Whales with a lot of money to spend have taken a noticeably bullish stance on MicroStrategy.

Looking at options history for MicroStrategy (NASDAQ:MSTR) we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $58,675 and 23, calls, for a total amount of $1,481,415.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1280.0 and $3000.0 for MicroStrategy, spanning the last three months.

Volume & Open Interest Development

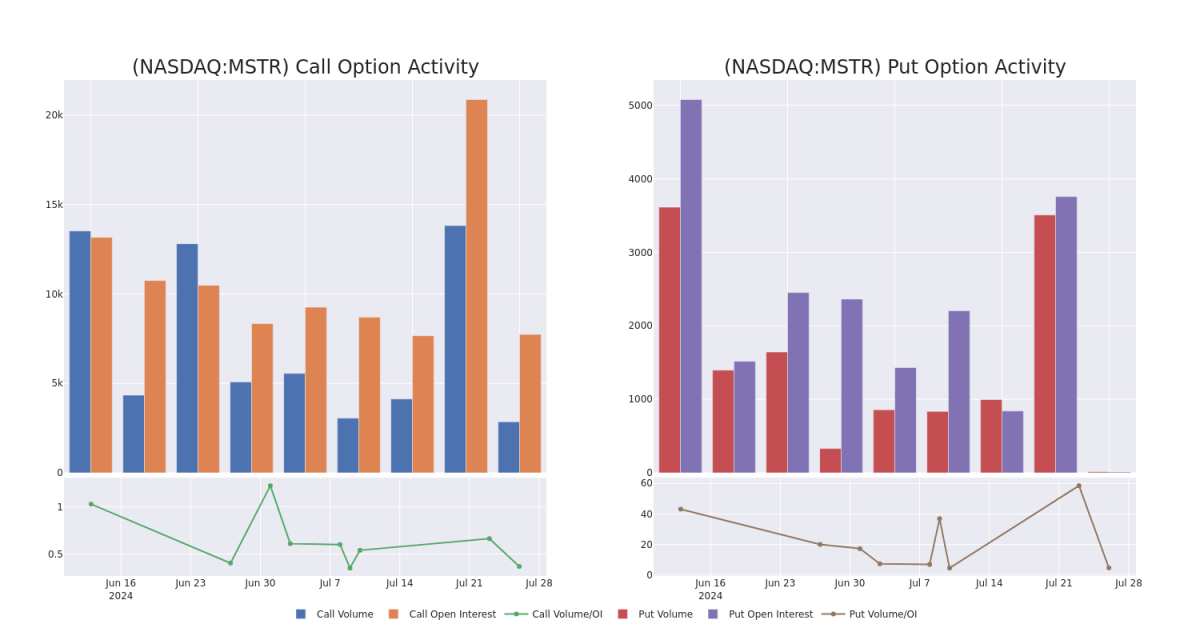

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MicroStrategy's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy's whale activity within a strike price range from $1280.0 to $3000.0 in the last 30 days.

MicroStrategy 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 07/26/24 | $35.6 | $29.6 | $35.61 | $1740.00 | $174.5K | 134 | 80 |

| MSTR | CALL | SWEEP | BEARISH | 07/26/24 | $128.0 | $120.0 | $123.05 | $1600.00 | $123.2K | 328 | 48 |

| MSTR | CALL | TRADE | NEUTRAL | 11/15/24 | $130.0 | $114.7 | $122.35 | $3000.00 | $110.1K | 163 | 0 |

| MSTR | CALL | SWEEP | BEARISH | 07/26/24 | $31.0 | $28.9 | $29.56 | $1700.00 | $105.7K | 696 | 80 |

| MSTR | CALL | SWEEP | BULLISH | 07/26/24 | $88.95 | $77.15 | $85.0 | $1650.00 | $85.0K | 243 | 129 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

In light of the recent options history for MicroStrategy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of MicroStrategy

- Trading volume stands at 48,576, with MSTR's price up by 5.39%, positioned at $1693.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 6 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.