUT | SWEEP | NEUTRAL | 01/16/26 | $32.0 | $28.8 | $30.38 | $216.75 | $30.3K | 0 | 312 |

| FANG | CALL | TRADE | BEARISH | 07/26/24 | $0.35 | $0.2 | $0.2 | $220.00 | $30.0K | 106 | 100 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 獠牙 | 打电话 | 贸易 | 看涨 | 07/19/24 | 40.2 美元 | 37.1 美元 | 39.2 美元 | 166.75 美元 | 39.2 万美元 | 28 | 1 |

| 獠牙 | 放 | 扫 | 中立 | 01/16/26 | 32.5 美元 | 28.8 美元 | 30.85 美元 | 216.75 美元 | 30.7 万美元 | 0 | 427 |

| 獠牙 | 放 | 扫 | 中立 | 01/16/26 | 32.0 美元 | 29.3 美元 | 30.74 美元 | 216.75 美元 | 30.6K | 0 | 378 |

| 獠牙 | 放 | 扫 | 中立 | 01/16/26 | 32.0 美元 | 28.8 美元 | 30.38 美元 | 216.75 美元 | 30.3 万美元 | 0 | 312 |

| 獠牙 | 打电话 | 贸易 | 粗鲁的 | 07/26/24 | 0.35 美元 | 0.2 美元 | 0.2 美元 | 220.00 美元 | 30.0K | 106 | 100 |

About Diamondback Energy

关于响尾蛇能量

Diamondback Energy is an independent oil and gas producer in the United States. The company operates exclusively in the Permian Basin. At the end of 2023, the company reported net proven reserves of 2.2 billion barrels of oil equivalent. Net production averaged about 448,000 barrels per day in 2023, at a ratio of 59% oil, 21% natural gas liquids, and 20% natural gas.

响尾蛇能源公司是美国一家独立的石油和天然气生产商。该公司仅在二叠纪盆地运营。截至2023年底,该公司报告的净探明储量为22亿桶石油当量。2023年,平均每天净产量约为44.8万桶,比例为59%的石油,21%的液化天然气和20%的天然气。

Diamondback Energy's Current Market Status

响尾蛇能源的当前市场状况

- With a volume of 1,325,225, the price of FANG is down -2.17% at $205.47.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 17 days.

- FANG的交易量为1,325,225美元,下跌了-2.17%,至205.47美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在17天后公布。

Professional Analyst Ratings for Diamondback Energy

响尾蛇能源专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $221.8.

5位市场专家最近发布了该股的评级,共识目标价为221.8美元。

- An analyst from Bernstein has decided to maintain their Outperform rating on Diamondback Energy, which currently sits at a price target of $236.

- An analyst from Keybanc has revised its rating downward to Overweight, adjusting the price target to $225.

- Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Outperform rating on Diamondback Energy with a target price of $245.

- An analyst from Benchmark downgraded its action to Buy with a price target of $154.

- An analyst from Piper Sandler persists with their Overweight rating on Diamondback Energy, maintaining a target price of $249.

- 伯恩斯坦的一位分析师决定维持对响尾蛇能源的跑赢大盘评级,该评级目前的目标股价为236美元。

- Keybanc的一位分析师已将其评级下调至增持,将目标股价调整为225美元。

- 丰业银行的一位分析师在评估中保持了响尾蛇能源的行业跑赢大盘评级,目标价为245美元。

- Benchmark的一位分析师将其评级下调至买入,目标股价为154美元。

- 派珀·桑德勒的一位分析师坚持对响尾蛇能源的增持评级,将目标价维持在249美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Diamondback Energy options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的响尾蛇能源期权交易。