July 22, 2024 - $Ryanair (RYAAY.US)$shares slumped 11.46% to $101.22 in pre-market trading on Monday. Ryanair Holdings has reported its FY2025 first quarter results today.

Q1 Highlights include:

Traffic grew 10% to 55.5m, despite multiple Boeing delivery delays.

Rev. per pax fell 10% (ave. fare down 15% & ancil. rev. flat).

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).Record Summer schedule launched (5 new bases, over 200 new S.24 routes).

Multiple “Approved OTA” partnerships signed to protect consumers.

Fuel hedges extended: 75% FY25 at under $80bbl saves over €450m & c.45% FY26 at $78bbl.

Over 50% of €700m share buyback completed.

Q1 FY25 BUSINESS REVIEW:

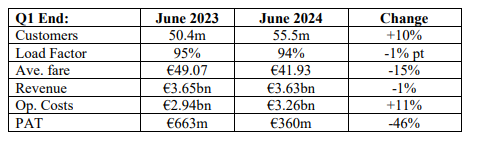

Q1 scheduled revenue fell 6% to €2.33bn. While traffic grew 10% to 55.5m, our customers enjoyed substantial savings thanks to 15% lower fares due, in part, to the absence of the first half of Easter which fell into March, and more price stimulation than we had previously expected. Ancillary sales rose 10% to €1.30bn (c.€23.40 per passenger). As a result, total revenue declined 1% to €3.63bn. Operating costs increased 11% to €3.26bn, marginally ahead of traffic growth, as fuel hedge savings offset higher staff and other costs which was in part due to Boeing delivery delays.

SHAREHOLDER RETURNS:

A €700m share buyback commenced in May. To date we have completed over 50% of the programme. When complete, Ryanair will have returned over €7.8bn to shareholders since 2008. A final dividend of €0.178 per share is due to be paid in Sept.

OUTLOOK:

FY25 traffic is expected to grow 8% (198m to 200m passengers), subject to no worsening Boeing delivery delays. As previously guided, we expect unit costs to rise modestly this year as ex-fuel costs (incl. pay & productivity increases, higher handling & ATC fees and the impact of multiple B737 delivery delays) are substantially offset by our fuel hedge savings, and rising net interest income, which widen Ryanair’s cost advantage over its competitors. While Q2 demand is strong, pricing remains softer than we expected, and we now expect Q2 fares to be materially lower than last summer (previously expected to be flat to modestly up). The final H1 outcome is, however, totally dependent on close-in bookings and yields in Aug. and Sept. As is normal at this time of year, we have almost zero Q3 and Q4 visibility, although Q4 will not benefit from last year’s early Easter. It is too early to provide meaningful FY25 PAT guidance, although we hope to be able to do so at our H1 results in Nov. The final FY25 outcome remains subject to avoiding adverse developments during FY25 (especially given continuing conflicts in Ukraine and the Middle East, repeated ATC shortstaffing and capacity restrictions, or further Boeing delivery delays).”

Related Reading: Press Release