GMS' (NYSE:GMS) 31% CAGR Outpaced the Company's Earnings Growth Over the Same Five-year Period

GMS' (NYSE:GMS) 31% CAGR Outpaced the Company's Earnings Growth Over the Same Five-year Period

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term GMS Inc. (NYSE:GMS) shareholders would be well aware of this, since the stock is up 292% in five years. It's also up 10% in about a month.

购买公司股票(不考虑杠杆)最糟糕的结果是你输掉了你所投入的所有资金。但是当你选定一个真正繁荣的公司时,你可以获得超过100%的回报。长期持有gms inc(纽交所:gms)的股东对此应该非常清楚,因为该股票在五年内上涨了292%。它还在大约一个月内上涨了10%。

Since it's been a strong week for GMS shareholders, let's have a look at trend of the longer term fundamentals.

由于这对于GMS股东来说是一个强劲的一周,让我们来看看更长期的基本面趋势。

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

虽然市场是一个强大的定价机制,但股价反映的不仅仅是企业的基本业绩,还有投资者的情绪。一个不完美但简单的方式来考虑公司市场意识的变化是比较每股收益(EPS)的变化和股价的变化。

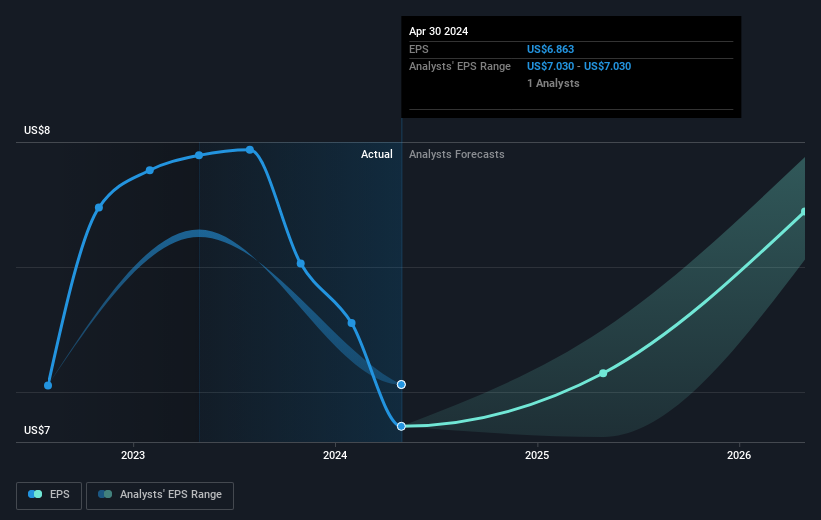

During five years of share price growth, GMS achieved compound earnings per share (EPS) growth of 39% per year. This EPS growth is higher than the 31% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

在五年的股价增长期间,GMS实现了每股收益年复合增长率(EPS)为39%。这种EPS增长高于股价的平均年增长率31%。因此可以得出结论:整个市场已对该股票变得更加谨慎。

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

下图显示了EPS随时间的变化情况(如果您单击该图像,则可以查看更多详细信息)。

We know that GMS has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

我们知道GMS在过去三年中改善了其底线,但未来会发生什么?免费阅读我们的报告,了解其财务状况如何随时间变化的详情,这可能非常值得。

A Different Perspective

不同的观点

It's good to see that GMS has rewarded shareholders with a total shareholder return of 25% in the last twelve months. However, that falls short of the 31% TSR per annum it has made for shareholders, each year, over five years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for GMS that you should be aware of.

很高兴看到GMS在过去12个月内以25%的总股东回报率奖励股东。但是,这低于其每年为股东创造的31%TSR。虽然考虑市场条件可能对股价产生不同的影响非常值得,但还有其他更重要的因素。例如,我们已经发现1个GMS的警告信号,你应该注意。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您愿意查看另一家公司(具有潜在的更好财务状况),请不要错过这个免费的公司列表,证明它们可以增长收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

During five years of share price growth, GMS achieved compound earnings per share (EPS) growth of 39% per year. This EPS growth is higher than the 31% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

During five years of share price growth, GMS achieved compound earnings per share (EPS) growth of 39% per year. This EPS growth is higher than the 31% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.