Northbound funds sold a net of 4.985 billion yuan in A-shares, while southbound funds bought a net of 0.745 billion Hong Kong dollars in Hong Kong stocks.

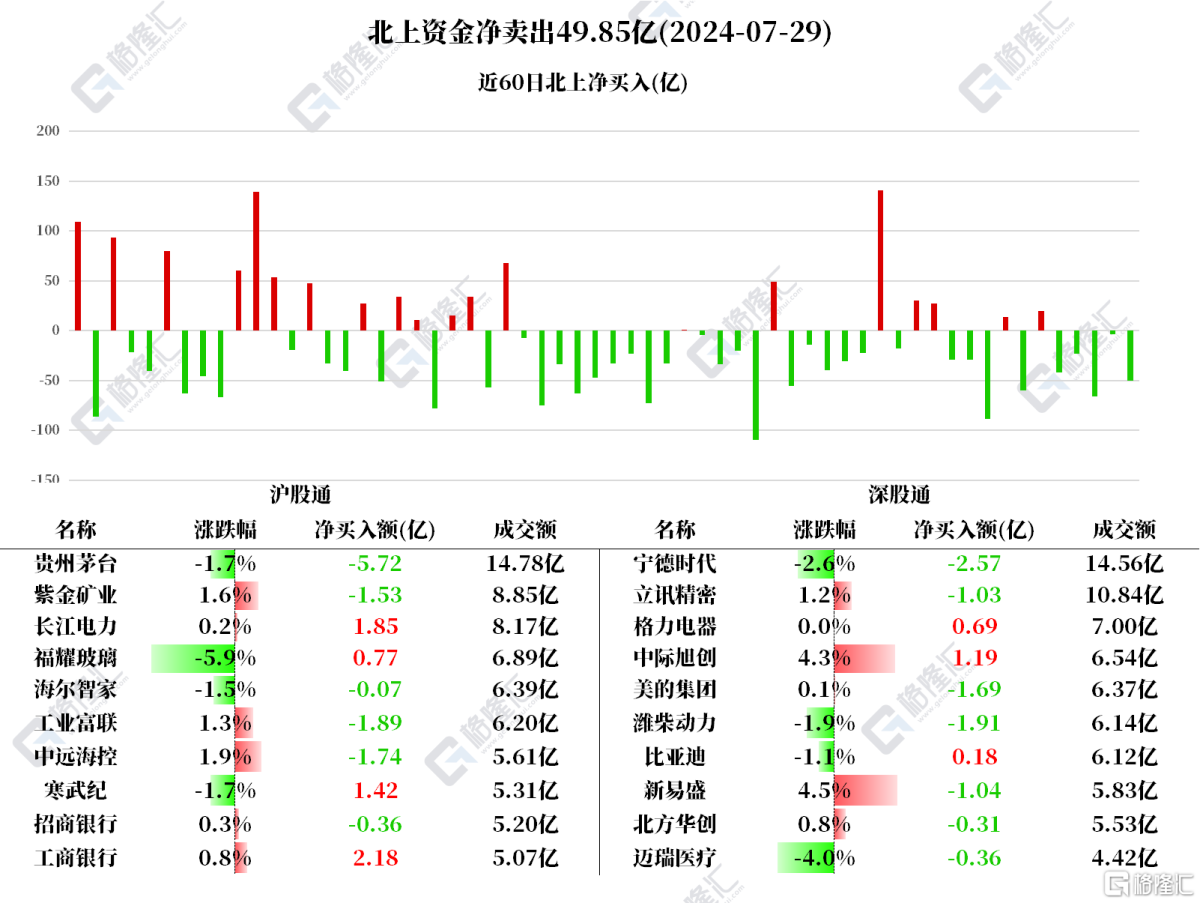

On July 29th, northbound funds net sold A shares for 4.985 billion yuan, marking the fifth consecutive day of net selling.

Net sells of 0.572 billion yuan for Kweichow Moutai, 0.257 billion yuan for Contemporary Amperex Technology, 0.191 billion yuan for Weichai Power, 0.189 billion yuan for Foxconn Industrial Internet, 0.174 billion yuan for Zhongyuan Haikong, 0.169 billion yuan for Midea Group, 0.153 billion yuan for Zijin Mining Group, 0.104 billion yuan for Eoptolink Technology Inc., and 0.103 billion yuan for Luxshare Precision Industry.

Net purchases of 0.218 billion yuan for Industrial and Commercial Bank of China, 0.185 billion yuan for China Yangtze Power, 0.142 billion yuan for Cambricon Technologies Corporation Limited, and 0.119 billion yuan for Zhongji Innolight.

Net purchases of 0.218 billion yuan for Industrial and Commercial Bank of China, 0.185 billion yuan for China Yangtze Power, 0.142 billion yuan for Cambricon Technologies Corporation Limited, and 0.119 billion yuan for Zhongji Innolight.

