In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Cheniere Energy (NYSE:LNG) in relation to its major competitors in the Oil, Gas & Consumable Fuels industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company's performance in the industry.

Cheniere Energy Background

Cheniere Energy owns and operates the Sabine Pass liquefied natural gas terminal via its stake in Cheniere Partners. It also owns the Corpus Christi LNG terminals as well as Cheniere Marketing, which markets LNG using Cheniere's gas volumes.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Cheniere Energy Inc | 8.50 | 9.50 | 2.44 | 10.78% | $1.52 | $1.26 | -41.82% |

| Enterprise Products Partners LP | 11.59 | 2.32 | 1.25 | 5.21% | $2.38 | $1.79 | 18.61% |

| Energy Transfer LP | 14.80 | 1.51 | 0.64 | 3.0% | $3.76 | $3.78 | 13.87% |

| Williams Companies Inc | 17.14 | 4.11 | 4.82 | 5.09% | $1.75 | $1.69 | -10.06% |

| ONEOK Inc | 19.24 | 2.89 | 2.36 | 3.88% | $1.4 | $1.63 | 5.75% |

| Kinder Morgan Inc | 19.33 | 1.54 | 3.05 | 1.88% | $1.58 | $2.02 | 2.03% |

| MPLX LP | 10.96 | 3.23 | 4.06 | 14.84% | $1.57 | $1.15 | 2.16% |

| Targa Resources Corp | 27.21 | 10.82 | 1.84 | 10.11% | $0.98 | $1.0 | 0.93% |

| Western Midstream Partners LP | 11.26 | 4.70 | 4.70 | 18.24% | $0.84 | $0.68 | 20.95% |

| Plains All American Pipeline LP | 15.40 | 1.22 | 0.26 | 1.96% | $0.71 | $0.47 | -2.8% |

| Antero Midstream Corp | 18 | 3.22 | 6.15 | 4.83% | $0.25 | $0.19 | 7.06% |

| EnLink Midstream LLC | 39 | 6.87 | 0.93 | 1.53% | $0.28 | $0.36 | -4.48% |

| Frontline Plc | 8.34 | 2.23 | 2.82 | 7.77% | $0.34 | $0.22 | 16.3% |

| Ultrapar Participacoes SA | 9.45 | 1.76 | 0.20 | 3.16% | $1.24 | $2.06 | -0.51% |

| New Fortress Energy Inc | 9.25 | 2.50 | 1.66 | 3.27% | $0.2 | $0.38 | 19.2% |

| Scorpio Tankers Inc | 6.76 | 1.44 | 2.88 | 8.07% | $0.3 | $0.26 | 1.8% |

| Hafnia Ltd | 4.87 | 1.73 | 1.45 | 7.97% | $0.24 | $0.68 | 74.09% |

| Plains GP Holdings LP | 21.83 | 2.47 | 0.08 | 2.74% | $0.71 | $0.82 | -2.8% |

| TORM PLC | 4.73 | 1.71 | 2.11 | 11.22% | $0.27 | $0.29 | 13.81% |

| Hess Midstream LP | 16.91 | 8.41 | 1.71 | 11.98% | $0.27 | $0.3 | 16.56% |

| International Seaways Inc | 5.16 | 1.53 | 2.57 | 8.23% | $0.19 | $0.17 | -4.43% |

| Transportadora de Gas del Sur SA | 42.06 | 1.79 | 5.31 | 5.06% | $120.58 | $88.44 | 6.15% |

| Average | 15.87 | 3.24 | 2.42 | 6.67% | $6.66 | $5.16 | 9.25% |

By analyzing Cheniere Energy, we can infer the following trends:

The stock's Price to Earnings ratio of 8.5 is lower than the industry average by 0.54x, suggesting potential value in the eyes of market participants.

The elevated Price to Book ratio of 9.5 relative to the industry average by 2.93x suggests company might be overvalued based on its book value.

With a relatively high Price to Sales ratio of 2.44, which is 1.01x the industry average, the stock might be considered overvalued based on sales performance.

With a Return on Equity (ROE) of 10.78% that is 4.11% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.52 Billion is 0.23x below the industry average, suggesting potential lower profitability or financial challenges.

With lower gross profit of $1.26 Billion, which indicates 0.24x below the industry average, the company may experience lower revenue after accounting for production costs.

With a revenue growth of -41.82%, which is much lower than the industry average of 9.25%, the company is experiencing a notable slowdown in sales expansion.

Debt To Equity Ratio

The debt-to-equity (D/E) ratio indicates the proportion of debt and equity used by a company to finance its assets and operations.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

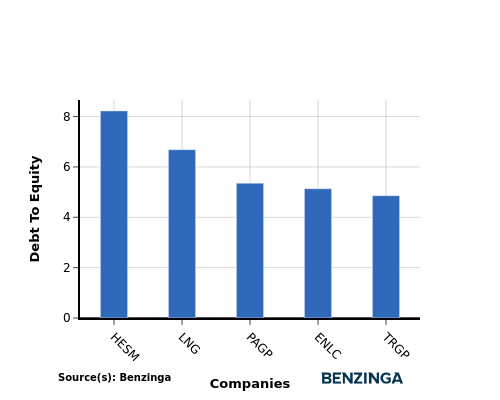

When assessing Cheniere Energy against its top 4 peers using the Debt-to-Equity ratio, the following comparisons can be made:

Cheniere Energy is positioned in the middle in terms of the debt-to-equity ratio compared to its top 4 peers.

This suggests a balanced financial structure, where the company maintains a moderate level of debt while also relying on equity financing with a debt-to-equity ratio of 6.69.

Key Takeaways

For Cheniere Energy in the Oil, Gas & Consumable Fuels industry, the PE, PB, and PS ratios indicate that the company is undervalued compared to its peers. However, the high ROE suggests strong profitability potential. The low EBITDA and gross profit may indicate operational challenges, while the low revenue growth suggests limited expansion opportunities.

This article was generated by Benzinga's automated content engine and reviewed by an editor.