Down 30% for more than a month.

Since June 12th this year, the stock price of Leshan Giantstar Farming&Husbandry Corporation, which is located in Sichuan and often referred to as "Little Muyuan", began to turn around and fell sharply for a total of more than 30% in 28 trading days, surprising many medium and long-term value investors.

Before that, from July 2021 to March 2024, the stock price of Leshan Giantstar Farming&Husbandry Corporation rose more than 270% in 3 years, significantly outperforming the hog farming sector, which had a negative growth rate of -13% during the same period.

Why did a once highly-regarded pig company in the capital markets suddenly experience repeated sharp falls?

01

Around the end of May this year, small pig companies including Leshan Giantstar Farming&Husbandry Corporation experienced a wave of rapid declines. For example, Xinwufeng, Dongrui Stock, and Shennong Group fell by 37%, 34%, and 21% respectively.

In my opinion, the collective decline of small pig companies was mainly due to the fact that hog futures contracts for the distant months experienced a collective sell-off in June, and the expectations of optimistic prices for pigs in 2025 in the secondary market began to be revised downwards.

Currently, the spot price of foreign three-element pigs has soared to over 19 yuan, a significant increase of nearly 40% compared to the low level of 13.65 yuan in February. Now, the entire industry has good profit margins. In fact, in the second quarter alone, many large-scale pig companies have turned losses into profits. For example, Muyuan Foods had a profit of over 3 billion yuan in the second quarter, and there are clear signs of performance recovery.

Previously, based on the continuous surge in the spot prices of pigs and linear projections of the pig cycle, the secondary market generally expected that the pig cycle had reversed this year, and the upward trend in pig prices was expected to be relatively long.

Since the end of May this year, commodity futures markets have given different warning signals. The latest prices for hog futures contracts 2501, 2503, and 2505 are 16.43 yuan/kg, 15.25 yuan/kg, and 15.425 yuan/kg respectively, a drop of 2.29 yuan/kg, 1.35 yuan/kg, and 1.58 yuan/kg respectively from their peak in June. These prices are significantly lower than the prices of contracts 2407, 2409, and 2411 and the spot price of live pigs this year.

The time when hog futures contracts for the distant months opened this round of adjustments roughly coincided with the time when small pig companies such as Leshan Giantstar Farming&Husbandry Corporation began to decline.

From the above perspectives, the commodity pig market believes that pig prices will return to a downward trend (elimination of losses) starting from next year. The main trading logic may be derived from the bullish pig prices this year, the addition of industrial funds to replenish production capacity, and cyclic profits.

However, in addition to the impact on expectations of prices for pig futures contracts for the distant months, the sharp decline in the stock price of Leshan Giantstar Farming&Husbandry Corporation also had some negative factors of its own.

On the one hand, a questioning article intensified market concerns.

At the end of June, Miao Tou published an article titled "Will the Stock Price of Leshan Giantstar Farming&Husbandry Corporation, Also Known as 'Little Muyuan', Crash?", raising doubts about the discrepancies in the data on feed costs and the number of pigs slaughtered in 2023 by the company, which attracted significant market attention.

According to the article, the number of pigs slaughtered in 2023 was 2.67 million (1.78 million for fattening pigs and 0.11 million for breeding sows), and based on an estimated annual feed consumption of 1.1 tons per breeding sow and 1 ton per 3 fattening pigs, the annual feed consumption of Giantstar was 0.714 million tons. Based on the disclosed feed costs of 2.397 billion yuan, it can be inferred that the average feed cost of Giantstar was about 3357 yuan/ton, which is significantly lower than the average feed price of 4250 yuan/ton for fattening pigs in Chongqing in 2023 (according to Wind data).

Therefore, this article questioned whether Giantstar deliberately concealed its feed costs or whether there was a virtual increase in revenue from the sale of pigs. Furthermore, it analyzed that there were shortfalls in the income from the leather business, the price difference between fattening and suckling pigs, and the mismatch between feed ingredients and the number of pigs slaughtered, all of which were between 0.3-0.5 billion yuan, which was quite suspicious.

