Merck & Co's Options: A Look at What the Big Money Is Thinking

Merck & Co's Options: A Look at What the Big Money Is Thinking

Investors with a lot of money to spend have taken a bullish stance on Merck & Co (NYSE:MRK).

有很多钱可以投资的投资者对默沙东(NYSE: MRK)持看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

不管这些人是机构还是富人,我们无从得知。但是,当这样的大事发生在MRK身上时,通常意味着有人知道即将发生的事情。

Today, Benzinga's options scanner spotted 10 options trades for Merck & Co.

今天,Benzinga的期权扫描器发现了10个默沙东期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 70% bullish and 20%, bearish.

这些资金充裕的交易者的总体情绪在70%的看好和20%的看淡之间分裂。

Out of all of the options we uncovered, there was 1 put, for a total amount of $93,721, and 9, calls, for a total amount of $344,552.

在我们发现的所有期权中,有1个看跌期权,总金额为93721美元,还有9个看涨期权,总金额为344552美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $130.0 for Merck & Co over the last 3 months.

考虑到这些合约的成交量和持仓量,近3个月来鲸鱼们一直将默沙东的目标价区间定在105.0美元到130.0美元之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

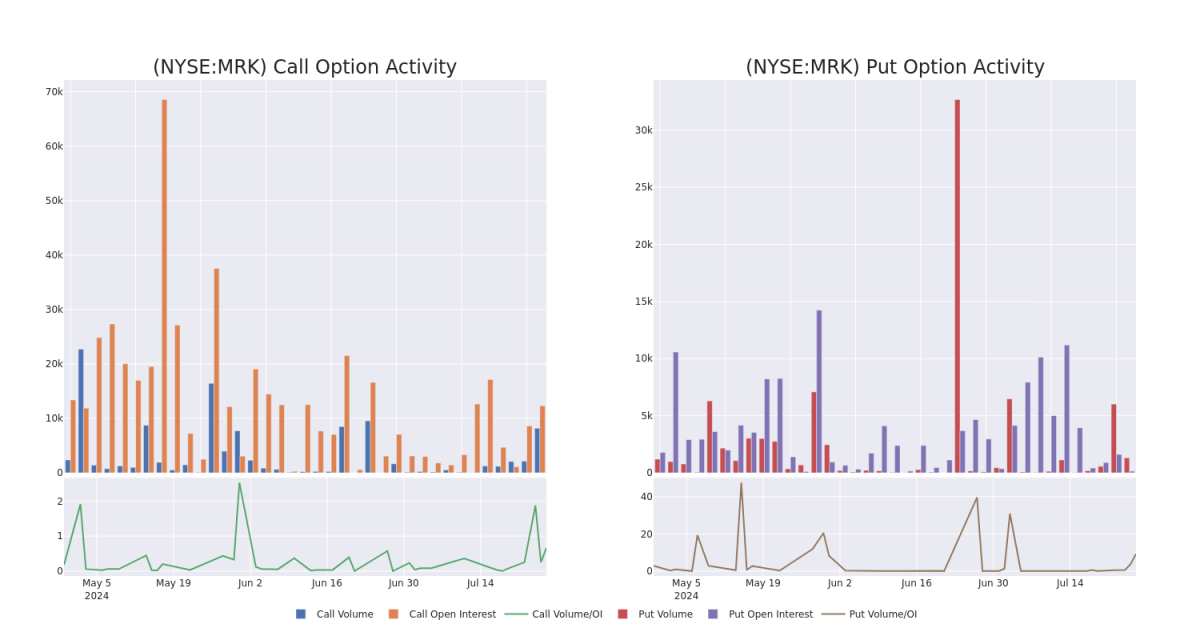

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Merck & Co's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Merck & Co's substantial trades, within a strike price spectrum from $105.0 to $130.0 over the preceding 30 days.

评估成交量和持仓量是期权交易的一项战略性步骤。这些指标揭示了默沙东的期权在指定行权价上的流动性和投资者兴趣。即将到来的数据可视化了过去30天内在105.0美元到130.0美元行权价范围内,关联默沙东实质性交易的看跌和看涨期权的成交量和持仓量的波动。

Merck & Co Option Activity Analysis: Last 30 Days

默沙东期权活动分析:最近30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | PUT | SWEEP | BULLISH | 08/02/24 | $0.93 | $0.8 | $0.8 | $120.00 | $93.7K | 142 | 1.3K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $1.6 | $1.38 | $1.45 | $130.00 | $72.6K | 1.7K | 1.5K |

| MRK | CALL | SWEEP | BULLISH | 08/16/24 | $2.7 | $2.16 | $2.7 | $130.00 | $54.0K | 5.1K | 200 |

| MRK | CALL | SWEEP | BULLISH | 08/02/24 | $1.48 | $1.42 | $1.48 | $130.00 | $37.9K | 1.7K | 2.1K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $2.12 | $2.02 | $2.02 | $128.00 | $36.3K | 3.0K | 1.1K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | 看跌 | SWEEP | 看好 | 08/02/24 | $0.93 | $0.8 | $0.8 | $120.00 | $93.7K | 142 | 1.3K |

| MRK | 看涨 | SWEEP | 看淡 | 08/02/24 | $1.6 | $1.38应翻译为1.38美元 | $1.45 | $130.00 | $72.6K | 1.7K | 1.5K |

| MRK | 看涨 | SWEEP | 看好 | 08/16/24 | $2.7 | $2.16 | $2.7 | $130.00 | $54.0K | 5.1K | 200 |

| MRK | 看涨 | SWEEP | 看好 | 08/02/24 | 1.48美元 | $1.42 | 1.48美元 | $130.00 | $37.9K | 1.7K | 2.1K |

| MRK | 看涨 | SWEEP | 看淡 | 08/02/24 | $2.12 | $2.02 | $2.02 | 128.00美元 | $36.3千 | 3.0K | 1.1千 |

About Merck & Co

关于默沙东

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

默沙东生产多种药品,治疗多种领域的疾病,包括心代谢症、癌症和感染。在癌症领域,该公司的免疫肿瘤学平台正在成为总销售额的主要贡献者。该公司还具有实质性的疫苗业务,包括预防儿童疾病以及人类乳头瘤病毒(HPV)治疗。此外,默沙东出售与动物健康相关的药品。从地理角度来看,公司销售额的近一半来自于美国境内。

Having examined the options trading patterns of Merck & Co, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在检查了默克和有限公司的期权交易模式之后,我们现在将直接关注该公司。这种转变使我们能够深入研究其现有市场地位和表现。

Present Market Standing of Merck & Co

默沙东的现市场地位

- With a trading volume of 3,124,311, the price of MRK is up by 0.09%, reaching $125.96.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 4 days from now.

- 成交量为3,124,311,默沙东的股价上涨了0.09%,达到125.96美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个盈利报告将在4天内发布。

What Analysts Are Saying About Merck & Co

关于默沙东的分析师观点

1 market experts have recently issued ratings for this stock, with a consensus target price of $134.0.

1名市场专家最近对这支股票发表了评级,预计目标价为134.0美元。

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Merck & Co, which currently sits at a price target of $134.

- 大摩资源lof的一位分析师决定维持对默沙东的等权重评级,当前价格目标为$134。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。机智的交易者通过不断学习、调整他们的策略、监测多个因子和密切关注市场动向来控制这些风险。通过Benzinga Pro实时提醒了解最新的默沙东期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.