Track the latest developments in north-south funding

On July 23, Beishang Capital sold a net share of 4.183 billion yuan. Among them, Shanghai Stock Connect had net sales of 1.03 billion yuan and Shenzhen Stock Connect had net sales of 3.153 billion yuan.

Among the top ten traded stocks, Kweichow Moutai, Wuliangye, and Zhongji Xuchuang had net sales of 0.336 billion yuan, 0.27 billion yuan, and 0.227 billion yuan respectively.

BYD, Cambrian and Agricultural Bank received net purchases of 0.41 billion yuan, 0.257 billion yuan, and 0.254 billion yuan respectively.

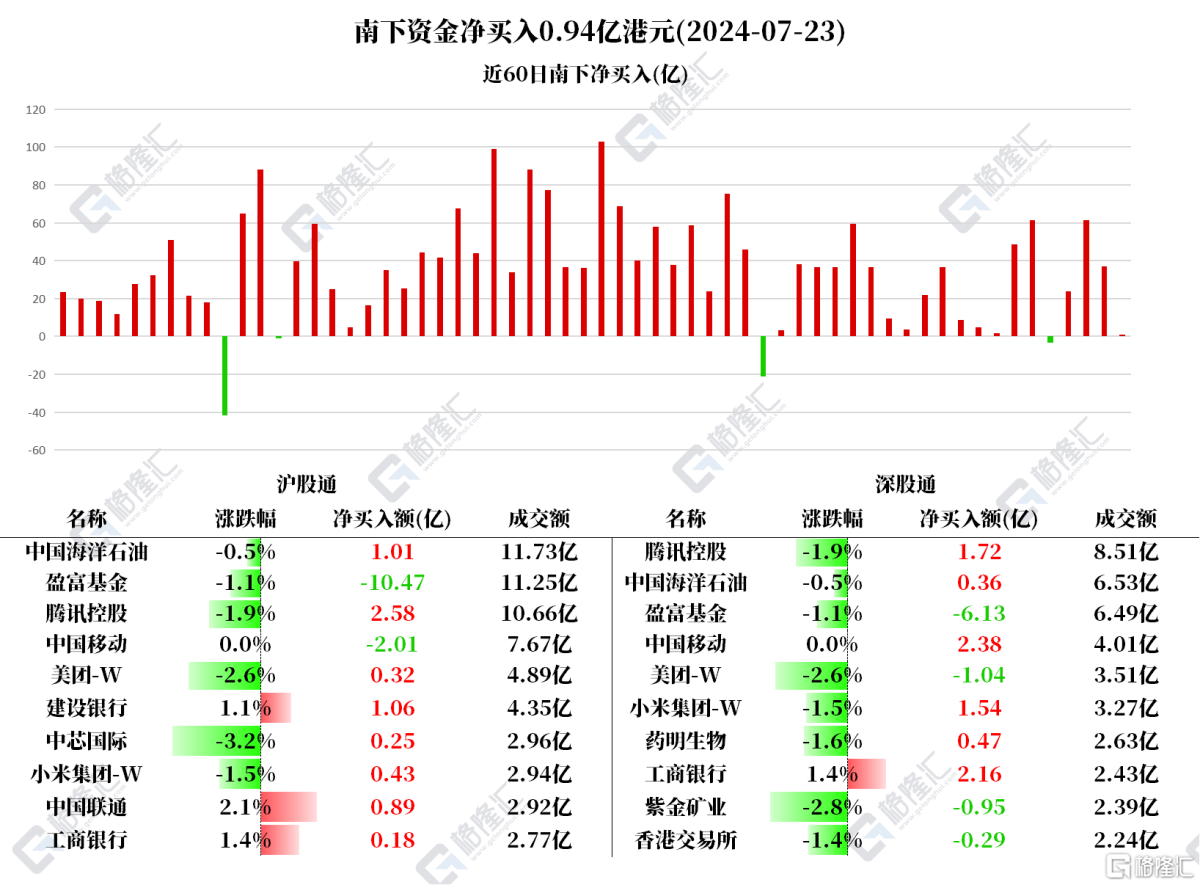

Today, Southbound made a net purchase of Hong Kong stocks of 0.094 billion yuan. Among them, Hong Kong Stock Connect (Shanghai) had a net purchase of HK$0.163 billion, and Hong Kong Stock Connect (Shenzhen) had a net sale of HK$68.2956 million.

Net purchases of Tencent 0.43 billion, ICBC 0.233 billion, Xiaomi 0.197 billion, CNOOC 0.137 billion, China Construction Bank 0.105 billion; net sales of Prosperity Fund 1.66 billion.

According to statistics, Southbound Capital has made net purchases of Tencent for 7 consecutive days, totaling HK$6.26,406 billion.

