Shanghai Taisheng Wind Power Equipment Co., Ltd.'s (SZSE:300129) Subdued P/E Might Signal An Opportunity

Shanghai Taisheng Wind Power Equipment Co., Ltd.'s (SZSE:300129) Subdued P/E Might Signal An Opportunity

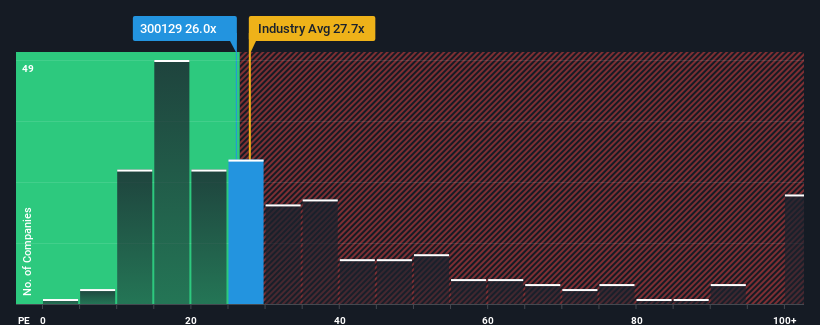

With a median price-to-earnings (or "P/E") ratio of close to 27x in China, you could be forgiven for feeling indifferent about Shanghai Taisheng Wind Power Equipment Co., Ltd.'s (SZSE:300129) P/E ratio of 26x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shanghai Taisheng Wind Power Equipment hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Is There Some Growth For Shanghai Taisheng Wind Power Equipment?

The only time you'd be comfortable seeing a P/E like Shanghai Taisheng Wind Power Equipment's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This means it has also seen a slide in earnings over the longer-term as EPS is down 52% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 53% per year over the next three years. That's shaping up to be materially higher than the 24% per annum growth forecast for the broader market.

In light of this, it's curious that Shanghai Taisheng Wind Power Equipment's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shanghai Taisheng Wind Power Equipment currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Shanghai Taisheng Wind Power Equipment (1 is significant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com