Booking Holdings Options Trading: A Deep Dive Into Market Sentiment

Booking Holdings Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on Booking Holdings. Our analysis of options history for Booking Holdings (NASDAQ:BKNG) revealed 15 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $71,548, and 13 were calls, valued at $1,070,087.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $2000.0 to $4250.0 for Booking Holdings over the last 3 months.

Volume & Open Interest Trends

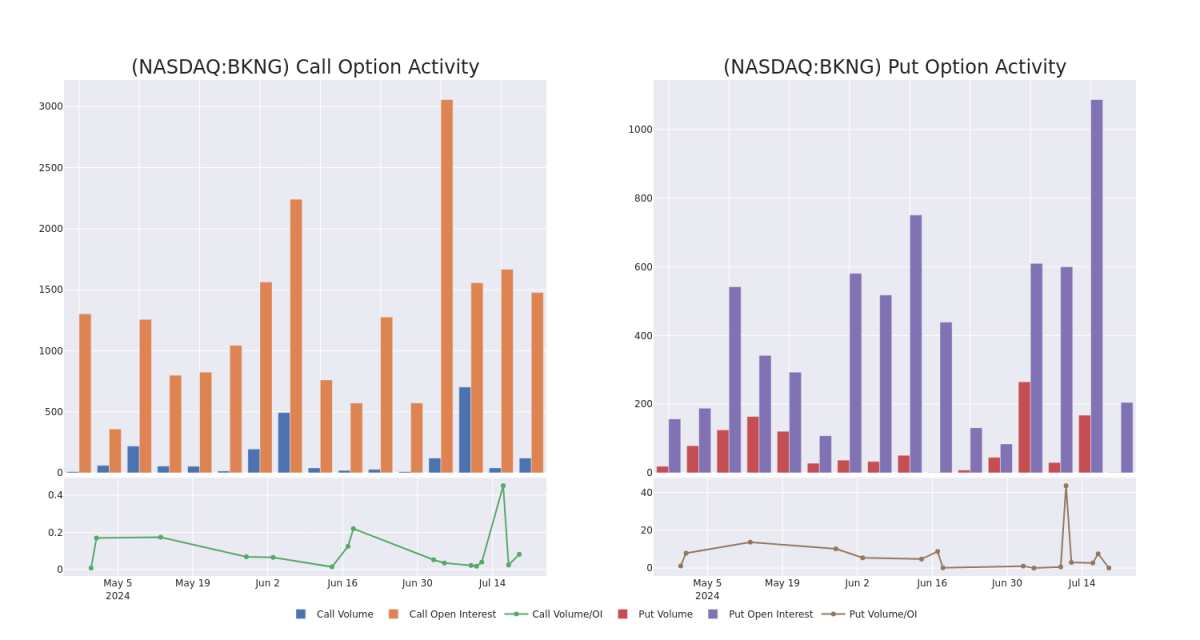

In today's trading context, the average open interest for options of Booking Holdings stands at 145.7, with a total volume reaching 1.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Booking Holdings, situated within the strike price corridor from $2000.0 to $4250.0, throughout the last 30 days.

Booking Holdings Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | TRADE | BEARISH | 01/17/25 | $2015.0 | $2010.0 | $2010.0 | $2000.00 | $201.0K | 300 | 0 |

| BKNG | CALL | TRADE | NEUTRAL | 01/17/25 | $2010.4 | $1996.9 | $2004.0 | $2000.00 | $200.4K | 300 | 1 |

| BKNG | CALL | TRADE | BEARISH | 08/16/24 | $176.8 | $164.4 | $168.9 | $3905.00 | $135.1K | 3 | 0 |

| BKNG | CALL | TRADE | NEUTRAL | 01/17/25 | $1240.0 | $1227.7 | $1235.0 | $2800.00 | $123.5K | 312 | 0 |

| BKNG | CALL | TRADE | BULLISH | 09/20/24 | $155.0 | $155.0 | $155.0 | $4000.00 | $77.5K | 65 | 0 |

About Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Having examined the options trading patterns of Booking Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Booking Holdings Standing Right Now?

- With a volume of 65,332, the price of BKNG is down -0.28% at $3956.25.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 10 days.

Expert Opinions on Booking Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $4455.4.

- Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Booking Holdings, targeting a price of $4900.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Booking Holdings, targeting a price of $4600.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Booking Holdings with a target price of $3497.

- Consistent in their evaluation, an analyst from Tigress Financial keeps a Strong Buy rating on Booking Holdings with a target price of $4580.

- An analyst from Benchmark upgraded its action to Buy with a price target of $4700.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Booking Holdings with Benzinga Pro for real-time alerts.