The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. We wouldn't blame Shenzhen Dynanonic Co., Ltd (SZSE:300769) shareholders if they were still in shock after the stock dropped like a lead balloon, down 75% in just one year. That'd be a striking reminder about the importance of diversification. To make matters worse, the returns over three years have also been really disappointing (the share price is 65% lower than three years ago). Furthermore, it's down 15% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 7.4% in the same timeframe.

If the past week is anything to go by, investor sentiment for Shenzhen Dynanonic isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

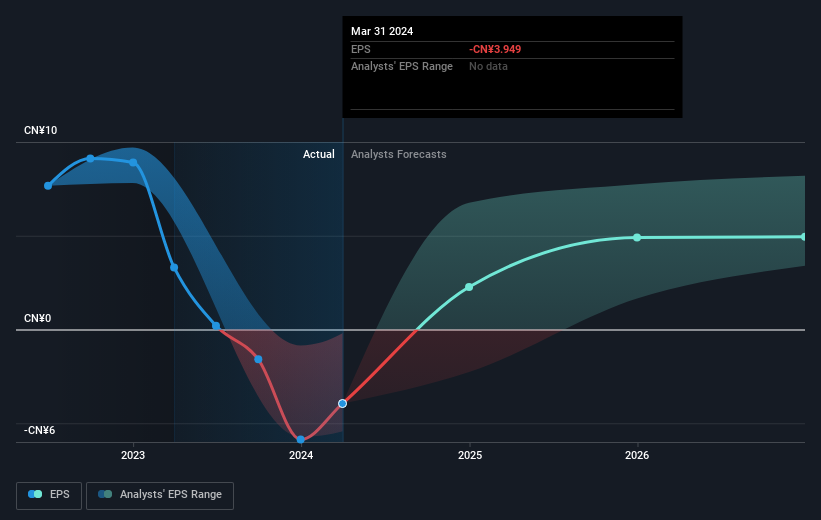

During the last year Shenzhen Dynanonic saw its earnings per share drop below zero. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. We hope for shareholders' sake that the company becomes profitable again soon.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Shenzhen Dynanonic's key metrics by checking this interactive graph of Shenzhen Dynanonic's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Shenzhen Dynanonic shareholders are down 75% for the year. Unfortunately, that's worse than the broader market decline of 19%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Shenzhen Dynanonic better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Shenzhen Dynanonic , and understanding them should be part of your investment process.

Of course Shenzhen Dynanonic may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com