Macro trend

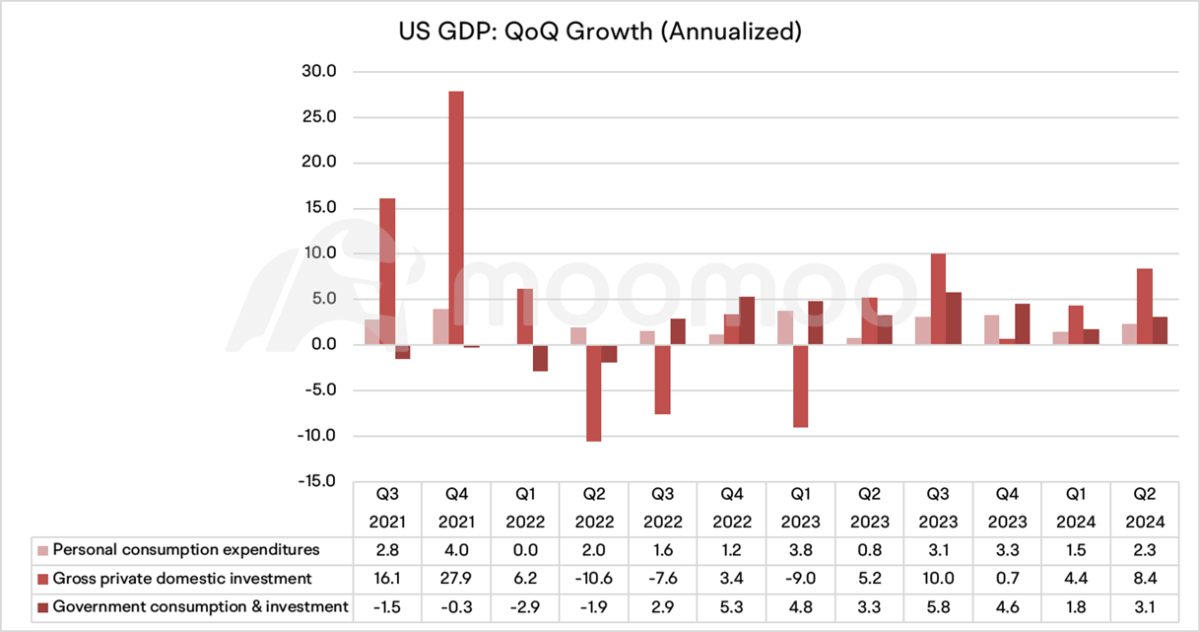

The US GDP grew strongly by 2.8% in the second quarter, which is significantly higher than expected.

The actual GDP annual growth rate in the second quarter of 2024 was 2.8%. Economists surveyed by Dow Jones expect second-quarter growth to be 2.1% after a 1.4% increase in the first quarter. The Bureau of Economic Analysis noted that the accelerating growth of real GDP in the second quarter compared to the first quarter mainly reflects the rebound of private inventory investment and the acceleration of consumer spending.

US June personal consumption expenditure inflation slowed to 2.5%, but core personal consumption expenditure remained unchanged at 2.6%.

The annual inflation rate of personal consumption expenditure in the US fell from 2.6% in May to 2.5% in June 2024, which is in line with market expectations. Calculated on a monthly basis, the price index of personal consumption expenditures rose by 0.1% in June, meeting expectations. In June 2024, the core personal consumption expenditure inflation indicator of the US economy remained unchanged at 2.6%, the same as in May and higher than the market's expected 2.5%. Calculated on a monthly basis, the core personal consumption price rose 0.2% in June, higher than 0.1% in May, and higher than the market's expected 0.1%.

US June new home sales fell to a 7-month low.

In June 2024, new single-family home sales in the United States fell 0.6% MoM and the seasonally adjusted annual rate was 0.617 million sets, due to high housing prices and mortgage interest rates continue to suppress buyers' affordability. This is the lowest level in 7 months, far below the expected 0.64 million. The median price of newly sold homes during this period was $417,300, and the average selling price was $487,200, both lower than the $417,600 and $507,800 in the same period last year. At the same time, there were 0.476 million new homes for sale during this period, which, according to the latest sales rate, is approximately 9.3 months of supply.

