Unpacking the Latest Options Trading Trends in Oracle

Unpacking the Latest Options Trading Trends in Oracle

Investors with a lot of money to spend have taken a bearish stance on Oracle (NYSE:ORCL).

在擁有很多資金的投資者中,有人對Oracle(NYSE:ORCL)採取了看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.

無論這些機構是還是富人,我們不知道。但當這麼大的事情發生在ORCL時,這通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 8 options trades for Oracle.

今天,Benzinga的期權掃描器發現了8個Oracle的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 25% bullish and 50%, bearish.

這些大手交易者的總體情緒分爲25%看好和50%看淡。

Out of all of the options we uncovered, there was 1 put, for a total amount of $31,250, and 7, calls, for a total amount of $297,780.

在我們發現的所有期權中,共有1個看跌期權,金額爲31,250美元,以及7個看漲期權,金額總計爲297,780美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $170.0 for Oracle during the past quarter.

分析這些合約的成交量和持倉量,似乎大戶們在過去的季度裏一直在關注Oracle在130.0美元到170.0美元之間的目標價區間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

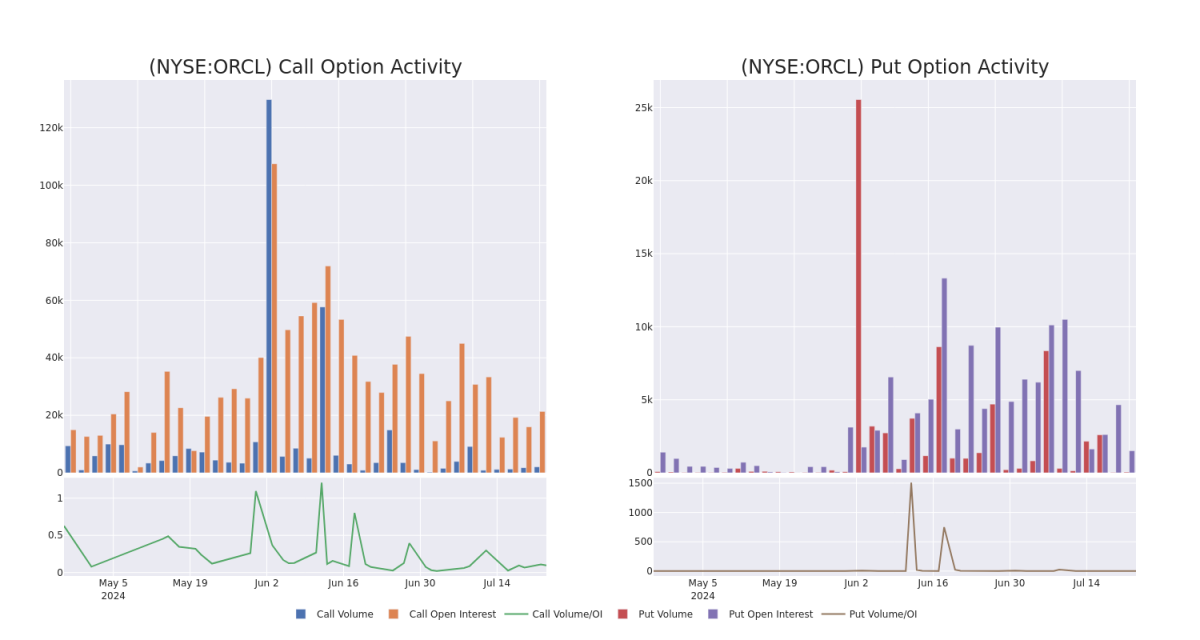

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Oracle's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oracle's whale trades within a strike price range from $130.0 to $170.0 in the last 30 days.

在交易期權時,查看成交量和持倉量是一個很有用的方法。這些數據可以幫助您跟蹤Oracle的期權在某個執行價格下的流動性和興趣。下面,我們可以觀察過去30天內所有Oracle的鯨魚交易期權(在執行價格區間爲130.0美元到170.0美元之間)的看漲期權和看跌期權的成交量和持倉量演變情況。

Oracle Option Volume And Open Interest Over Last 30 Days

Oracle過去30天的期權成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | TRADE | BULLISH | 09/20/24 | $16.4 | $16.1 | $16.4 | $130.00 | $68.8K | 3.7K | 42 |

| ORCL | CALL | SWEEP | BEARISH | 07/26/24 | $1.97 | $1.96 | $1.97 | $142.00 | $55.1K | 1.5K | 1.5K |

| ORCL | CALL | SWEEP | NEUTRAL | 10/18/24 | $10.9 | $8.2 | $9.63 | $140.00 | $43.1K | 162 | 45 |

| ORCL | CALL | SWEEP | BEARISH | 09/20/24 | $6.8 | $6.65 | $6.65 | $145.00 | $41.2K | 6.6K | 163 |

| ORCL | CALL | SWEEP | BULLISH | 09/20/24 | $3.15 | $3.1 | $3.1 | $155.00 | $37.7K | 6.2K | 14 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看漲 | 交易 | 看好 | 09/20/24 | $16.4 | $16.1 | $16.4 | $130.00 | $68.8K | 3.7K | 42 |

| ORCL | 看漲 | SWEEP | 看淡 | 07/26/24 | $1.97 | 1.96美元 | $1.97 | $142.00 | $55.1K | 1.5K | 1.5K |

| ORCL | 看漲 | SWEEP | 中立 | 10/18/24 | $10.9 | $8.2 | $9.63 | $140.00 | $43.1K | 162 | 45 |

| ORCL | 看漲 | SWEEP | 看淡 | 09/20/24 | $6.8 | $6.65 | $6.65 | $145.00 | $41.2K | 6,600份 | 163 |

| ORCL | 看漲 | SWEEP | 看好 | 09/20/24 | $3.15 | $3.1 | $3.1 | $155.00 | $37.7千美元 | 6.2千 | 14 |

About Oracle

關於Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企業提供數據庫技術和企業資源規劃(ERP)軟件。Oracle成立於1977年,是第一個商用SQL數據庫管理系統的創始人。如今,Oracle在175個國家擁有430,000個客戶,由136,000名員工支持。

Oracle's Current Market Status

Oracle當前的市場狀況

- With a trading volume of 869,314, the price of ORCL is up by 1.94%, reaching $142.89.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 48 days from now.

- 隨着869,314的交易量,ORCL的價格上漲1.94%,達到142.89美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次業績將在48天后公佈。

What Analysts Are Saying About Oracle

分析師對Oracle的評價

In the last month, 3 experts released ratings on this stock with an average target price of $150.0.

在過去的一個月中,有3位專家對此股票發表了評級,平均目標價爲150.0美元。

- An analyst from Guggenheim has revised its rating downward to Buy, adjusting the price target to $175.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Oracle, targeting a price of $150.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Oracle, which currently sits at a price target of $125.

- 一位來自古根海姆的分析師將其評級下調爲買入,調整價格目標至175美元。

- 派傑投資維持其持有評級,目標價爲150美元。

- 大摩資源lof的一位分析師決定維持其對Oracle的等權重評級,目前的價位爲125美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.

交易期權存在更高的風險,但也提供了更高的利潤潛力。精明的交易者通過持續教育、策略性交易調整、利用各種因子以及關注市場動態來減少這些風險。通過Benzinga Pro保持對Oracle最新期權交易的關注,以獲取實時提醒。