Newlink Technology Inc. (HKG:9600) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The last month has meant the stock is now only up 9.2% during the last year.

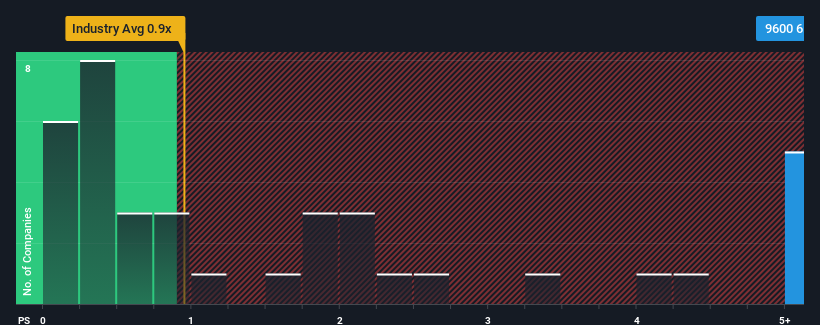

In spite of the heavy fall in price, given around half the companies in Hong Kong's IT industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Newlink Technology as a stock to avoid entirely with its 6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Newlink Technology's Recent Performance Look Like?

For example, consider that Newlink Technology's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Newlink Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Newlink Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Newlink Technology's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that Newlink Technology's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Newlink Technology's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't expect to see Newlink Technology trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 3 warning signs we've spotted with Newlink Technology (including 2 which are concerning).

If you're unsure about the strength of Newlink Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com