On July 1st, Leshan Giantstar Farming&Husbandry Corporation seemed to have indirectly responded to the above questioning article, but it did not completely dispel some investors' concerns.

(Source: Leshan Giantstar Farming&Husbandry Corporation WeChat Official Account)

On the other hand, the premium of the valuation of Leshan Giantstar Farming&Husbandry Corporation to its counterparts in the pig industry is quite high, which itself has considerable downward pressure.

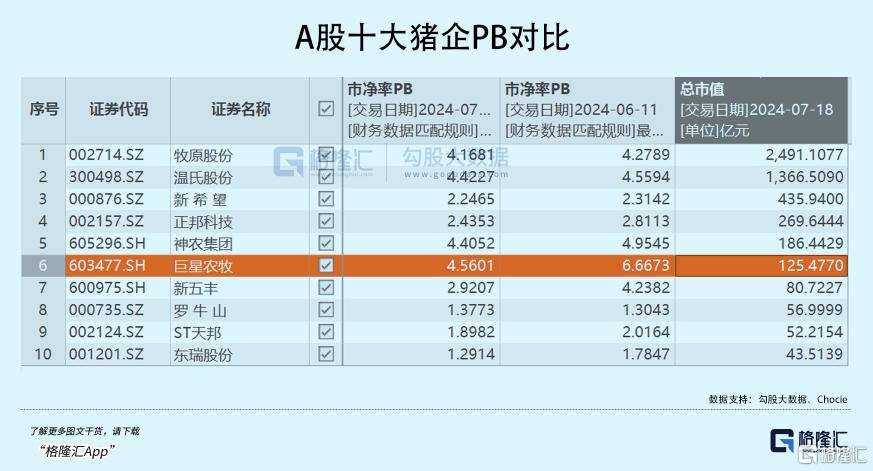

Before this round of decline, the PB ratio of Leshan Giantstar Farming&Husbandry Corporation was 6.67 times, significantly higher than the 4.95 times of Shennong Group, which had similar breeding performance and business volume, and also higher than the 4.28 times of Muyuan Foods and the 4.56 times of Wens Foodstuff Group.

Due to concerns about the sustained reversal of the pig cycle and the bearish questioning of operational data, the valuation of Leshan Giantstar Farming & Husbandry Corporation is quickly correcting downward. Currently, Leshan Giantstar, Sunlon, Muyuan Foods, and Wens Foodstuff Group are all above four times the stock price, with little difference in the gap, making this valuation level relatively reasonable.

02

It cannot be denied that Leshan Giantstar Farming & Husbandry Corporation has shown remarkable growth in the past few years and is also the main driving force behind the stock price's significant rise.

In September 2019, Zhenjing Stock announced the acquisition of 100% of Leshan Giantstar's shares, which was widely questioned by the market. This is because the company's performance changed dramatically after its IPO and it was in a hurry to sell its shell in less than two years, leading to intensive inquiries from regulatory authorities.

In August 2020, Leshan Giantstar Farming & Husbandry Corporation finally successfully listed on the stock market through a backdoor listing with Zhenjing Stock. Three years later, in August 2023, the original controlling shareholder H&H Group and Giant Star Group signed a "Stock Transfer Agreement," and Tang Guangyue ultimately became the controlling shareholder of the company.

After going public, Leshan Giantstar Farming & Husbandry Corporation adopted a dual breeding mode of "company + farmers" and self-breeding and self-raising. This is unusual among listed pig companies - Wens Foodstuff Group and New Hope Liuhe adopt the former mode, while Muyuan Foods only adopts the latter.

Leshan Giantstar Farming & Husbandry Corporation synchronously iterates the two breeding modes, with the proportion of self-breeding and self-raising gradually increasing to more than 30% of the breeding scale, and there may be further room for improvement in the future. For example, the Dechang Giant Star 1 million-breeding and self-raising project with a total investment of 3 billion yuan was officially put into operation on April 10, 2024.

Regarding the breeding pigs, Leshan Giantstar Farming & Husbandry Corporation has close cooperation with the world-renowned pig breeding improvement company PIC, which has significantly improved its production capacity and efficiency, making its operational data better than the industry average and helping to reduce breeding costs. For example, in terms of the production performance of the Gao Guan Farm, the PSY reached 31.88 in 2021, with 14.5 piglets per litter and 13.14 weaned piglets per litter per sow, which is significantly higher than the industry average performance.