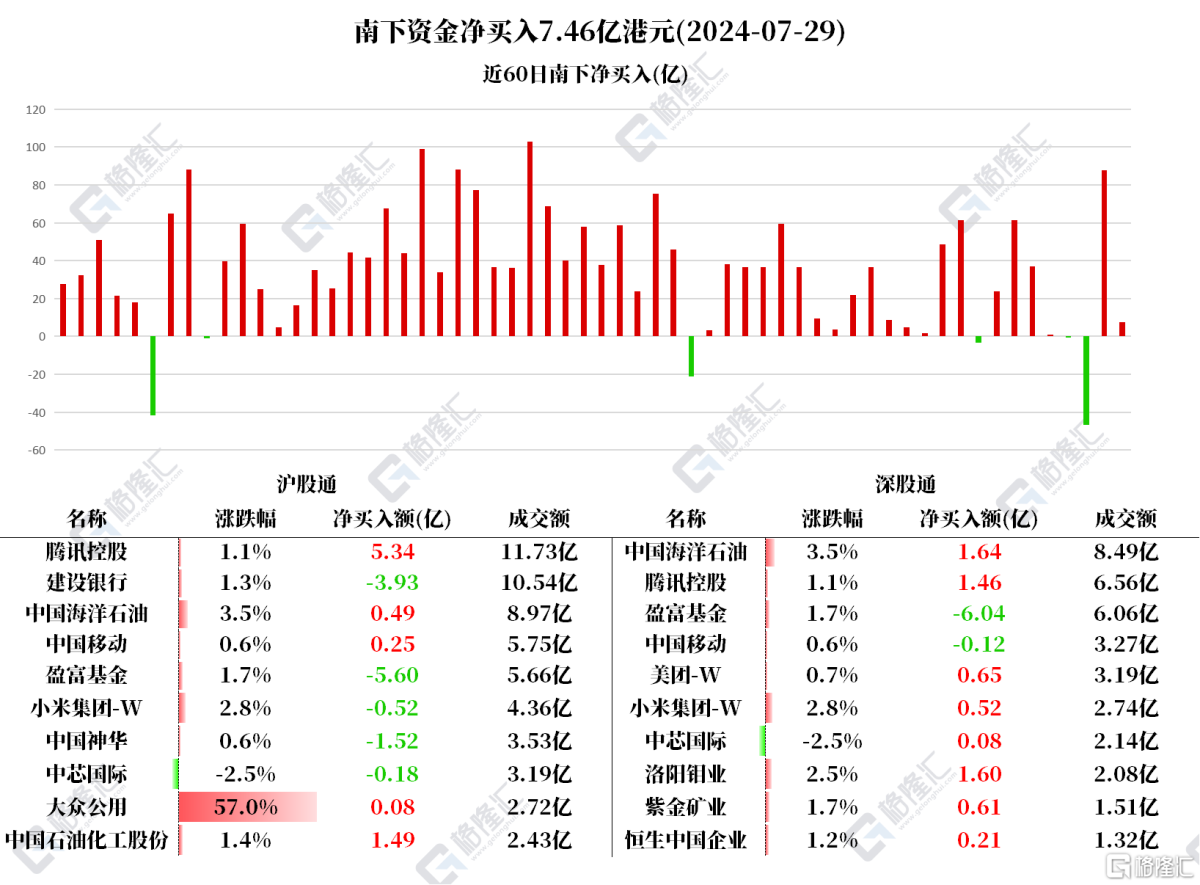

Southbound funds net bought Hong Kong stocks for 0.745 billion Hong Kong dollars.

Net purchases of 0.679 billion Hong Kong dollars for Tencent, 0.213 billion Hong Kong dollars for CNOOC Limited, 0.16 billion Hong Kong dollars for CMOC Group Limited, and 0.149 billion Hong Kong dollars for Sinopec.

Net sells of 1.164 billion Hong Kong dollars for Tracker Fund of Hong Kong, 0.393 billion Hong Kong dollars for China Construction Bank Corporation, and 0.152 billion Hong Kong dollars for China Shenhua Energy.

According to statistics, southbound funds have been net buying Tencent for three consecutive days, with a total of 1.76 billion Hong Kong dollars; they have been net selling China Construction Bank Corporation for two consecutive days, with a total of 1.11 billion Hong Kong dollars.

Individual Stocks Concerned: China Mobile: On the news front, Goldman Sachs issued a research report stating that the company's management maintained its expectations for stable growth in revenue and profit in 2024. Due to increased R&D and marketing expenses for enterprise business (cloud, artificial intelligence, industrial internet, etc.), EBITDA profit margin continued to show a downward trend, but the slowdown in depreciation costs helped support the trend of stable net profit margin. The management believes that the dividend payout ratio can be increased from 71% to the target of 75% in 2026. Goldman Sachs believes that stable business growth and steady capital expenditures should help China Mobile gradually increase its dividends. Chinahongqiao:

Today, Kweichow Moutai's stock price fell below 1400 yuan. Recently, UBS Group has expressed a pessimistic view on the white liquor (baijiu) industry, downgrading its ratings from buy to neutral for Kweichow Moutai, Wuliangye Yibin, Luzhou Laojiao, and Jiangsu Yanghe Brewery Joint-Stock. Given that leading white liquor enterprises have not actively controlled supply and significantly expanded capacity, it is expected that the retail price of super high-end white liquor companies will face greater pressure in 2024-2025.

Contemporary Amperex Technology's stock price dropped by 2.55%. In the first half of the year, the company's revenue was 166.767 billion yuan, a year-on-year decrease of 11.88%; its net income attributable to shareholders was 22.865 billion yuan, a year-on-year increase of 10.37%.

After reaching a new high last week, the Industrial and Commercial Bank of China's stock price fell for two consecutive days and rose slightly by 0.84% today. Recently, more than 10 banks have lowered the renminbi deposit rates.

Materials of the companies of North Water

Tencent's stock price rose by 1.07%, reaching 358.2 Hong Kong dollars per share.

China Construction Bank Corporation's stock price rose by 1.3%. The company's stock price had previously reached a new high and has since fallen by 1.27%.