The Nasdaq 100 closed lower by more than 200 points during Thursday's session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company's prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga's insider transactions platform.

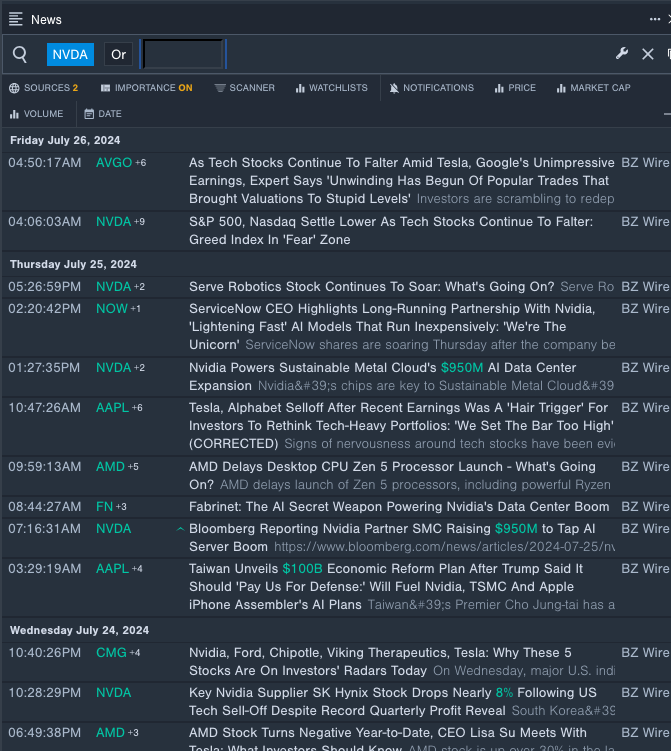

NVIDIA

- The Trade: NVIDIA Corporation (NASDAQ:NVDA) President and CEO Jen Hsun Huang sold a total of 240,000 shares at an average price of $120.29. The insider received around $28.9 million from selling those shares.

- What's Happening: On July 22, Piper Sandler analyst Harsh Kumar maintained NVIDIA with an Overweight and raised the price target from $120 to $140.

- What NVIDIA Does: Nvidia is a leading developer of graphics processing units.

- Benzinga Pro's real-time newsfeed alerted to latest NVDA news

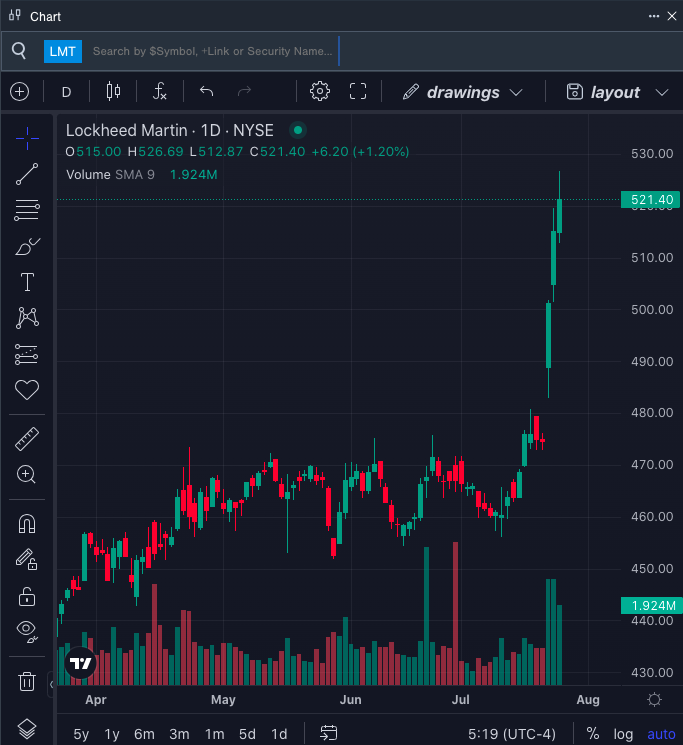

Lockheed Martin

- The Trade: Lockheed Martin Corporation (NYSE:LMT) Pres. Missiles & Fire Control Timothy S Cahill sold a total of 3,975 shares at an average price of $515.36. The insider received around $2.05 million from selling those shares.

- What's Happening: On July 25, JP Morgan analyst Seth Seifman maintained Lockheed Martin with an Overweight and raised the price target from $518 to $560.

- What Lockheed Martin Does: Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001.

- Benzinga Pro's charting tool helped identify the trend in LMT stock.