Nanshui focuses on individual stocks

Kweichow Moutai and Wuliangye: According to the news, liquor analysts say that in 2024Q2, Maotai's revenue is expected to increase by 13% and profit to grow by less than 15%; Wuliangye's revenue and profit are expected to grow by nearly 10%.

Zhongji Xuchuang: According to the CITIC Construction Investment Securities Research Report, Zhongji Xuchuang's net profit maintained rapid growth in the first half of the year. According to the median forecast, the company's net profit to mother in the first half of the year was 2.325 billion yuan, an increase of 279% over the previous year. In the first half of 2024, the company's current main product, 800G/400G optical modules, achieved rapid annual growth. The company's product structure continued to be optimized, and high-end products accounted for a high proportion of sales revenue, driving a significant increase in the company's revenue and net profit.

Cambrian Period: CITIC Securities analysts Xu Tao and Wang Ziyuan said that since 2022, the US has repeatedly increased restrictions on Chinese semiconductors. Currently, the US restrictions on the Chinese semiconductor industry are gradually weakening, and domestic preparations have already been made in advance for this, so it is expected that the impact on the semiconductor industry will decrease marginally. It is recommended that domestic equipment, parts and materials companies continue to pay attention to the increase in orders brought about by the new product layout and advanced production capacity in the “stuck neck” field. Under external restrictions, the rate of localization of semiconductor equipment is expected to increase rapidly, and we continue to be optimistic about the rapid increase in orders from domestic semiconductor equipment companies in recent years.

Agricultural Bank: Zhongtai Securities released a research report saying that interest rate cuts are in line with expectations, LPR is linked to 7-day OMO, and interest rate marketization is further deepening. The current LPR reduction of 10 bp will have an impact of about 1 bp on banks' 2024 interest spreads, and 0.5 pcts/1.1 pcts on revenue and profit before tax, respectively. Judging from recent adjustments in LPR and deposit interest rates, every time the central bank cuts LPR twice, the major banks will then cut interest rates on listed deposits twice. However, since the beginning of this year, they have cut interest rates for two rounds, and a new round of deposit interest rate cuts can be expected. Bank stocks are stable and defensive, and at the same time have high dividends and the investment attributes of state-owned financial institutions; from an investment perspective, they strongly support the bank stock market, and at the same time, bank fundamentals are stable. The fundamentals of high-quality urban agricultural commercial banks are highly deterministic, so choose urban agricultural commercial banks with cheap valuations.

Beishui focuses on individual stocks

Tencent: Nomura published a report maintaining the “buy” investment rating of Tencent Holdings and the target price of HK$467 unchanged. Nomura expects Tencent's second-fiscal quarter earnings to be better than expected. The bank estimates that Tencent's non-GAAP earnings per share will grow steadily (34% yearly).

ICBC: Huafu Securities believes that the banking sector's market has been driven by three factors since this year. The first is the spread of dividend rate stock selection logic within the sector, and the spread of high-dividend strategies from state-owned banks to small and medium banks. The second is the relaxation of real estate policies. Third, the market expects that the downward slope of bank net interest spreads will slow down and that fundamentals will soon bottom out. Looking forward to the future, the banking sector should test the effects of earlier policies and future fundamental trends more.

Xiaomi: Goldman Sachs published a research report stating that Xiaomi's revenue forecast for the second quarter of this year and 2024 to 2026 was raised by 2% to 3% to reflect a more steady long-term sales growth forecast for the Internet of Things and smart electric vehicles. The bank also raised Xiaomi's net profit forecast for 2024 to 2026 by 1% to 4%, mainly due to new measures for electric vehicle sales services with fewer losses and higher profits.

According to this industry, Xiaomi's smartphone gross margin recorded 13.4%, 13.7%, and 13.2% in the second quarter of this year and next two years, respectively. It is also expected that Xiaomi may maintain its important position in the field of artificial intelligence-driven interactive networks. The bank also mentioned that overseas revenue has resumed growth since the first quarter of this year and recorded a compound annual growth rate of 14% from 2023 to 2026. Goldman Sachs slightly raised the target price of Xiaomi from HK$23 to HK$23.2, maintaining a “buy” rating.

CNOOC: According to the news, CNOOC previously announced that the company has formulated an action plan to “improve quality, increase efficiency and increase return” for 2024. The annual dividend payment rate is not less than 40%, and the absolute value of the annual dividend is not less than HK$0.70 per share (tax included). The company will maintain the continuity and stability of the shareholder return policy on the basis of comprehensive consideration of factors such as future earnings, capital requirements, financial conditions, and future prospects, and provide shareholders with competitive dividend returns.