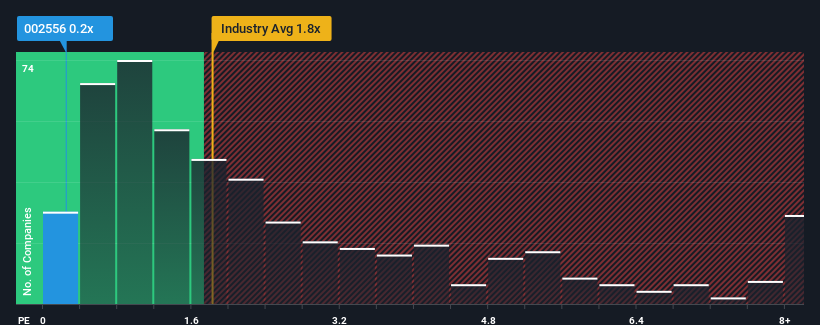

Anhui Huilong Agricultural Means of Production Co.,Ltd.'s (SZSE:002556) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Anhui Huilong Agricultural Means of ProductionLtd Has Been Performing

As an illustration, revenue has deteriorated at Anhui Huilong Agricultural Means of ProductionLtd over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Anhui Huilong Agricultural Means of ProductionLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Anhui Huilong Agricultural Means of ProductionLtd's earnings, revenue and cash flow.How Is Anhui Huilong Agricultural Means of ProductionLtd's Revenue Growth Trending?

Anhui Huilong Agricultural Means of ProductionLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.6%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.6% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Anhui Huilong Agricultural Means of ProductionLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Anhui Huilong Agricultural Means of ProductionLtd's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Anhui Huilong Agricultural Means of ProductionLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Anhui Huilong Agricultural Means of ProductionLtd (2 are significant) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com