In the second quarter of this year, Leshan Giantstar Farming & Husbandry Corporation's overall PSY has reached more than 29, with a target of 30 for the second half of the year, while in June, Muyuan Foods' PSY only reached more than 28. In fact, Sunlon Group also cooperates with PIC, and its breeding and management performance is excellent, showing that PIC's pig breeding technology is quite good.

In terms of breeding costs, as of April 2024, Leshan Giantstar Farming & Husbandry Corporation's breeding cost was 6.35 yuan/jin, equivalent to 12.82 yuan/kg, which is significantly lower than Muyuan Foods, which considers itself cost-effective at 14.8 yuan/kg, and much lower than most of its peers, which are concentrated in the range of 14 to 16 yuan/kg.

In terms of output, Leshan Giantstar Farming & Husbandry Corporation's growth is particularly rapid. In 2020, Leshan Giantstar's output was only 0.315 million heads, a year-on-year increase of 42%. By 2023, the output had reached 2.6737 million heads, a year-on-year increase of 74.7%, with a 3-year compound annual growth rate of 104%. Some institutions predict that Leshan Giantstar will achieve an output of 4 million heads and 7 million heads in 2024 and 2025, respectively, and the company's long-term goal is 10 million heads.

To achieve the output target, Leshan Giantstar Farms & Husbandry Corporation needs to have a large amount of funds, and the asset-liability ratio cannot be too high. On the one hand, the company launched a fixed increase in December last year, raising no more than 1.75 billion yuan. On the other hand, Leshan Giantstar Farms & Husbandry Corporation's asset-liability ratio has continued to rise from 37% in 2020 to 62% in Q1 2024 since it expanded its production capacity significantly, slightly lower than Wens Foodstuff Group and Muyuan Foods, but higher than Dongrui Group and Sunlon Group. However, with this year's significant rebound in pig prices, the asset-liability ratio is expected to decline, and if the subsequent fixed increase goes smoothly, Leshan Giantstar Farms & Husbandry Corporation's production capacity is likely to take a big step forward.

In the previous pig cycle, Zhengbang Science & Technology, Tech-bank Food, and Fujian Aonong Biological Technology Group Inc. significantly and aggressively expanded pig production capacity despite their high breeding costs and eventually faced either reorganization and acquisition or the miserable fate of struggling on the brink of delisting.

Leshan Giantstar Farms & Husbandry Corporation is a big dark horse in the pig industry, not only with relatively low breeding costs but also with rapidly expanding production capacity, reminiscent of the fast growth of Muyuan Foods at the time.

03

It is true that the pig cycle has indeed entered a reversal in the first half of this year, which is conducive to the improvement of the industry's cash flow and asset-liability ratio. However, the sustained upward cyclicity of the reversal may no longer be regular.

First, after the outbreak of African swine fever, the difference in breeding costs among different entities is significant.

Second, the scale of pig breeding and the industry concentration are already at a relatively high level, and the previous law of adjusting pig production capacity through small adjustments in prices by small and medium-sized pig farmers is no longer suitable.

It is impossible to accurately predict whether pig prices will continue to remain highly positive next year or be as pessimistic as the current commodity market. Of course, the commodity market may also have priced it wrong, and it will be revised when the time comes.

But regardless, rising or falling pig prices are no longer the core factors determining the stock prices of pig companies (continuous growth in cash flow is).

For example, in this round of pork price increases, New Hope did not rebound significantly and is still struggling at the bottom. Muyuan Foods, on the other hand, has experienced a considerable degree of valuation repair, with a 30% rebound since its low point this year.

Giantstar farming & husbandry corporation priced too optimistically before, and now it has returned to a relatively reasonable valuation level through a large drop in stock price, which can be considered appropriate. As long as the financial data are true and reliable, the growth logic of Giantstar farming & husbandry corporation has not been seriously damaged, and its value may return in the medium to long-term future. (End of article)