General Motors Company (NYSE:GM) shares are down on Thursday, following a disappointing earnings report and a similar downward trend in Ford Motor Company (NYSE:F) shares after its mixed Q2 earnings report.

What To Know: Ford reported adjusted EPS of 47 cents, missing the analyst estimate of 68 cents, despite revenue exceeding expectations at $47.80 billion compared to $44.02 billion. This negative sentiment from Ford's earnings miss could be spilling over to GM, contributing to its stock decline.

GM may also be under pressure following the company's Q2 financial results. The company announced that it delayed its 2024 Buick EV and pushed its EV pickup plant opening to 2026.

What Else: Additionally, GM's self-driving unit, Cruise LLC, is striving to regain its footing after a significant setback according to Bloomberg. Following a mishandled pedestrian collision, Cruise's driverless license was suspended. The company has since overhauled its top management, including hiring Marc Whitten as CEO and is working to restore operations with improved safety metrics. GM aims to resume fully autonomous rides by the end of the year and start charging fares by early 2025.

What Else: Additionally, GM's self-driving unit, Cruise LLC, is striving to regain its footing after a significant setback according to Bloomberg. Following a mishandled pedestrian collision, Cruise's driverless license was suspended. The company has since overhauled its top management, including hiring Marc Whitten as CEO and is working to restore operations with improved safety metrics. GM aims to resume fully autonomous rides by the end of the year and start charging fares by early 2025.

Despite Cruise's $1.2 billion loss in second-quarter and $1.8 billion in the first half of the year, GM is investing $850 million to support Cruise into first-quarter 2025. The company hopes to attract partners and investors by demonstrating progress in autonomous driving technology.

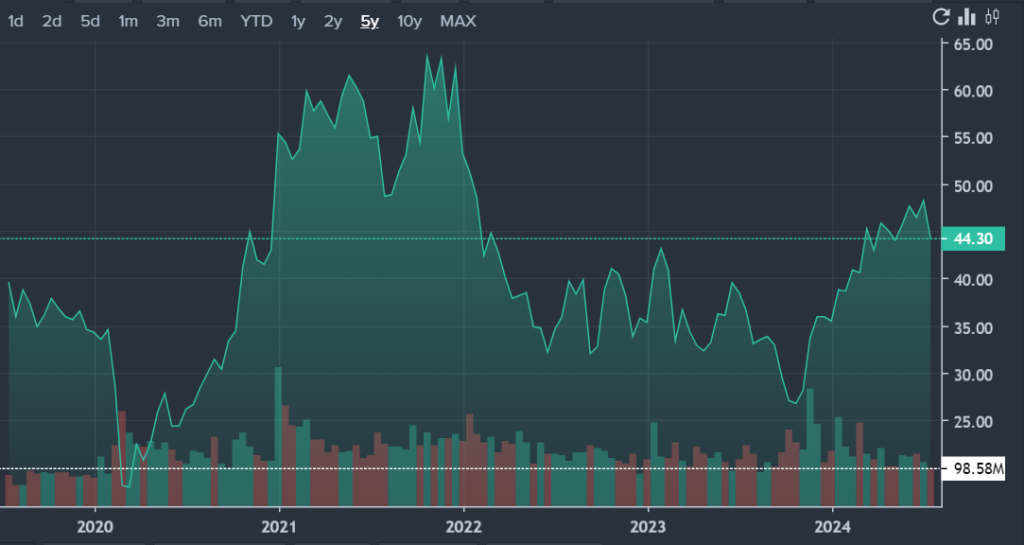

GM Price Action: General Motors shares were down by 4.44% at $44.43 according to Benzinga Pro.

- Gambler Turns $5 Into $2.2M On Side Bet In Las Vegas: Here's How

Photo Via Shutterstock.