Cautious Investor? These ETFs Are a Safer Way to Invest in the AI Boom

Cautious Investor? These ETFs Are a Safer Way to Invest in the AI Boom

For the record, I'm not one to chase hype, and currently, there's no buzz bigger than artificial intelligence (AI). Honestly, I'm quite content with the AI exposure already baked into my S&P 500 index funds.

聲明一下,我不是一個追逐炒作的人,而如今,沒有比人工智能更受矚目的了。實際上,我對於我的S&P 500指數基金已經包含的人工智能投資暴露感到相當滿意。

However, if you're intent on tapping into the AI sector more directly, diving headfirst into individual semiconductor or software stocks might not be the safest approach.

不過,如果你打算更直接地利用人工智能板塊,那麼盲目地投資於單獨的半導體或軟件股並不是最安全的方法。

Instead, consider the strategic use of thematic exchange-traded funds (ETFs). These can provide targeted AI exposure while mitigating risks associated with single-company volatility.

相反地,考慮通過主題ETF來實現策略性利用,這樣可以在降低與單一公司波動相關的風險的同時,提供有針對性的投資於人工智能業務。

Today, I'll introduce a solid AI-focused ETF from CI Global Asset Management that's caught my eye, but I'll also suggest a more conservative ETF to help balance out the inherent risks of sector-specific investing.

今天,我將介紹一種來自CI Global資產管理的優質人工智能ETF,這個ETF已經吸引了我的目光,但是我也會建議一種更爲保守的ETF,以幫助您平衡這種特定板塊投資的固有風險。

The AI ETF

人工智能ETF

Creating your own AI-themed portfolio involves a lot of work. You need to look into each company's revenues to figure out just how much of their business is tied to or supports AI, not to mention the regular due diligence of stock picking.

創建您自己的人工智能主題投資組合需要大量的工作。您需要查看每個公司的收入,以確定其業務中與人工智能相關的比例,並考慮股票選擇的常規盡職調查等。

Alternatively, you can simplify this task by investing in a thematic ETF like the CI Global Artificial Intelligence ETF (TSX:CIAI).

或者,您可以通過投資類似CI Global人工智能ETF(TSX:CIAI)這樣的主題ETF來簡化這項任務。

This ETF is actively managed by two finance experts who handle the stock picking and portfolio rebalancing for you. But despite being actively managed, CIAI is quite affordable with a management fee of just 0.20%.

該ETF由兩位金融專家積極管理,他們負責爲您選擇股票和平衡投資組合。但是儘管進行了積極管理,CIAI的管理費用只有0.20%,相當實惠。

The ETF is relatively new, so the Management Expense Ratio (MER) is still to be determined, but it has already gathered significant investor interest with $582 billion in assets under management â a strong start for a thematic ETF.

此ETF是相對較新的,因此其管理費用比率(Management Expense Ratio,MER)還有待確定。但它已經引起了投資者的濃厚興趣,管理資產達到5820億美元 -- 這是一個主題ETF的強勁開端。

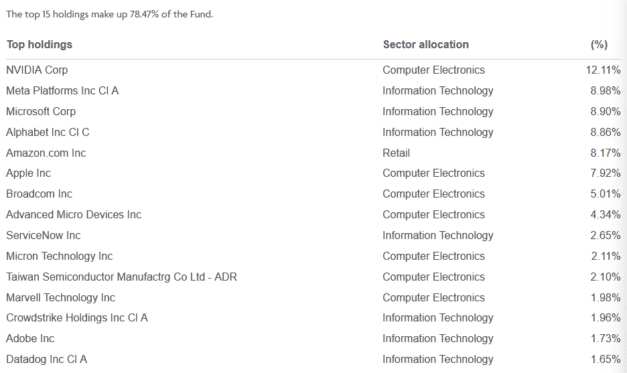

Hereâs a snapshot of its top holdings as of July:

以下是它在7月份的前幾個股票持倉快照:

The safe ETF

安全ETF

While CIAI offers exciting exposure to the AI sector, it's also rated as "high" risk by the fund manager. This indicates that its share price could experience significant fluctuations.

雖然CIAI提供了令人興奮的人工智能資產配置,但基金經理將其評級爲“高風險”。這表明其股票價格可能會出現顯著波動。

To counterbalance this volatility, it's wise to maintain a portion of your portfolio in safer assets that can help you take advantage of any major dips in the market. While holding cash is one option, it doesn't offer growth potential.

爲了抵消這種波動,將投資組合中的一部分保留在更安全的資產中是明智的,這樣可以幫助您利用市場中的任何重大下跌。儘管持有現金是一個選擇,但它不提供增長潛力。

A strategic choice for keeping your funds secure while still earning returns is the CI High Interest Savings ETF (TSX:CSAV).

在保持基金安全的同時仍然獲得回報的戰略選擇是CI高收益儲蓄ETF(TSX:CSAV)。

This ETF functions like a high-interest savings account but in ETF form, providing a net yield of 4.6% as of July 9th, with monthly distributions. It has a MER of 0.16%.

這種ETF的功能類似於高利息儲蓄帳戶,但是以ETF形式提供,截至7月9日,其淨收益率爲4.6%,並提供每月分配。它的MER爲0.16%。

The post Cautious Investor? These ETFs Are a Safer Way to Invest in the AI Boom appeared first on The Motley Fool Canada.

本文最初發表於The Motley Fool Canada。

Today, I'll introduce a solid AI-focused ETF from

Today, I'll introduce a solid AI-focused ETF from