Public funds continue to increase investment in this track.

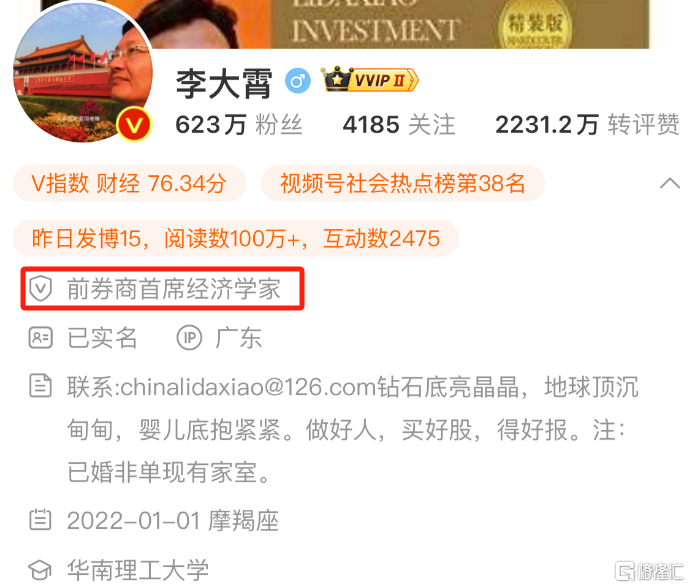

Li Daxiao, the most bullish person on A-shares, has resigned.

The introduction of Li Daxiao's Weibo has been updated, and he is now the former chief economist of a brokerage.

A reporter asked Li Daxiao for confirmation, and he replied that he retired normally on July 13th this year. Regarding his arrangements after retirement, Li Daxiao said:"At present, there is no plan. But I will continue to contribute to the healthy development of the capital market, which is my aspiration."

Public information shows that Li Daxiao was born in 1964 and has reached the age of 60 this year. Li Daxiao was also known as a representative of the bulls, and he became famous with the phrase "diamond bottom is shiny, earth top is heavy, baby bottom is tight", calling on investors to be good, buy good stocks and get good returns.

Li Daxiao has retired, but A-shares have not yet passed the 3000 point mark.

1

"Separation fee" of 0.218 billion? Stock price plunged.

Dong Yuhui's resignation caused a sensation on the internet.

