Have China Biotech Services Holdings Insiders Been Selling Stock?

Have China Biotech Services Holdings Insiders Been Selling Stock?

Some China Biotech Services Holdings Limited (HKG:8037) shareholders may be a little concerned to see that the Executive Chairman & Compliance Officer, Xiaolin Liu, recently sold a substantial HK$5.0m worth of stock at a price of HK$0.40 per share. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 2.3%.

一些China Biotech Services Holdings Limited(HKG:8037)的股東可能會稍微擔心,因爲執行主席兼合規主管劉孝林最近以每股0.40港元的價格大量賣出了總值500萬港元的股票。但值得注意的是,他們仍然對該股抱有很大的投資興趣,這次賣出只減少了他們持股的2.3%。

The Last 12 Months Of Insider Transactions At China Biotech Services Holdings

在過去一年內,China Biotech Services Holdings的內部交易情況

Notably, that recent sale by Xiaolin Liu is the biggest insider sale of China Biotech Services Holdings shares that we've seen in the last year. So what is clear is that an insider saw fit to sell at around the current price of HK$0.39. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

值得注意的是,劉孝林最近的這次賣出是我們在過去一年中所見到的China Biotech Services Holdings股票的最大內部賣出交易。所以可以清楚地看到,內部人士認爲以當前的0.39港元價格賣出是合適的。雖然內部人士的賣出是一個負面情況,但對我們來說,如果股票以更低的價格賣出會更爲負面。考慮到這次交易是以當前價格進行的,這讓我們有些謹慎,但並不是一個嚴重的問題。

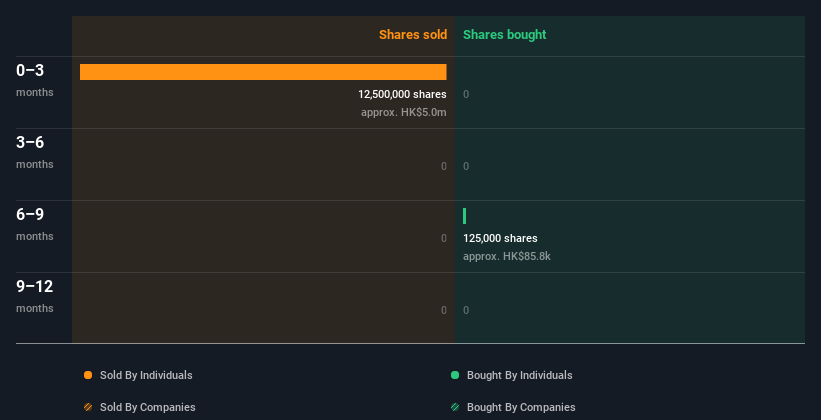

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

SEHK:1600內部交易成交量:2024年6月5日

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

對於那些喜歡發現潛力股票的人,可以免費查看最新內部交易股票的小盤公司名單,這可能正是您要找的機會。

Insider Ownership

內部人員持股情況

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that China Biotech Services Holdings insiders own 65% of the company, worth about HK$244m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

我喜歡查看公司內部人持有多少股份,以幫助了解他們與內部人的利益一致程度。高比例的內部人持股通常使公司領導更加關注股東利益。很高興看到中國生物科技服務控股股東持有公司的65%的股份,價值約24400萬港元。我喜歡看到這種程度的內部人持股,因爲增加了管理層思考股東最佳利益的機會。

What Might The Insider Transactions At China Biotech Services Holdings Tell Us?

中國生物科技服務控股的內部交易有什麼信息可以告訴我們?

An insider sold stock recently, but they haven't been buying. Despite some insider buying, the longer term picture doesn't make us feel much more positive. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing China Biotech Services Holdings. When we did our research, we found 3 warning signs for China Biotech Services Holdings (1 makes us a bit uncomfortable!) that we believe deserve your full attention.

近期有內部人出售了股票,但他們沒有買入。儘管有一些內部人買入,但從長期來看,情況沒有讓我們感到更加積極。儘管內部人在公司持有很多股票(這是好的),但我們對他們的交易分析並不讓我們對該公司感到信心。除了了解內部交易情況,還有助於識別中國生物科技服務控股面臨的風險。在我們的調研中,我們發現了3個警示信號(其中一個讓我們有點不舒服!),我們認爲這是值得您全力關注的。

But note: China Biotech Services Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但請注意:中國生物科技服務控股可能不是最好的買入股票。因此,請查看這份具有高roe和低債務的有趣公司的免費列表。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

對於本文而言,內部人是指向相關監管機構報告其交易的個人。我們目前僅考慮公開市場交易和直接利益的私人處置,但不包括衍生交易或間接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

For those who like to find

For those who like to find