Data: US new home sales

US mortgage rates ticked up slightly, nearing a four-month low.

According to data from Freddie Mac, US mortgage rates have slightly risen. The average rate for a 30-year fixed mortgage rose from 6.77% last week to 6.78%. Although it has fallen from recent highs, rising lending costs continue to hinder homebuyers in record-high house prices. Existing home sales fell for the fourth consecutive month in June, and new home purchases also declined. As a result, the time homes stay on the market is longer, and more sellers are lowering their asking prices.

Fund Flows.

The excess earnings rate of S&P 500 component companies still remains at a healthy level of 79%, but the excess revenue rate is currently at its lowest level since the fourth quarter of 2016.

Hedge funds have increased their long US dollar positions in recent months, reflecting their relative optimism about the US economy and the potential for future monetary tightening.

Once a recession sets in, the yield curve will steepen.

Metal selloff intensifies, and copper price falls below US$9000.

The price of copper fell below $9,000 per tonne for the first time since early April, as global stocks faced selling pressure and pessimism about demand from China intensified. Since its peak in mid-May, this industrial metal has fallen by about 20%, as the bullish bet on supply tightening and usage increase has turned into concerns about increasing inventories and a weak spot market in China. In addition, the selloff of global technology stocks has raised doubts about the strength of the AI industry, where investors had expected a surge in copper usage for data centers and power infrastructure.

Company news.

Alphabet's profit margin is worrying, and YouTube's growth is slowing.

In the second quarter, Alphabet's capital expenditures rose to $13.2 billion, exceeding expectations, as it invested heavily in artificial intelligence and competed with Microsoft. Although cost-cutting measures such as layoffs have been implemented, analysts pointed out that the increase in seasonal recruitment and the early release of Pixel may affect profit margins in the third quarter. In addition, YouTube faces severe year-on-year comparisons and competition from Amazon in the online advertising video market.

Musk said Tesla's board of directors will discuss the possibility of investing $5 billion in AI startup xAI.

Elon Musk announced that Tesla's board of directors will discuss the possibility of investing $5 billion in its AI startup xAI. Earlier this week, Musk conducted a poll on Twitter, and more than two-thirds of respondents supported the idea. After the positive public response, Musk said on Thursday that Tesla will consider the investment. He also pointed out that approval from the Tesla board of directors and voting by shareholders are required before the acquisition can take place.

Warranty costs erode profits, Ford's stock price falls to a 15-year low.

On Thursday, Ford Motor's stock price plummeted by 18%, marking the biggest drop in over 15 years. Previously, the company announced significantly lower-than-expected earnings due to a surge in old vehicle maintenance costs, which amounted to 0.8 billion US dollars. Ford announced an adjusted earnings per share of 47 cents, lower than the average expected 67 cents per share from Bloomberg surveyed analysts. This drop wiped out the company's gains for 2024 and resulted in a total annual decline of over 8% for the stock.

Declining revenue for Visa raised concern among Wall Street.

Visa's lackluster performance in the third quarter led several brokerages to lower the target price of the stock, triggering concerns about customers' spending slowdown and its impact on the entire US payment industry. Disappointing results highlight the challenges faced by the industry, as inflation and high borrowing costs result in fewer purchases by customers and slower wage growth.

Sources say there is no indication that Microsoft plans to restrict Crowdstrike's access after a Windows outage.

An insider says there is no indication that Microsoft plans to limit Crowdstrike's use of Windows operating system. Earlier, this cybersecurity software caused technical malfunctions worldwide, causing many computers running the Windows operating system to crash.

Important economic data of the week

This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any particular security or investment strategy. The information contained in this content is for illustrative purposes only and may not be suitable for all investors. This content does not consider the investment objectives, financial situation, or needs of any specific person and should not be regarded as individual investment advice. It is recommended that you consider the suitability of the information for your individual circumstance before making any investment decisions in any capital market product. Past investment performance is not indicative of future results. Investment involves risk and the possibility of loss of principal.

On moomoo, investment products and services in the United States are provided by Moomoo Financial Inc, a licensed entity regulated by the US Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of Financial Industry Regulatory Authority (FINRA) and of Securities Investor Protection Corporation (SIPC).