Unpacking the Latest Options Trading Trends in ServiceNow

Unpacking the Latest Options Trading Trends in ServiceNow

Deep-pocketed investors have adopted a bearish approach towards ServiceNow (NYSE:NOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NOW usually suggests something big is about to happen.

财力雄厚的投资者对ServiceNow(纽约证券交易所代码:NOW)采取了看跌的态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是NOW的如此实质性的举动通常表明大事即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for ServiceNow. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了ServiceNow的17项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 17% leaning bullish and 41% bearish. Among these notable options, 3 are puts, totaling $162,745, and 14 are calls, amounting to $521,781.

这些重量级投资者的总体情绪存在分歧,17%的人倾向于看涨,41%的人倾向于看跌。在这些值得注意的期权中,有3个是看跌期权,总额为162,745美元,14个是看涨期权,总额为521,781美元。

Expected Price Movements

预期的价格走势

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $600.0 and $1160.0 for ServiceNow, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场推动者将注意力集中在ServiceNow在过去三个月的600.0美元至1160.0美元之间的价格区间上。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

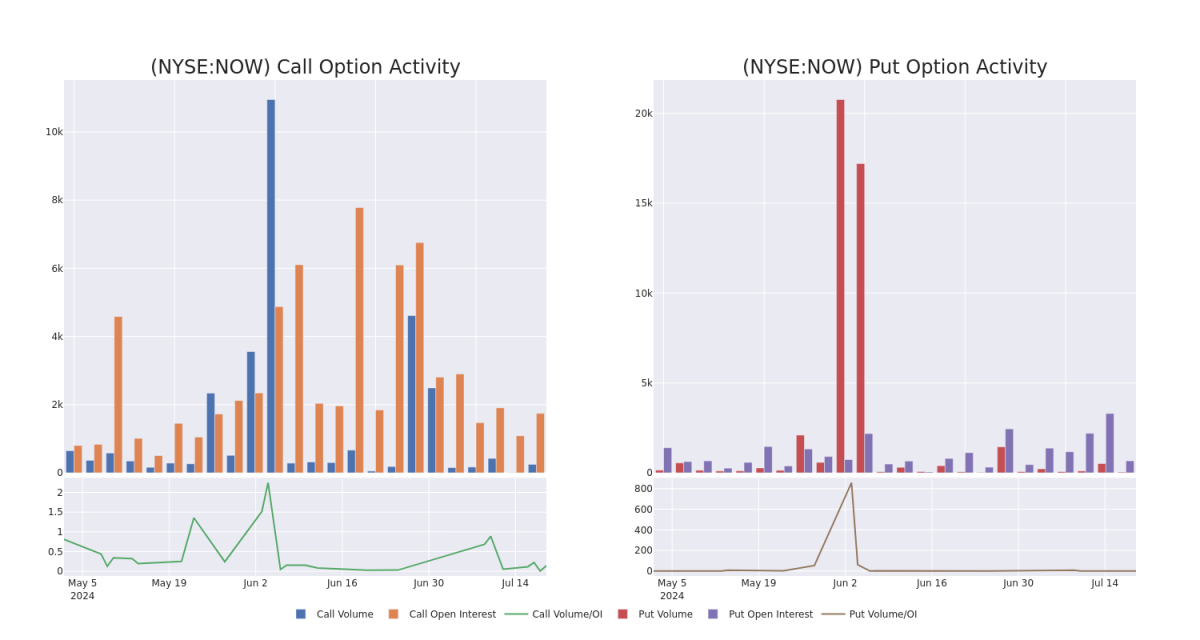

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下ServiceNow期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $600.0 to $1160.0 in the last 30 days.

下面,我们可以分别观察ServiceNow在过去30天行使价范围内所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

ServiceNow Option Activity Analysis: Last 30 Days

ServiceNow 期权活动分析:过去 30 天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | TRADE | BEARISH | 08/16/24 | $31.0 | $29.8 | $31.0 | $770.00 | $93.0K | 165 | 31 |

| NOW | CALL | TRADE | NEUTRAL | 07/26/24 | $26.2 | $24.5 | $25.4 | $775.00 | $55.8K | 65 | 150 |

| NOW | CALL | TRADE | NEUTRAL | 06/20/25 | $234.8 | $218.3 | $226.72 | $600.00 | $45.3K | 42 | 2 |

| NOW | CALL | TRADE | NEUTRAL | 01/17/25 | $118.1 | $107.5 | $111.8 | $720.00 | $44.7K | 192 | 4 |

| NOW | CALL | TRADE | BEARISH | 07/26/24 | $30.0 | $28.6 | $29.05 | $765.00 | $43.5K | 105 | 29 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 现在 | 放 | 贸易 | 粗鲁的 | 08/16/24 | 31.0 美元 | 29.8 美元 | 31.0 美元 | 770.00 美元 | 93.0 万美元 | 165 | 31 |

| 现在 | 打电话 | 贸易 | 中立 | 07/26/24 | 26.2 美元 | 24.5 美元 | 25.4 美元 | 775.00 美元 | 55.8 万美元 | 65 | 150 |

| 现在 | 打电话 | 贸易 | 中立 | 06/20/25 | 234.8 美元 | 218.3 美元 | 226.72 美元 | 600.00 美元 | 45.3 万美元 | 42 | 2 |

| 现在 | 打电话 | 贸易 | 中立 | 01/17/25 | 118.1 美元 | 107.5 美元 | 111.8 美元 | 720.00 美元 | 44.7 万美元 | 192 | 4 |

| 现在 | 打电话 | 贸易 | 粗鲁的 | 07/26/24 | 30.0 美元 | 28.6 美元 | 29.05 美元 | 765.00 美元 | 43.5 万美元 | 105 | 29 |

About ServiceNow

关于 ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供软件解决方案,通过SaaS交付模式构建和自动化各种业务流程。该公司主要专注于为企业客户提供IT职能。ServiceNow从IT服务管理开始,扩展到IT职能部门,最近将其工作流程自动化逻辑引向了IT以外的职能领域,尤其是客户服务、人力资源服务交付和安全运营。ServiceNow 还提供应用程序开发平台即服务。

Present Market Standing of ServiceNow

ServiceNow 目前的市场地位

- With a volume of 156,289, the price of NOW is up 2.19% at $773.05.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 1 days.

- NOW的交易量为156,289美元,上涨2.19%,至773.05美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在1天后公布。

Expert Opinions on ServiceNow

专家对 ServiceNow 的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $823.0.

在过去的一个月中,5位行业分析师分享了他们对该股的见解,提出平均目标价为823.0美元。

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $900.

- Reflecting concerns, an analyst from Guggenheim lowers its rating to Sell with a new price target of $640.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for ServiceNow, targeting a price of $920.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for ServiceNow, targeting a price of $820.

- Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for ServiceNow, targeting a price of $835.

- 尼德姆的一位分析师谨慎地将其评级下调至买入,将目标股价定为900美元。

- 出于担忧,古根海姆的一位分析师将其评级下调至卖出,新的目标股价为640美元。

- Keybanc的一位分析师保持立场,继续对ServiceNow进行增持评级,目标价格为920美元。

- Stifel的一位分析师保持立场,继续维持ServiceNow的买入评级,目标价格为820美元。

- Canaccord Genuity的一位分析师坚持自己的立场,继续维持ServiceNow的买入评级,目标价格为835美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ServiceNow options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的ServiceNow期权交易。