Amazon Tests AI Chips in Texas Lab, Aims to Cut Nvidia Costs

Amazon Tests AI Chips in Texas Lab, Aims to Cut Nvidia Costs

Amazon.com Inc (NASDAQ:AMZN) is making significant strides in artificial intelligence with its homegrown AI chips.

亞馬遜(NASDAQ: AMZN)正在人工智能領域取得重大進展,推出了自家的AI芯片。

In its Austin, Texas, chip lab, Amazon engineers are rigorously testing a new server design that features these AI chips, aiming to reduce reliance on Nvidia Corp's (NASDAQ:NVDA) costly chips, Reuters reports.

據路透社報道,在其位於德克薩斯州奧斯汀的芯片實驗室,亞馬遜的工程師正在嚴格測試一種新的服務器設計,該設計採用了這些AI芯片,旨在減少對英偉達公司(NASDAQ: NVDA)高昂芯片的依賴。

Amazon's efforts align with similar initiatives by rivals Microsoft Corp (NASDAQ:MSFT) and Google parent Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL).

亞馬遜的努力與競爭對手微軟公司(NASDAQ: MSFT)和谷歌母公司Alphabet Inc(NASDAQ: GOOG)(NASDAQ: GOOGL)的類似倡議保持一致。

Also Read: Nvidia Dominates GPU Market as Generative AI Adoption Grows, Analyst Says

據一位分析師稱,英偉達在生成式人工智能應用增長的推動下主導了GPU市場。

Rami Sinno, director of engineering for Amazon's Annapurna Labs, highlighted the growing customer demand for more affordable alternatives to Nvidia. Annapurna Labs, acquired by Amazon in 2015, is integral to this development.

亞馬遜Annapurna Labs工程部門主管Rami Sinno強調了客戶對更實惠的英偉達替代方案的不斷增長需求。亞馬遜於2015年收購的Annapurna Labs對於這一發展具有重要作用。

Amazon has been developing its Graviton chips, which perform non-AI computing tasks, for nearly a decade. The latest AI chips, Trainium and Inferentia, offer significant cost savings.

亞馬遜開發的Graviton芯片執行非人工智能計算任務已近十年。最新的AI芯片Trainium和Inferentia提供了顯著的成本節約。

"The offering of up to 40%, 50% in some cases of improved price and performance means it should be half as expensive as running that same model with Nvidia," said David Brown, Vice President of Compute and Networking at AWS, according to Reuters.

AWS計算和網絡副總裁David Brown告訴路透社:“高達40%,在某些情況下可達50%的提高價格和性能意味着,與使用英偉達相同型號相比,應該便宜一半。”

Sales at AWS, which accounts for almost 20% of Amazon's total revenue, grew by 17% to $25 billion in the January-March quarter compared to the previous year. AWS holds approximately one-third of the cloud computing market, with Microsoft's Azure at about 25%.

AWS的銷售額佔亞馬遜總收入的近20%,在1月至3月的季度增長了17%,達到250億美元。 AWS持有約三分之一的雲計算市場份額,而微軟的Azure市場份額約爲25%。

Analysts view Nvidia as the primary beneficiary in the AI sector. Mizuho Securities reports that Nvidia controls 70% to 95% of the market share for artificial intelligence accelerators.

分析師認爲英偉達是人工智能領域的主要受益者。瑞穗證券報告稱,英偉達控制着70%至95%的人工智能加速器市場份額。

The Big Tech trio—Google, Microsoft, and Amazon—along with Oracle Corp (NYSE:ORCL)—contribute more than 40% of Nvidia's revenue.

谷歌、微軟和亞馬遜這三家大型科技公司以及甲骨文公司(NYSE: ORCL)爲英偉達貢獻了40%以上的收入。

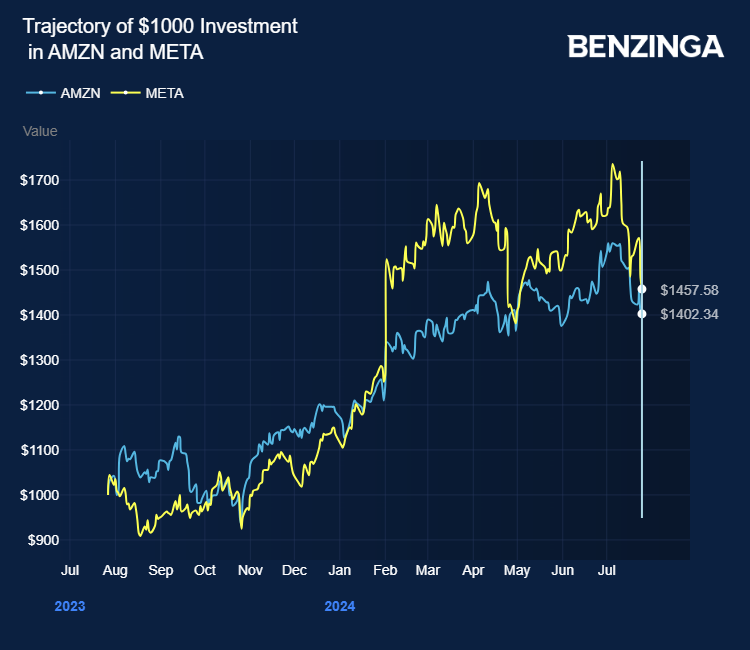

Amazon stock gained over 40% in the last 12 months, reaching a market cap of $1.87 trillion. Nvidia stock surged over 147% in the last 12 months and currently has a market cap of $2.76 trillion. Investors can gain exposure to the stocks through SPDR S&P 500 (NYSE:SPY) and iShares Core S&P 500 ETF (NYSE:IVV).

亞馬遜股票在過去12個月中上漲了超過40%,市值達到1.87萬億美元。 英偉達股票在過去12個月中上漲了超過147%,目前市值爲2.76萬億美元。投資者可以通過SPDR S&P 500(NYSE: SPY)和iShares Core S&P 500 ETF(NYSE: IVV)獲得這些股票的曝光。

Price Action: AMZN shares traded higher by 1.47% at $182.50 premarket at the last check on Friday.

AMZN股票在過去12個月中上漲了超過40%,在上週五的最後一次檢查時,盤前交易上漲了1.47%,至182.50美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

Photo by Sundry Photography via Shutterstock

通過Shutterstock上的Sundry Photography拍攝