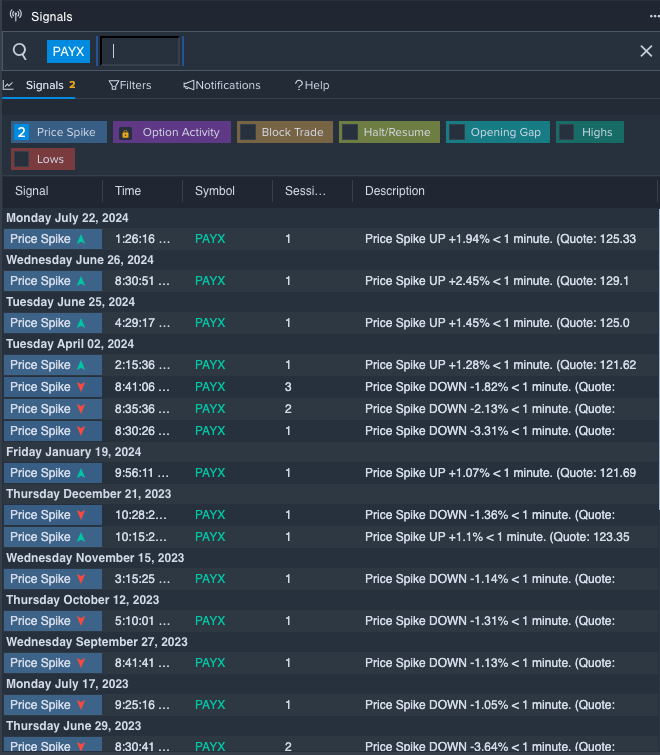

Paychex

- The Trade: Paychex, Inc. (NASDAQ:PAYX) Sr. VP of Sales Mark Anthony Bottini sold a total of 8,954 shares at an average price of $123.60. The insider received around $1.1 million from selling those shares.

- What's Happening: On July 10, Paychex declared a regular quarterly cash dividend of 98 cents per share.

- What Paychex Does: Paychex is a leading provider of payroll, human capital management, and insurance solutions servicing small and midsize clients primarily in the United States.

- Benzinga Pro's signals feature notified of a potential breakout in PAYX shares.

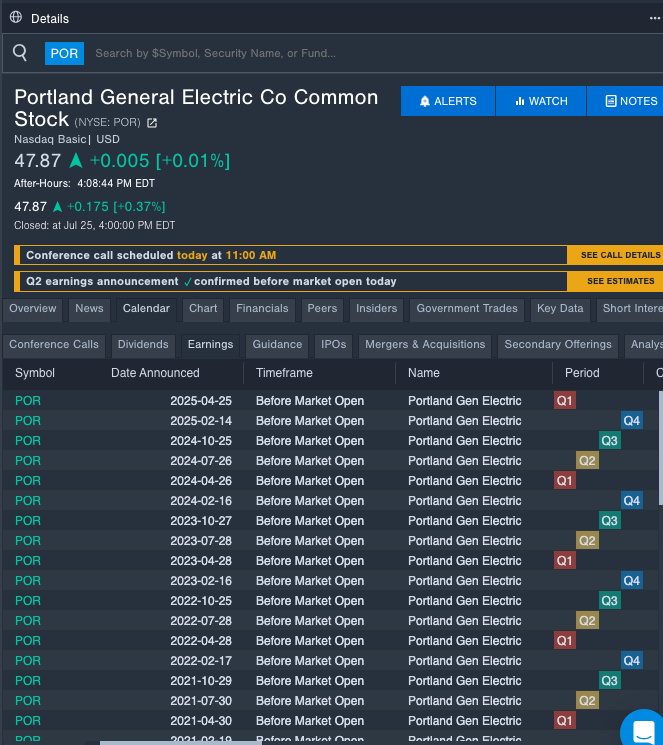

Portland General Electric

- The Trade: Portland General Electric Company (NYSE:POR) EVP, COO Benjamin Felton sold a total of 1,886 shares at an average price of $48.00. The insider received around $90,528 from selling those shares.

- What's Happening: On July 22, Keybanc analyst Sophie Karp upgraded Portland Gen Electric from Sector Weight to Overweight.

- What Portland General Electric Does: Portland General Electric is a regulated electric utility providing generation, transmission, and distribution services in a service territory that includes about half of all Oregon residents and two thirds of the state's business activity.

- Benzinga Pro's earnings calendar was used to track POR upcoming earnings report.

- Top 3 Defensive Stocks That Are Ticking Portfolio Bombs