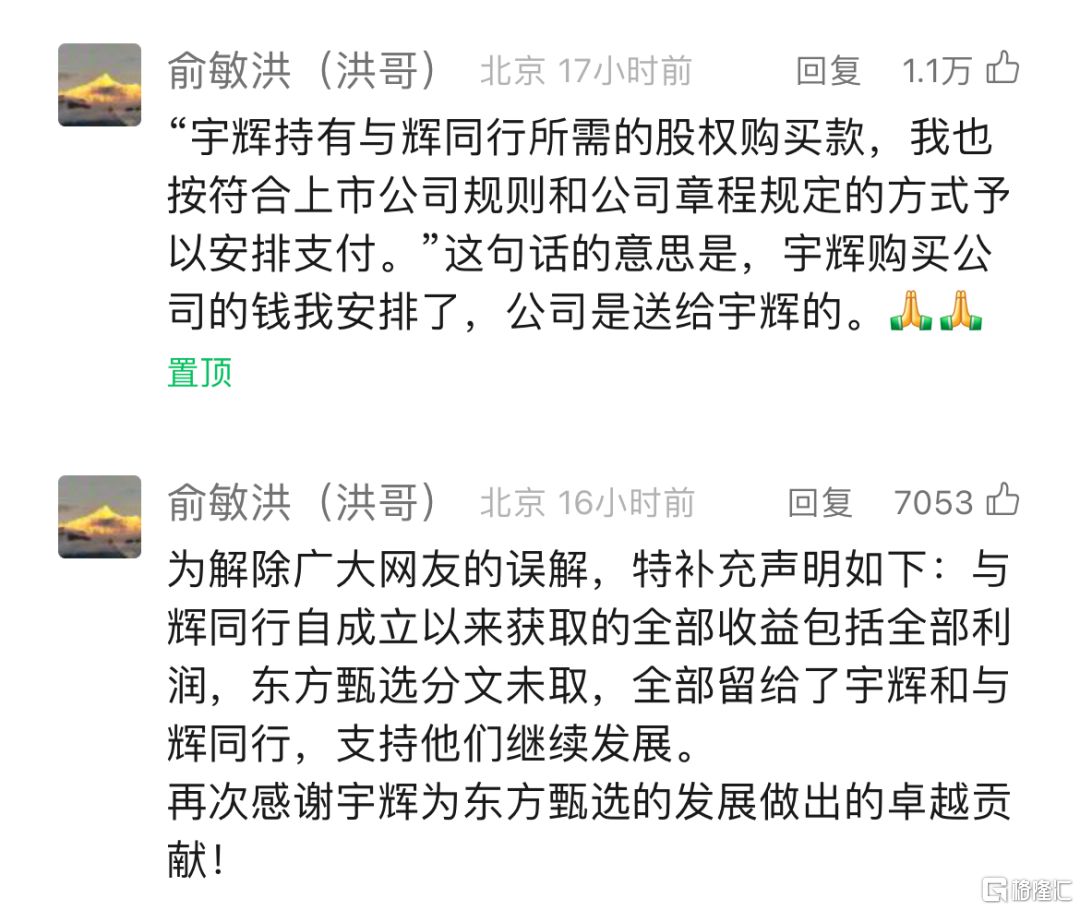

Eastbuy announced last night that its well-known anchor Dong Yuhui will resign immediately. At the same time, its subsidiary will be sold to Dong Yuhui for 76.585 million yuan.

Dong Yuhui and Yu Minhong subsequently released open letters disclosing more details of the incident. Yu Minhong said that Dong Yuhui's money to buy the company was arranged by him. The company was given to Dong Yuhui, and all the net profits with Dong Yuhui were left to him.

According to an announcement by Eastbuy, Yuhuitongxing's pure profit was 0.141 billion yuan during the period from December 22, 2023 to June 30, 2024.

In other words, if things go smoothly and there is no overlap between the stock purchase price and the net profit with Yuhuitongxing, to complete this 'cut', Yu Minhong needs to pay a total of 0.218 billion "separation fee" on behalf of the behind-the-scenes investors to Dong Yuhui.

Netizens comment: Today, Yu Minhong and Dong Yuhui parted ways t amiably. Tomorrow, in the live e-commerce arena, they will go from "colleagues (xing)" to "colleagues (hang)".

On July 25th, the main account of Eastbuy lost 0.017 million fans, while Yuhuitongxing gained 0.117 million on the same day. As of 10 a.m. on July 26th, the number of Yuhuitongxing fans was 21.658 million, and the number of Eastbuy fans was 29.854 million.

Yu Minhong is dignified, Dong Yuhui is free, and small shareholders are miserable.

On the same day, the stock price of Eastbuy's parent company New Oriental American stocks fell 5.46%. Eastbuy's Hong Kong stocks opened sharply lower today, falling as much as 25% and hitting a new low since June 2022, down 88% from the highest price in January 2023. New Oriental's Hong Kong stocks opened lower by more than 6%, falling as much as 8%.

As of November 30th last year, New Oriental held 54.89% of Eastbuy's shares, Yu Minhong held 5.06%, and Sun Dongxu, Yin Qiang, Sun Chang and others held more than 1.95%, which means that the float is less than 38%.

As of July 25th this year, Hong Kong stock investors held 25.89% of Eastbuy's shares, which means that mainland investors hold 68% of the company's float.

From the perspective of institutional investors, as of the first half of 2024, the largest single institutional shareholder of Eastbuy was Vanguard Sailing Fund, with a shareholding ratio of 1.91%; the second largest institutional shareholder was China Europe Fund, with a shareholding ratio of 1.9%; and the third largest institutional shareholder, Jinyi Fund, which belongs to China International Capital Corporation, has a shareholding ratio of 1.84%. The shareholding ratios of BlackRock, Rich Country, Ruiyuan, Southern Dongying and Taikang Assets are all over 0.5%.

It is reported that Eastbuy plans to hold a shareholder communication meeting online at 3 pm today.

2

Public funds continue to increase investment in this track.

In the era of smart phones, many bull stocks have emerged in the consumer electronics industry, which was one of the most favored industries for public funds. With the penetration rate of smart phones reaching its peak, the downturn of the industry has continued for a decade.

In the past decade, the consumer electronics industry has become a niche track that many fund managers even avoid.

