For the US election, how about adopting this trading strategy? Sell profitable stocks now, so you'll have cash on hand this fall to buy big when the election is heating up.

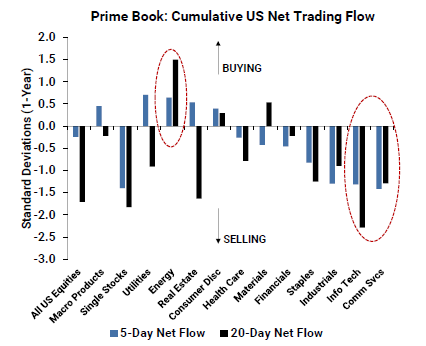

This is exactly what hedge funds have been doing since May, even as the market continues to hit new highs since then. According to Goldman Sachs Group's main brokerage division, the hedge fund's net leverage ratio — often viewed as a barometer of risk appetite — fell to 54% in early July, its lowest level since January. After spending two months reducing their holdings of the best-performing stocks, hedge funds are now under-allocating technology, media, and telecom stocks to the extent that they have reached their highest level on record.

But don't think of it as shorting. On the contrary, this so-called smart money is preparing for a crazy presidential election. They want to have cash to allocate at any time when stock market volatility intensifies and stock prices begin to fluctuate.

Goldman Sachs FICC

Goldman Sachs FICC“Fund managers need to prepare for the chaos that may occur during the US election,” said Jonathan Caplis, CEO of hedge fund research firm PivotalPath. “Net sales are just strategic profit returns. This is putting on the brakes rather than running away in droves.”

It's easy to understand why traders are preparing for a turbulent election season. As concerns about President Joe Biden's age and physical condition raise calls for him to withdraw from the election campaign are getting louder and louder, and Democrats are still considering who they will eventually run for election. Meanwhile, the economic agenda proposed by former President Donald Trump, the Republican nominee for the presidential election, included tax cuts and immigration restrictions, raising concerns about soaring inflation and worsening US fiscal conditions.

In the case of known events and unknown results, the degree of dispersion of individual stocks, or the potential consequences of stocks changing in different directions, will expand. This is exactly what hedge funds are happy to see, as they usually hold long and short positions at the same time.

Start early

Given all of this uncertainty, some traders expect the election to affect the stock market earlier than usual.

“What we've heard from hedge funds this year is that the election story is likely to come much earlier than November,” said Adam Singleton, chief investment officer of External Alpha, a subsidiary of Man Group Plc. “Reducing the risk of uncertain binary events is prudent and good portfolio management.”

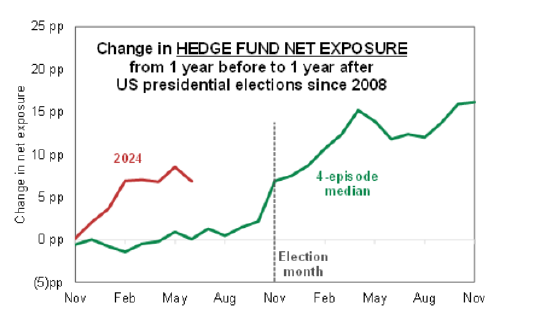

On the eve of a presidential election, hedge funds' equity risk exposure usually falls. The fund manager will then quickly re-leverage shortly before the vote and continue to increase their positions after the vote. Goldman Sachs data shows that the current net exposure is still above the long-term average of the election cycle, which indicates that hedge funds still have room to sell.

Goldman Sachs

Goldman SachsThere are a few typical ways hedge funds trade political events. One is from an industry perspective. Fund managers will determine topics favorable to each candidate, reduce risk exposure before voting, and then drastically increase their winning holdings after voting.

The other is to assess the market's overall risk appetite, which can be viewed as an alternative indicator of stock price trends. Under this strategy, the Foundation reduces its net exposure and then tries to understand how investors view the winning candidate. This wait-and-see strategy worked in 2016, when the market expected the market to fall if Trump won, but the opposite was true.

The hardest bet

Another riskiest approach is to focus on a specific company or a small group of stocks and bet on whether they will perform well if a candidate wins. This is the hardest thing to do because market pricing can fluctuate drastically after the election results are announced.

“Many fund managers will try to see how the situation develops after the election before entering the market,” Singleton said.

For large technology stocks that want to drastically reduce their holdings in the past year — such as Nvidia, Meta, Amazon, and Alphabet Inc., the parent company of Google. — As far as the fund is concerned, it is currently facing serious risks.

“While rotation may make sense, and the prices of these stocks should eventually stabilize, if they continue to defy gravity and continue to push higher in the short term, there will be a kind of 'flat pressure',” said Frank Monkam, senior portfolio manager at Antimo. Under such circumstances, since the expected decline did not occur, more investors would buy stocks, thereby forming self-realization of rising stock prices.

Ultimately, November's trading will determine whether it is correct to close a profit order. Hedge fund returns have been lagging behind the S&P 500 index for the past four years. According to PivotAlPath data, the US long and short basic hedge funds returned 7.4% in the first half of this year, and the S&P 500 index rose 14% during the same period.