Financial giants have made a conspicuous bearish move on Thermo Fisher Scientific. Our analysis of options history for Thermo Fisher Scientific (NYSE:TMO) revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $162,140, and 6 were calls, valued at $422,002.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $500.0 to $660.0 for Thermo Fisher Scientific over the recent three months.

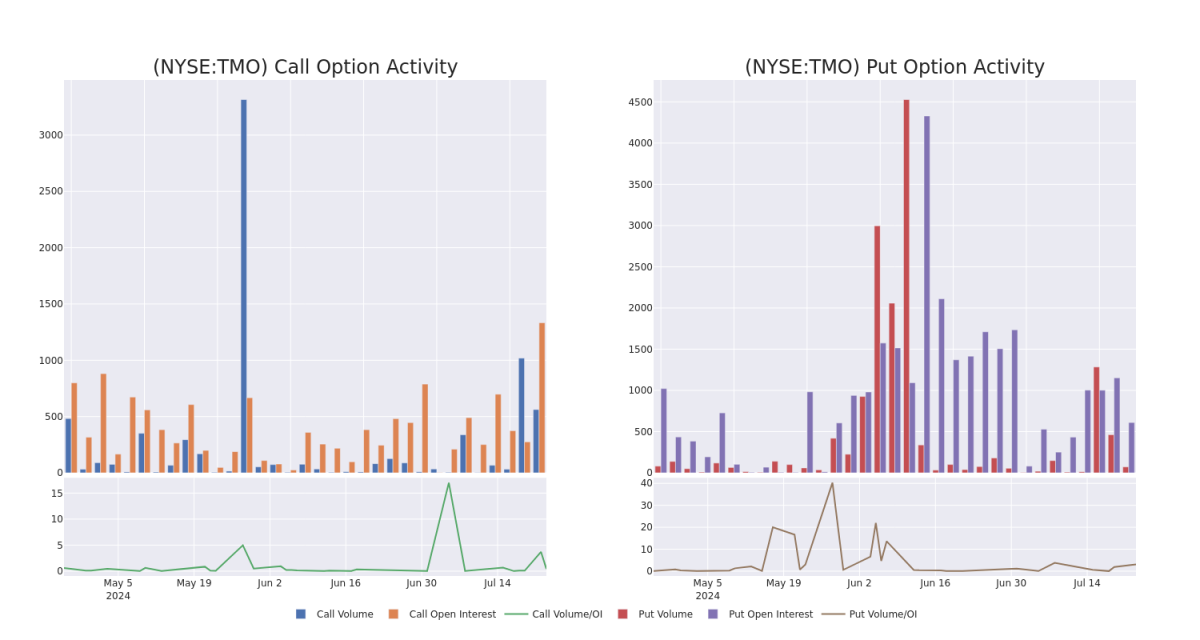

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Thermo Fisher Scientific's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Thermo Fisher Scientific's significant trades, within a strike price range of $500.0 to $660.0, over the past month.

Thermo Fisher Scientific Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | SWEEP | BEARISH | 01/17/25 | $10.6 | $10.4 | $10.4 | $640.00 | $104.0K | 470 | 191 |

| TMO | CALL | SWEEP | BEARISH | 01/17/25 | $10.5 | $10.4 | $10.4 | $640.00 | $104.0K | 470 | 2 |

| TMO | CALL | TRADE | BULLISH | 09/20/24 | $16.6 | $11.9 | $15.9 | $590.00 | $89.0K | 251 | 56 |

| TMO | PUT | TRADE | NEUTRAL | 01/16/26 | $32.0 | $23.1 | $26.8 | $500.00 | $80.4K | 17 | 30 |

| TMO | CALL | SWEEP | NEUTRAL | 01/17/25 | $7.2 | $6.4 | $7.2 | $660.00 | $61.9K | 239 | 86 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of end-2023 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (10%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

Where Is Thermo Fisher Scientific Standing Right Now?

- With a trading volume of 671,684, the price of TMO is up by 1.86%, reaching $556.56.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 1 days from now.

Professional Analyst Ratings for Thermo Fisher Scientific

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $600.0.

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Thermo Fisher Scientific, targeting a price of $600.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Thermo Fisher Scientific, which currently sits at a price target of $600.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Thermo Fisher Scientific with Benzinga Pro for real-time alerts.