Affected by the industry cycle recovery, AI-driven growth, and other factors, the formerly neglected electronic industry has regained the pursuit of fund managers. Fund quarterly reports show that the electronic industry has become the first overweight industry of public fund for two consecutive quarters, with a month-on-month increase of 3.8%.

The A-share electronic industry allocation ratio in the second quarter was 15.8%, which is at a high level in recent years, and the over-allocation ratio reached 5.8%. Huachuang Securities data shows that in the second quarter, the top 5 industries with active equity funds, respectively, are electronics (15.8%), medical and biological (11.1%), power equipment (10.1%), food and beverage (9.6%), and non-ferrous metals (6.0%).

The specific holding changes show that the overall direction of active equity funds is highly related to the industry's high fluctuation in the second quarter. Active equity funds reduced the allocation of food and beverage in the second quarter.

Among the top ten active+flexible configured fund stocks, 6 belong to the electronics industry, 2 belong to the communications industry, and the other 2 are autos and home appliances. Among them, BYD has the highest amount of additional investment, about 6.45 billion yuan; Foxconn Industrial Internet follows closely with an additional investment of about 5.95 billion yuan; Luxshare Precision comes in third with an additional investment of about 5.18 billion yuan.

3

Is the recession trade starting to spread?

Copper prices plunged, luxury goods giants rarely decline.

On Wednesday, the US technology sector plummeted, and the Nasdaq hit its largest decline since the end of 2022. After a sharp drop at the opening of technology stocks in the US stock market last night, they continued to show an adjustment trend.

For a time, the world's artistic style suddenly changed, and the voice of recession trading began to spread and heat up.

As a thermometer for global demand, the international copper price has continued to fall, and it has plummeted by about 20% compared to the peak in May. The main reason for the decline in copper prices is market concerns about global economic recession.

Goldman Sachs analyst Adam Gillard once issued a warning: The situation is deteriorating, this is an oversupply market, and the copper price will drop in the short term.

In addition, the decline in the performance of luxury goods giants has exacerbated market concerns about global economic recession.

Kering Group, the mother company of Gucci, announced its latest performance, showing that the revenue for the first half of 2024 fell by 11%, and the operating profit fell by 42% to 1.6 billion euros.

Kering Group is one of the largest luxury goods groups in the world. The revenue of its subsidiary's iconic brand GUCCI fell by 20% year-on-year and the profit fell by 44% in the first half of the year.

Looking at the regional sales, sales in the Asia-Pacific region, including China, fell by 22% in the first half of the year and accelerated in the second quarter; sales in Japan rose 8% due to the depreciation of the yen.

Kering Group stated that the challenge and uncertainty of the global economic environment resulted in the company expecting a decline in profits this year. This is the first time Kering Group has publicly admitted that its financial situation may be affected by the global economic environment.

Against the backdrop of a slowdown in global economic demand, another luxury goods giant, LVMH, failed to stay immune to it. The organic sales growth of the company in the second quarter slowed to 1%, lower than market expectations. In the quarter, LVMH achieved a small increase in organic sales in Europe, America, and Japan, but a 14% decline in non-Japanese Asia, including China.

Affected by the escalating global recession trade, the market's risk aversion sentiment has intensified, driving a significant increase in demand for safe-haven currencies such as the yen. On July 25th, the US dollar against the yen once again hit a new low of more than two and a half months at 151.945. Since July 11, the USD/JPY exchange rate has fallen by nearly 5%.

From the actions of bigwigs, it seems that the global market is entering a garbage time.

Amazon founder Bezos disclosed a plan to sell 25 million shares of stock (worth about 5 billion US dollars). According to incomplete statistics, in the past month, Huang Renxun, the founder of NVIDIA, has sold his company's stocks, realizing a total of more than 0.2 billion US dollars (approximately RMB 1.45 billion).

Buffett has also been selling recently. Over the past six trading days, Berkshire Hathaway, a subsidiary of Buffett, has reduced its shareholding of Bank of America stocks by 52.8 million shares, worth $2.3 billion, and its shareholding ratio has dropped to 12.5%. Berkshire Hathaway still holds 0.9801 billion shares of Bank of America stocks, with a market cap of $41.3 billion. Buffett used to have a habit of continuously selling large amounts of stock of a certain company, even to the point of liquidating it.