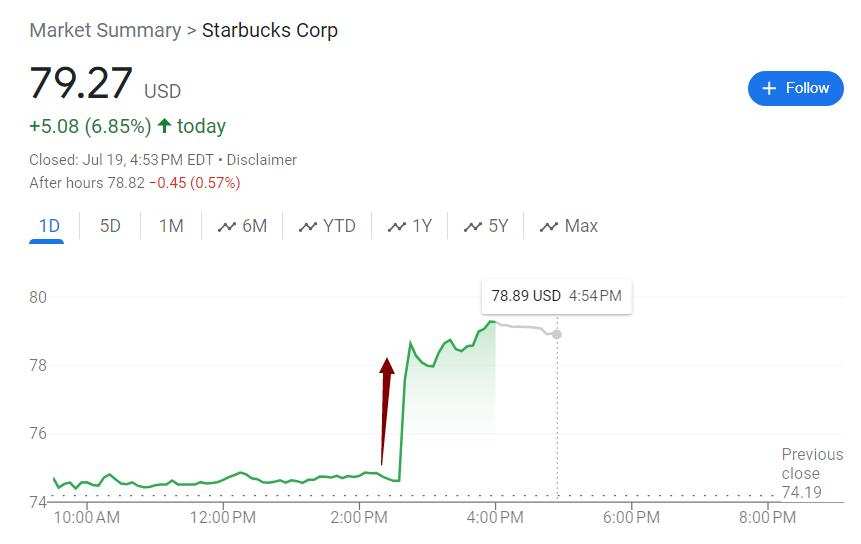

According to the media, Elliott holds a large amount of Starbucks shares and has been pushing for ways to improve the stock price. Recently, they have had private contact with Starbucks and the two parties may reach an agreement soon. Subsequently, the increase in Starbucks' stock price expanded from less than 0.6% to 6.8% in about ten minutes.

After news that it was targeted by Elliott Investment Management, a giant active investment fund, Starbucks' stock price jumped in mid-trading session.

During the afternoon trading session in the US stock market, in just about 10 minutes, Starbucks' stock price rose from nearly $74.60 to above $79.20. The intraday increase quickly expanded from less than 0.6% to about 6.8%, and the end-of-day increase further enlarged, hitting a daily high of $79.38. It rose about 7% intraday, ending close to 6.9%, marking the largest increase since November 2 last year, rebounding to the highest closing since June 25 after two consecutive days of decline.

Before the surge in Starbucks' stock price, it was reported by the media that Elliott Investment Management had already held a large amount of shares in Starbucks. This active investment institution had been encouraging Starbucks to find a way to enhance its stock price. In recent weeks, Elliott has been in contact with Starbucks, and the two sides may soon reach an agreement in private.

The media was unable to determine how large Elliott's undisclosed stake in Starbucks was before, and noted that it is currently unclear what other requirements Elliott has for Starbucks, such as whether it is seeking a seat on the Starbucks Board of Directors.

Following the media report, a Starbucks spokesperson stated that the company "does not comment on rumors and speculation." Representatives from Elliott did not immediately respond to requests for comment from other media outlets.

It is believed that Elliott's investment in Starbucks comes as the coffee company is at a significant crossroads for its development. In terms of store numbers and sales, Starbucks is the world's largest coffee company. In the past, Starbucks has been committed to becoming the third place for meetings outside of customers' homes and workplaces. Nowadays, takeaway services have become a growing engine for the industry, but Starbucks has been struggling to keep up with the trend. In China, this critical market, competition for Starbucks is also escalating.

Starbucks' recent financial reports have highlighted challenges in achieving performance targets set by its management.

In late April of this year, Starbucks announced that Q2 revenues had fallen 1.8% year-on-year to $8.563 billion, falling far short of analysts' expectations of $9.13 billion, and seeing its first quarterly sales decline since the end of 2020. Net income for the quarter fell by about 15% compared to the same period last year, also far below expectations.

In Q2, Starbucks' same-store sales fell 4%, while analysts had expected growth of 1.46%. In the US market, same-store sales fell by 3%, showing poor performance for the second consecutive quarter domestically. Analysts predicted growth of 2.31%, yet customer traffic in the US fell by 7%, the largest quarterly decline since 2010. In international markets outside the US, same-store sales for the quarter fell 6%, and in Starbucks' second largest market, mainland China, same-store sales fell 11%.

In addition to the Q2 report, Starbucks also lowered its guidance for Q3 and for the entire fiscal year, reducing its revenue growth expectations for the year from 7-10% to low single digits; it also reduced its expectations for same-store sales growth globally and in the US from 4-6% to flat to low single digits, and expects same-store sales in mainland China to drop by single digits rather than grow as previously predicted.

On the first trading day after the release of the Q2 report on May 1st, Starbucks' stock price plunged by as much as 18%, closing down 15.9%, marking the largest daily decline since May of last year.

After the release of the Q2 report, Starbucks executives stated that the company is losing customers who occasionally visit Starbucks, with active reward users decreasing by 1.5 million from the end of Q1 to the end of Q2.

Wall Street has pointed out that under high prices, consumption in the catering industry is visibly weakening, and this is directly reflected in the 'counter current' of the performance of consumer brands. Not only Starbucks, but also the two global catering giants Pizza Hut and KFC have reported a shrinkage in quarterly sales.

In a tight consumer environment, major catering brands are determined to put down their identities and use price cuts to exchange for market share. Starbucks announced that it will open transactions restricted to its application only to non-loyalty members for the first time in July. In early May, ThePaper reported that Starbucks was "quietly" offering discounts on various types of promotions, such as group purchases, full discounts, and discounts, and has chosen to "exchange volume for price."