From May 29th to June 4th, international oil prices fell rapidly, with five consecutive bearish candlesticks and a cumulative drop of nearly 10%, reaching a low of $72.48, just one step away from the psychological level of $70. There are two main reasons for the decline in international oil prices. One is that OPEC's production cut was less than expected. After the 37th ministerial meeting of OPEC on Sunday last week, it was announced that the voluntary production cut measures (about 2 million barrels per day, originally scheduled to expire at the end of June) would be extended to the end of 2024; collective production reduction measures (about 39 million barrels per day) would be extended until 2025. Although production cuts have been extended, there is no new production reduction plan as expected by the market. Under the disappointment of the expectation, international oil prices were negatively affected. The other reason is that the interest rate cuts of Europe and America are coming, meaning that there is downward pressure on the economy. Yesterday, the Bank of Canada announced its rate decision, cutting interest rates by 25 basis points and lowering the benchmark interest rate to 4.75%. Canada's latest core CPI annual rate is 1.6%, already lower than the moderate inflation standard of 2%, and the potential risk of recession has increased. The European Central Bank's interest rate decision today also has the possibility of interest rate cuts. Market participants expect the Fed to cut interest rates for the first time before the end of the year. Once the inflation rate of European and American countries falls more than expected, the demand for crude oil will significantly decrease. Coupled with OPEC's insufficient production reduction plan, the decline in international oil prices is logical.

Yesterday, Eastbuy issued an announcement called "Friendly Resignation of Esteemed Anchor", which mentioned that Mr. Dong Yuhui (a well-known anchor in China's live streaming e-commerce industry and an employee of Eastbuy) has decided not to continue as an employee and a senior member of a combined affiliated entity of the company ("Resignation") after friendly discussion with the company, and it will take effect on July 25, 2024. Dong Yuhui used to be the best anchor of Eastbuy. After the "Small Essay" incident, he left Eastbuy and continued to operate the "With Hui Together" brand. In another announcement called "Disclosure and Connected Transaction in respect of Sale of a Combined Affiliated Entity", Eastbuy mentioned that the buyer agrees to acquire 100% equity of the target company for a consideration of RMB 76,585,460. The buyer mentioned here is Dong Yuhui, meaning that "With Hui Together" has become a company that is 100% controlled by Dong Yuhui. Based on public data, the monthly transaction volume of "With Hui Together" live streaming room exceeds RMB 0.6 billion. Dong Yuhui obtained 100% equity of the company with a cost of less than RMB 0.1 billion, which shows the generosity and irreplaceable position of Dong Yuhui in Eastbuy.

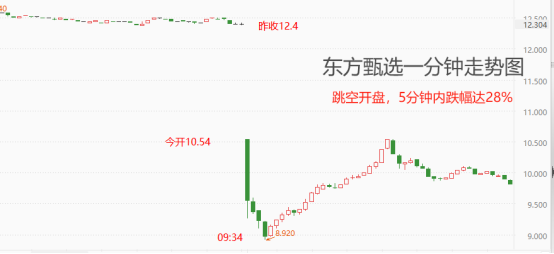

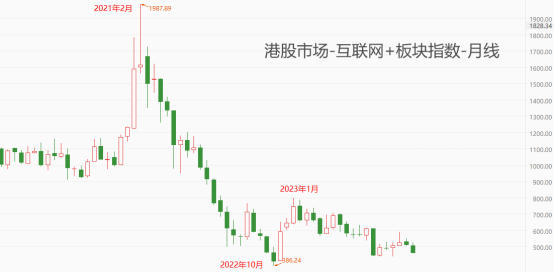

The resignation of Dong Yuhui is a major bearish news for Eastbuy. Yesterday, the closing price of Eastbuy stock was HKD 12.4. Today, the opening price dropped to HKD 10.54, and within the first five minutes of trading, it hit a low of HKD 8.92, with a maximum decline of more than 28%, which is nearly one-third. Although there was a rebound in the market afterwards, from a technical perspective, the integer mark of HKD 10 has been effectively broken down, and there is a lack of effective support below. The development of the market in the future is not optimistic. From a long-term perspective, the decline of Eastbuy's stock price began in February 2023, when Dong Yuhui was still working for Eastbuy. From this point of view, although the decline of Eastbuy's stock price was severely impacted by Dong Yuhui's resignation, this is not the only bearish factor. From a financial perspective, the company achieved a total revenue of RMB 2.795 billion in the second half of 2023, a year-on-year increase of 34.37%; in the 2023 fiscal year, the total revenue was RMB 5.41 billion, a year-on-year increase of 650.98%, more than six times. The probability of overall revenue growth in the 2024 fiscal year is high. It needs to be reminded that the "Small Essay" incident of Eastbuy happened on December 5, 2023, and the founding time of "With Hui Together" was on December 22, 2023. These two important time points were after the latest financial report of Eastbuy was released. The popularity of Eastbuy live streaming room after losing Dong Yuhui has always been less than expected, and the performance data in the first half of 2024 may be severely impacted. There is a possibility that the pessimistic view of Eastbuy's live streaming room popularity has already been reflected in the stock price trend of the first half of the year (cumulative decline of more than 60%), and when the semi-annual financial report is released (2024 fiscal year annual report), the stock price will experience a reverse upward trend of "no more bearish factors are bullish". From an industry perspective, the Hong Kong stock market's internet plus-related sector is still in a significant bearish trend, and the market trend in the second half of this year may refresh the lowest point formed in October 2022. Calculated from the highest point of 1987.89 in February 2021, the latest market price is 459.77, and the average decline of the internet industry has reached 76.9%. No matter how serious the bearish news is, the stock price has already realized the pessimistic expectation of a decline of 70% or 80%, and continued decline may lead to the situation where the stock price is lower than the intrinsic value. The appearance of the industry's "oversold rebound" opportunity depends on the Hang Seng Index stabilizing and rebounding. Since May 20, the cumulative decline of the Hang Seng Index has exceeded 13%, and there are still no signs of bottoming out. Based on this judgment, the timing of the "oversold rebound" of the internet plus-related sector still needs to wait patiently.

From an industry perspective, the Hong Kong stock market's internet plus-related sector is still in a significant bearish trend, and the market trend in the second half of this year may refresh the lowest point formed in October 2022. Calculated from the highest point of 1987.89 in February 2021, the latest market price is 459.77, and the average decline of the internet industry has reached 76.9%. No matter how serious the bearish news is, the stock price has already realized the pessimistic expectation of a decline of 70% or 80%, and continued decline may lead to the situation where the stock price is lower than the intrinsic value. The appearance of the industry's "oversold rebound" opportunity depends on the Hang Seng Index stabilizing and rebounding. Since May 20, the cumulative decline of the Hang Seng Index has exceeded 13%, and there are still no signs of bottoming out. Based on this judgment, the timing of the "oversold rebound" of the internet plus-related sector still needs to wait patiently.

Global stock market performance overnight on July 26

Dow Jones Industrial Average: 0.2%

Nasdaq 100 Index: -1.06%

S&P 500 Index: -0.51%

UK FTSE100 Index: 0.4%

German DAX30 Index: -0.48%

EURO STOXX 50 Index: -1.04%

Nikkei 225 Index: -0.53%

Risk reminder, disclaimer, special statement:

The market is risky and investment needs to be cautious. The content above only represents the personal opinions of the analyst and does not constitute any operational suggestions. Please do not consider this report as the only reference. Analysts' views may change at different times and updated content will not be notified separately.