Unpacking the Latest Options Trading Trends in Applied Mat

Unpacking the Latest Options Trading Trends in Applied Mat

Investors with a lot of money to spend have taken a bullish stance on Applied Mat (NASDAQ:AMAT).

拥有大量资金的投资者对Applied Mat (纳斯达克:AMAT) 持看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMAT, it often means somebody knows something is about to happen.

无论这些是机构还是富裕个人,我们都不知道。但是当出现这种与AMAT有关的大事件时,通常意味着某人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 25 uncommon options trades for Applied Mat.

今天,Benzinga的期权扫描仪发现了25笔应用材料的罕见期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 52% bullish and 32%, bearish.

这些大额交易者的整体情绪分为52%看多和32%看淡。

Out of all of the special options we uncovered, 15 are puts, for a total amount of $858,524, and 10 are calls, for a total amount of $421,561.

在我们发现的所有特殊期权中,15笔是看跌期权,总金额为858,524美元;10笔是看涨期权,总金额为421,561美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $165.0 to $290.0 for Applied Mat over the recent three months.

根据交易活动,这些重要投资者似乎瞄准了应用材料在最近三个月内涨到165.0美元至290.0美元的价格区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

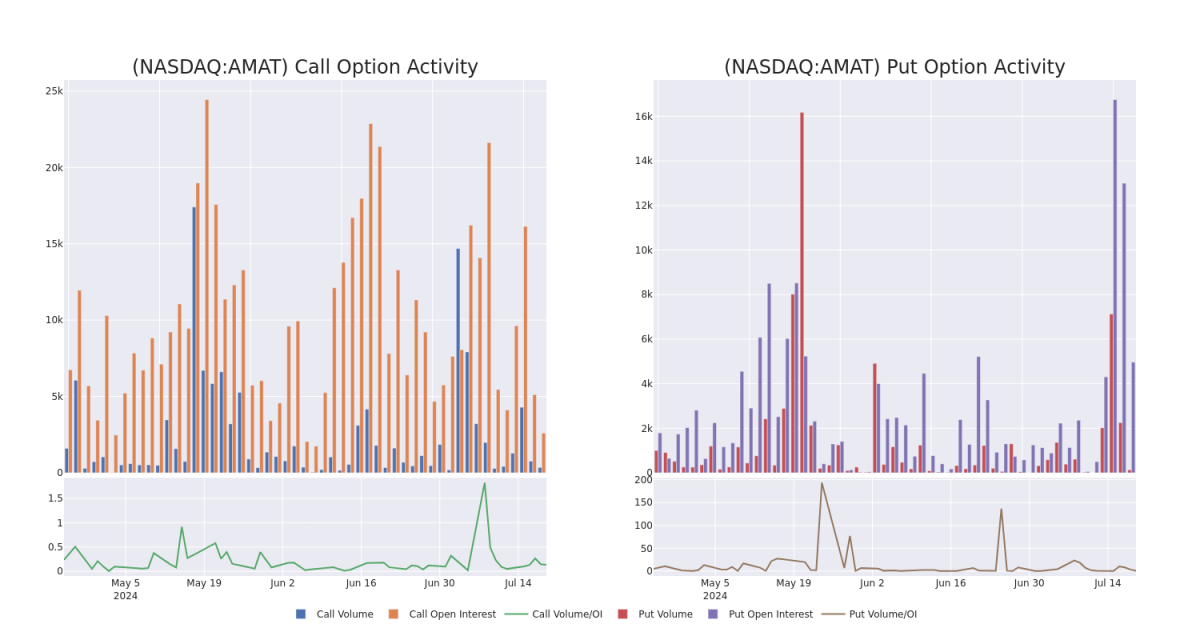

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Mat's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Applied Mat's significant trades, within a strike price range of $165.0 to $290.0, over the past month.

检查成交量和未平仓合约,为股票研究提供关键的见解。这些信息对于衡量在股价特定的行权价下,应用材料期权的流动性和兴趣水平至关重要。以下是应用材料重大交易的看涨/看跌期权在165.0美元至290.0美元行权价区间的成交量和未平仓合约趋势快照,过去一个月内的情况。

Applied Mat Call and Put Volume: 30-Day Overview

应用材料看涨和看跌期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | PUT | TRADE | BULLISH | 08/16/24 | $8.6 | $8.45 | $8.45 | $215.00 | $228.9K | 0 | 11 |

| AMAT | PUT | TRADE | BULLISH | 09/20/24 | $6.2 | $6.1 | $6.1 | $200.00 | $173.8K | 1.4K | 15 |

| AMAT | CALL | SWEEP | BULLISH | 01/17/25 | $60.45 | $59.6 | $60.45 | $165.00 | $151.1K | 1.1K | 0 |

| AMAT | PUT | SWEEP | BEARISH | 07/26/24 | $24.05 | $22.6 | $24.05 | $240.00 | $50.5K | 43 | 10 |

| AMAT | PUT | TRADE | BULLISH | 06/20/25 | $23.8 | $23.45 | $23.45 | $210.00 | $49.2K | 273 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | 看跌 | 交易 | 看好 | 08/16/24 | $8.6美元 | 8.45美元 | 8.45美元 | 215.00美元 | $228.9K | 0 | 11 |

| AMAT | 看跌 | 交易 | 看好 | 09/20/24 | $6.2 | 6.1美元 | 6.1美元 | 。 | 173,800美元 | 1.4千 | 15 |

| AMAT | 看涨 | SWEEP | 看好 | 01/17/25 | $60.45 | $59.6 | $60.45 | 165.00美元 | $151.1K | 1.1千 | 0 |

| AMAT | 看跌 | SWEEP | 看淡 | 07/26/24 | $24.05 | $22.6 | $24.05 | $240.00 | $50.5K | 43 | 10 |

| AMAT | 看跌 | 交易 | 看好 | 06/20/25 | $23.8 | $23.45 | $23.45 | 目标股价为$210.00。 | $49.2千 | 273 | 0 |

About Applied Mat

关于应用材料

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

应用材料是全球最大的半导体硅片制造设备或WFE制造商。应用材料拥有广泛的产品组合,几乎涵盖了WFE生态系统中的每个角落。具体而言,应用材料在沉积领域占据市场份额领先地位,该领域包括在半导体晶片上堆叠新材料。它更多地暴露于集成器件制造商和代工厂制造的通用逻辑芯片。它将全球最大的芯片制造商(包括台积电,英特尔和三星)视为客户。

Applied Mat's Current Market Status

应用材料目前的市场状态

- Trading volume stands at 2,210,854, with AMAT's price up by 3.18%, positioned at $216.95.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 24 days.

- 成交量为2210854,AMAT的股价上涨了3.18%,为216.95美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计24天内公布收益报告。

What The Experts Say On Applied Mat

关于应用材料的专家意见

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $282.5.

在过去的一个月中,有2位行业分析师分享了他们对这支股票的看法,建议平均目标价为282.5美元。

- An analyst from Stifel persists with their Buy rating on Applied Mat, maintaining a target price of $275.

- Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Applied Mat, targeting a price of $290.

- Stifel的一位分析师坚持对Applied Mat的买入评级,维持目标价为275美元。

- Cantor Fitzgerald的一位分析师继续持有Applied Mat的超配评级,目标价格为290美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Applied Mat options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。 精明的交易者通过不断自我教育,调整策略,监控多个因子并密切关注市场动向来管理这些风险。通过Benzinga Pro实时警报保持了解最新的应用材料期权交易动态。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMAT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMAT, it often means somebody knows something is about to happen.