Market Whales and Their Recent Bets on Edwards Lifesciences Options

Market Whales and Their Recent Bets on Edwards Lifesciences Options

Deep-pocketed investors have adopted a bullish approach towards Edwards Lifesciences (NYSE:EW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EW usually suggests something big is about to happen.

富有的投資者對於愛德華生命科學(紐交所:EW)採取了看好的策略,市場參與者不應該忽視這一點。我們在Benzinga追蹤公開期權記錄時發現了這一重大進展。這些投資者的身份仍然不得而知,但是EW的這樣一項重大舉措通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Edwards Lifesciences. This level of activity is out of the ordinary.

我們從今天Benzinga的期權掃描器中的14個非同尋常的Edwards Lifesciences期權活動中獲得了這些信息。該水平的活動是非同尋常的。

The general mood among these heavyweight investors is divided, with 64% leaning bullish and 14% bearish. Among these notable options, 6 are puts, totaling $403,470, and 8 are calls, amounting to $528,444.

這些重量級投資者的普遍心境是分裂的,其中64%看好,14%看淡。在這些顯著的期權中,有6個看跌期權,總計$403,470,有8個看漲期權,總計$528,444。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $72.5 for Edwards Lifesciences over the last 3 months.

考慮這些合同的成交量和持倉量,似乎過去3個月裏鯨魚們一直在針對Edwards Lifesciences的目標價格區間爲$50.0至$72.5。

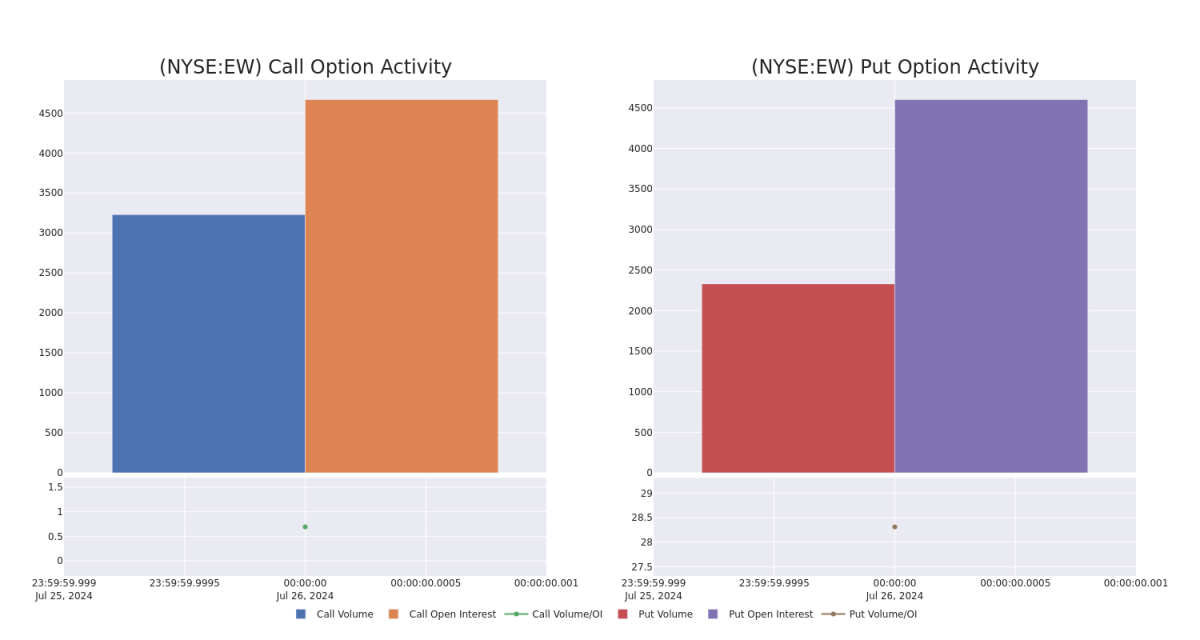

Volume & Open Interest Trends

成交量和未平倉量趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Edwards Lifesciences's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Edwards Lifesciences's substantial trades, within a strike price spectrum from $50.0 to $72.5 over the preceding 30 days.

