Financial giants have made a conspicuous bullish move on Morgan Stanley. Our analysis of options history for Morgan Stanley (NYSE:MS) revealed 17 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $555,420, and 8 were calls, valued at $741,626.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $72.5 to $115.0 for Morgan Stanley over the recent three months.

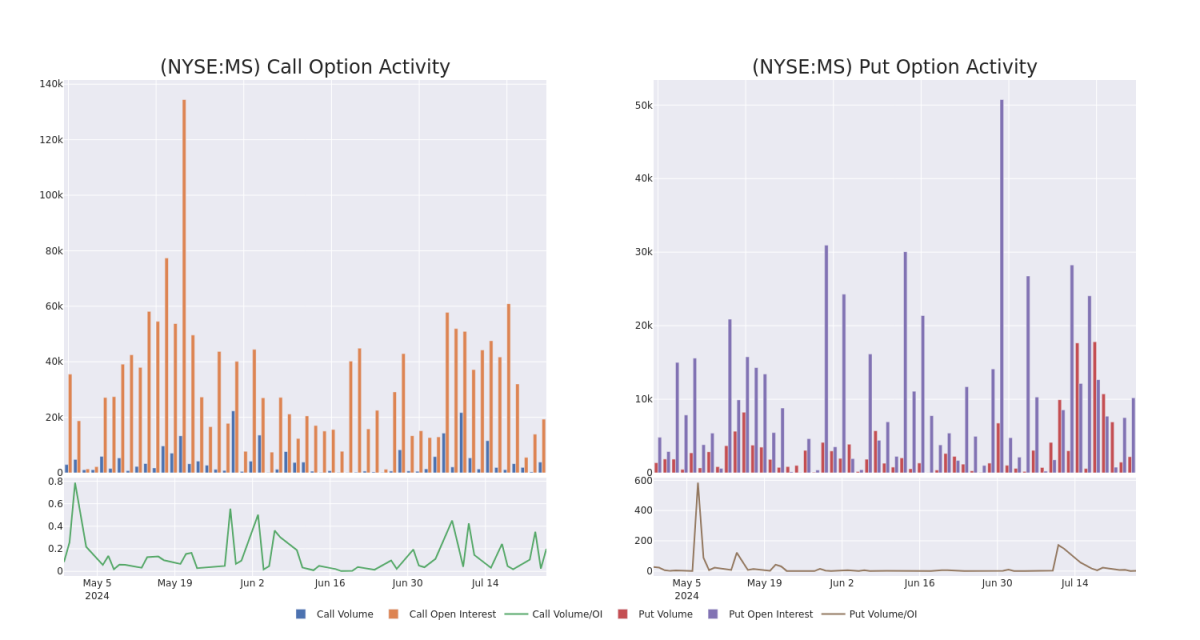

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Morgan Stanley stands at 2953.0, with a total volume reaching 6,052.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $72.5 to $115.0, throughout the last 30 days.

Morgan Stanley Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BEARISH | 09/19/25 | $7.25 | $6.75 | $6.95 | $115.00 | $382.2K | 113 | 550 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $9.95 | $9.65 | $9.95 | $105.00 | $159.1K | 1.2K | 160 |

| MS | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.35 | $115.00 | $104.5K | 5.4K | 85 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $10.1 | $10.05 | $10.05 | $105.00 | $92.4K | 1.2K | 293 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $7.7 | $7.4 | $7.7 | $100.00 | $69.3K | 538 | 245 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

In light of the recent options history for Morgan Stanley, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Morgan Stanley

- Trading volume stands at 5,580,498, with MS's price up by 0.63%, positioned at $102.61.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 83 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.