評估成交量和持倉量是期權交易的戰略步驟。這些指標揭示了Edwards Lifesciences期權在指定執行價格上的流動性和投資者的興趣。即將發佈的數據可視化了過去30天內Edwards Lifesciences的成交量和持倉量的波動,這些交易與執行價格區間爲$50.0至$72.5的看漲期權和看跌期權相關。

Edwards Lifesciences Call and Put Volume: 30-Day Overview

Edwards Lifesciences的看漲期權和看跌期權成交量:30天概述

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | CALL | TRADE | BEARISH | 01/17/25 | $2.7 | $2.5 | $2.55 | $72.50 | $178.2K | 33 | 801 |

| EW | PUT | TRADE | BEARISH | 01/17/25 | $4.5 | $4.2 | $4.5 | $60.00 | $135.0K | 1.2K | 300 |

| EW | PUT | TRADE | BULLISH | 01/17/25 | $4.4 | $4.1 | $4.2 | $60.00 | $126.0K | 1.2K | 600 |

| EW | CALL | SWEEP | BULLISH | 11/15/24 | $2.7 | $2.45 | $2.6 | $70.00 | $94.6K | 100 | 502 |

| EW | CALL | TRADE | BULLISH | 01/17/25 | $6.7 | $6.5 | $6.7 | $62.50 | $53.6K | 98 | 1 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | 看漲 | 交易 | 看淡 | 01/17/25 | $2.7 | $2.5 | $2.55 | $72.50 | $178.2K | 33 | 801 |

| EW | 看跌 | 交易 | 看淡 | 01/17/25 | $4.5 | $4.2 | $4.5 | $60.00 | $135.0K | 1.2K | 300 |

| EW | 看跌 | 交易 | 看好 | 01/17/25 | $4.4 | $4.1 | $4.2 | $60.00 | $126.0K | 1.2K | 600 |

| EW | 看漲 | SWEEP | 看好 | 11/15/24 | $2.7 | $2.45 | $2.6 | 70.00美元 | $94.6K | 100 | 502 |

| EW | 看漲 | 交易 | 看好 | 01/17/25 | $6.7 | $6.5 | $6.7 | $62.50 | $53.6K | 98 | 1 |

About Edwards Lifesciences

關於愛德華生命科學 愛德華生命科學是結構性心臟病和危重病人重心創新全球領導者。我們秉承對患者的熱情,通過與全球醫療保健領域的臨床醫生和相關人員合作,致力於改善和提高生活質量。欲了解更多信息,請訪問Edwards.com並關注我們的Facebook、Instagram、LinkedIn、Twitter和YouTube。

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

愛德華生命科學於2000年從百特國際中分離出來,設計、製造和銷售一系列適用於結構性心臟病的醫療設備和裝備。該公司在關鍵產品領域樹立了領先地位,包括手術組織心臟瓣膜、經導管瓣膜技術、手術clip和導管。該公司的總銷售額約有55%來自美國以外。

Current Position of Edwards Lifesciences

Edwards Lifesciences的當前持倉

- Trading volume stands at 8,101,822, with EW's price up by 4.18%, positioned at $62.2.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 89 days.

- 交易量爲8,101,822股,EW的股價上漲4.18%,位於$62.2。

- RSI指標顯示該股票可能已被超賣。

- 預計在89天內發佈收益報告。

Expert Opinions on Edwards Lifesciences

關於愛德華生命科學的專家意見

In the last month, 5 experts released ratings on this stock with an average target price of $76.4.

在過去的一個月裏,5位專家發佈了對這隻股票的評級,平均目標價爲$76.4。

- An analyst from TD Cowen has revised its rating downward to Hold, adjusting the price target to $70.

- An analyst from Baird downgraded its action to Neutral with a price target of $70.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Edwards Lifesciences, targeting a price of $85.

- An analyst from Truist Securities has revised its rating downward to Hold, adjusting the price target to $82.

- An analyst from B of A Securities downgraded its action to Neutral with a price target of $75.

- TD Cowen的一位分析師已將其評級下調至持有,將目標價調整爲$70。

- Baird的一位分析師已將其評級下調至中立,目標價爲$70。

- RBC Capital的一位分析師繼續持有愛德華生命科學的表現,將其評級調整爲跑贏大盤,目標價爲$85。

- 輝立證券的一位分析師已將其評級下調至持有,將目標價調整爲$82。

- b of A Securities的一位分析師已將其評級下調至中立,目標價爲$75。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Edwards Lifesciences options trades with real-time alerts from Benzinga Pro.

期權交易提供更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子和密切關注市場動態來管理這些風險。通過Benzinga Pro實時提醒了解最新的Edwards Lifesciences期權交易信息。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $72.5 for Edwards Lifesciences over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $72.5 for Edwards Lifesciences over the last 3 months.